The crypto market experienced significant selling pressure ahead of the important US Non-Farm Payroll (NFP) data. Bitcoin and most altcoins have lost significant value. However, some see this dip as a buying opportunity. According to the on-chain analytics platform Santiment, whale activity has surged in RARE Coin and nine other altcoins. Meanwhile, Bitcoin whales are also actively accumulating.

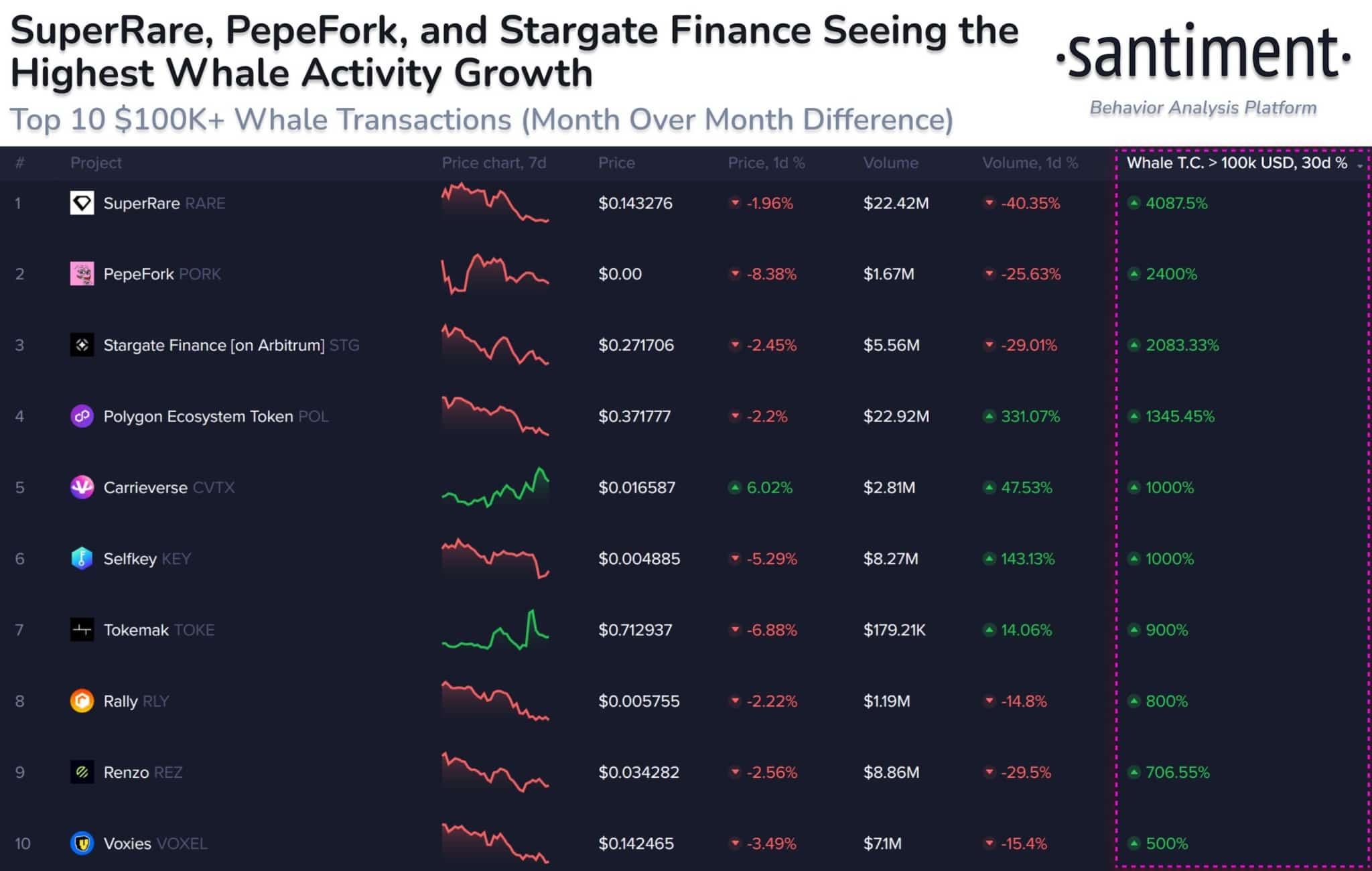

Santiment: Whale Activity Surges in RARE Coin and These 9 Altcoins

As reported by The Bit Journal, the crypto market faced heavy sell-offs today. Despite this, whales are taking advantage of the dip. The Santiment platform identified the top 10 altcoins experiencing the highest increase in whale activity. These projects include Superrare (RARE Coin), Pepeforketh (PORK), Stargatefinance (STG), Polygon (POL), Carrieverse (CVTX), Selfkey (KEY), Tokemakxyz (TOKE), Rally_io (RLY), Renzoprotocol (REZ), and Cryptovoxels (VOXEL).

The market uncertainty is making some investors cautious. However, whale activity in these altcoins suggests that large investors remain significantly engaged, showing continued interest despite market conditions.

Bitcoin Whales Accumulate on Every Dip

On-chain tracker SpotOnChain reported that a newly identified Bitcoin whale has withdrawn 1,145 BTC, worth $65.1 million, from the Binance exchange over the past four days. Data shows that this whale consistently buys during price dips, acquiring BTC at an average price of $56,841 across seven transactions. It seems the whale is taking full advantage of the current Bitcoin price dip.

While smaller traders lose patience and sell off their BTC during price drops, whales continue to accumulate. According to Santiment, Bitcoin whales added $7.8 billion worth of BTC even when the price dropped below $50,000 in early August. Earlier this week, Santiment noted: “Over the past month, wallets holding 10 to 10,000 BTC have collectively accumulated another 133,300 coins, while smaller traders impatiently continue to hand over their assets.”

Interestingly, this accumulation by Bitcoin whales is happening as the market awaits the release of US Non-Farm Payroll (NFP) data. Employment figures in the US have fallen to their lowest levels since 2021. The upcoming US Federal Reserve interest rate decision largely depends on these NFP numbers. While optimism surrounds a rate cut, the risk of a US recession has not been completely ruled out. Alongside Bitcoin whales, BTC miners are also holding onto their BTC, with Riot Platforms recently reaching a milestone of HODLing over 10,000 BTC.