A news that’s turning heads in the financial world, Japan’s SBI Group has reported a staggering increase in crypto-related profits and is gearing up to be the first in the nation to list USD Coin (USDC). Let’s dive into what this means for the crypto landscape.

SBI’s Crypto Profits Skyrocket

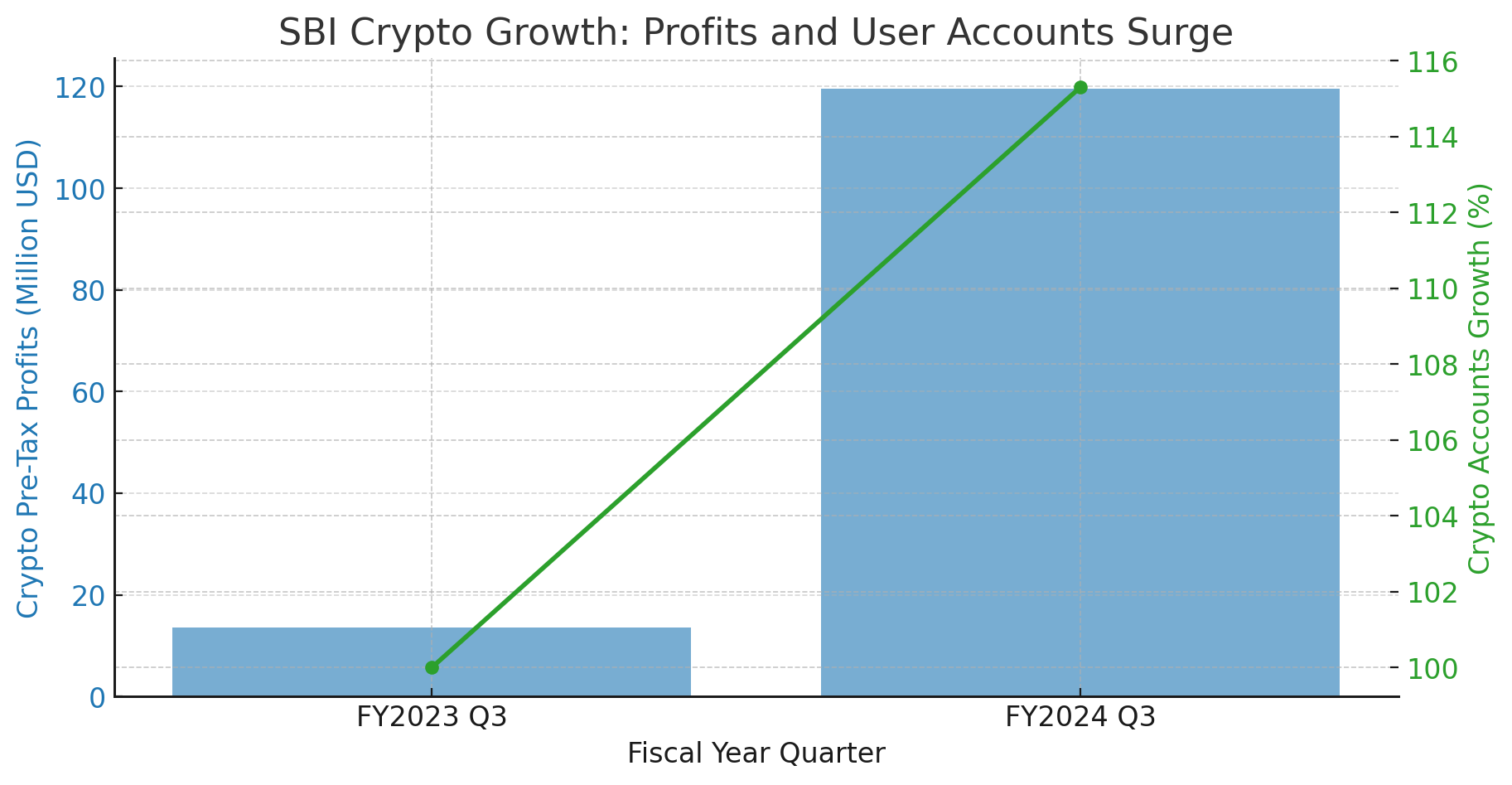

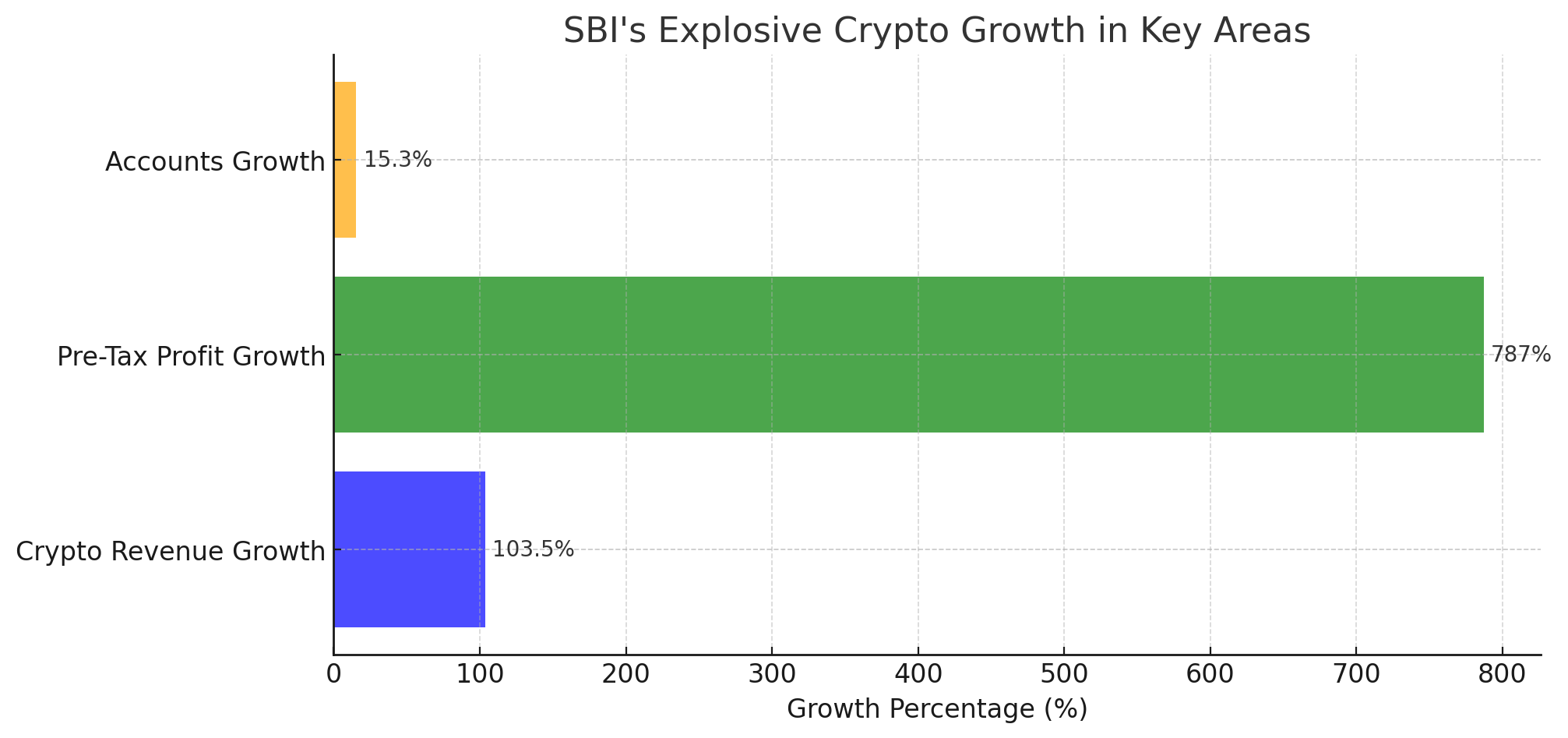

SBI Group, a heavyweight in Japan’s financial sector, has announced a jaw-dropping pre-tax profit of approximately $119.6 million from its crypto ventures in the third quarter of the fiscal year. This marks a 787% increase compared to the same period in the previous year. Talk about a windfall!

The company’s crypto operations include:

- SBI VC Trade: A cryptocurrency exchange platform.

- BITPoint: Another crypto exchange under SBI’s umbrella.

- SBI Crypto: Focused on crypto mining activities.

- B2C2: A UK-based liquidity provider and market maker.

- HashHub: A Tokyo-based blockchain firm.

The recent uptick in the crypto market has been a significant driver behind SBI’s impressive performance. The firm noted a 15.3% quarter-to-quarter rise in the number of accounts on SBI VC Trade and BITPoint, reflecting growing interest among investors.

Aiming for Japan’s First USDC Listing

SBI isn’t just resting on its laurels. The company is actively working to become the first crypto exchange operator in Japan to list USD Coin (USDC), a stablecoin pegged to the U.S. dollar. Following a November 2023 agreement with Circle, the U.S.-based USDC operator, SBI has been pushing for regulatory approval to offer USDC pairings in Japan.

Yoshitaka Kitao, SBI Holdings’ Chairman and CEO, emphasized the company’s commitment, stating that firms are now laying the groundwork for “the full-scale introduction of stablecoins in Japan.” Recent revisions to the Payment Services Act are set to provide Japanese crypto exchanges with the opportunity to enter the stablecoin market, and SBI is keen to lead the charge.

Expanding Through Acquisitions

In a strategic move to bolster its position, SBI is set to take over DMM Bitcoin, a domestic rival. Customers of DMM Bitcoin are slated to migrate to SBI VC Trade by March 8. This acquisition is expected to boost the number of crypto wallets on SBI VC Trade to about 1.3 million, with BITPoint hosting an additional 400,000 wallets.

The Bigger Picture: What Does This Mean for Crypto?

SBI’s aggressive expansion and focus on stablecoins like USDC could have significant implications for the broader crypto market. By pioneering USDC listings in Japan, SBI is enhancing its portfolio and paving the way for increased adoption of stablecoins in the country. This move could potentially set a precedent for other financial institutions to follow suit, further integrating cryptocurrencies into mainstream financial systems.

Moreover, SBI’s success story underscores the growing synergy between traditional financial institutions and the crypto world. As more established entities like SBI dive deeper into crypto, it signals a maturing market that’s becoming increasingly intertwined with conventional finance.

Looking Ahead

As SBI continues to push boundaries in the crypto space, all eyes will be on how the company navigates regulatory landscapes and market dynamics. Will other financial giants take a leaf out of SBI’s book and venture into crypto? Only time will tell. But one thing’s for sure: SBI’s bold moves are shaking up the financial world, and we’re here for it.

In the ever-evolving world of finance, SBI’s crypto journey is a testament to the transformative power of digital currencies. As the lines between traditional finance and crypto continue to blur, it’s clear that the future holds exciting possibilities. So, whether you’re a crypto enthusiast or a finance aficionado, keep an eye on SBI—they’re just getting started.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Frequently Asked Questions (FAQs)

1. Why did SBI Group’s crypto profits skyrocket?

SBI’s crypto profits surged by 787% year-over-year due to the booming crypto market, increased trading activity, and higher adoption of its exchange platforms SBI VC Trade and BITPoint.

2. What is SBI’s plan with USD Coin (USDC)?

SBI is working with Circle, the issuer of USDC, to become the first Japanese exchange to list the USD-pegged stablecoin, pending regulatory approval.

3. How will SBI’s acquisition of DMM Bitcoin impact its business?

By taking over DMM Bitcoin, SBI VC Trade’s crypto wallets will grow to 1.3 million, strengthening its dominance in Japan’s crypto exchange market.

4. What does this mean for Japan’s crypto industry?

If SBI successfully lists USDC, it could open doors for more stablecoin adoption in Japan, making the country a bigger player in the global crypto market.

5. What’s next for SBI in crypto?

SBI plans to expand its crypto services, grow its user base, and push for more stablecoin listings as Japan’s regulations evolve.

Glossary of Key Terms

Stablecoin – A cryptocurrency designed to maintain a stable value, often pegged to fiat currencies like the U.S. dollar (e.g., USDC).

Pre-tax Profits – The earnings a company reports before taxes are deducted. SBI’s crypto-related pre-tax profits hit $119.6 million in Q3.

SBI VC Trade & BITPoint – SBI’s two major crypto exchanges in Japan that saw a 15.3% growth in user accounts.

Circle – The U.S.-based fintech company behind USDC, partnering with SBI to bring the stablecoin to Japan.

Payment Services Act – Japan’s regulatory framework for crypto and fintech services, recently revised to allow stablecoin adoption by exchanges.