The U.S. Securities and Exchange Commission (SEC) has sued Nova Labs Inc. in a lawsuit accusing the company of fraud and securities law violations. Filing the complaint on January 17 in the U.S. District Court for the Southern District of New York, the complaint details allegations concerning unregistered crypto asset offerings and deceptive investor practices that began in April 2019.

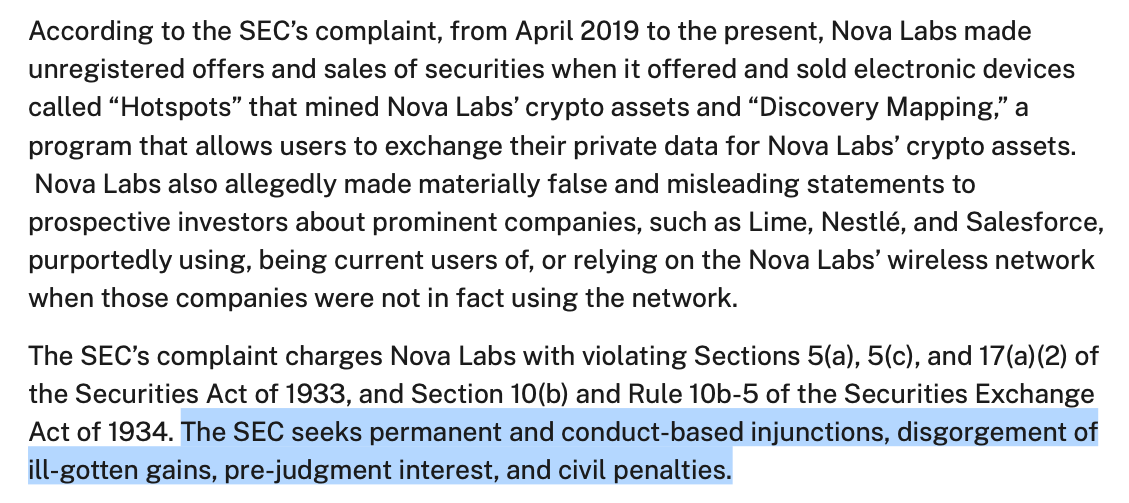

Nova Labs, the SEC says, engaged in illegal securities activities by offering its “Hotspots” devices that mine its proprietary crypto assets and a feature called ‘Discovery Mapping’ that allows users to exchange private data for digital tokens. The offerings, the regulator said, were never registered as required by federal law and considered securities by the regulator.

SEC Accuses Nova Labs of Misinformation

Nova Labs are also accused of disseminating misinformation. According to the company, they hoodwinked investors by saying well known companies such as Lime, Nestlé, and Salesforce used its wireless network. But SEC says claims were false, none of these companies used Nova Labs’ network, and it posed a serious risk that potential investors would be misled.

The lawsuit represents one of the final actions by the SEC in that capacity, coming days before Chair Gary Gensler is set to leave the post. The firm’s Gensler has been a vocal advocate of stricter oversight of the cryptocurrency industry, and called for oversight to protect investors from fraud and uncontrolled practices.

⚡️ SEC accuses Nova Labs of cryptocurrency fraud

The U.S. Securities and Exchange Commission (SEC) has charged (https://t.co/TmmGNsG6lM) Nova Labs with unregistered offerings of crypto assets and misleading investors.

✅ The company sold "Hotspots" devices and the "Discovery… pic.twitter.com/GjeLKfrNDF

— Traders Union (@TradersUnion_TU) January 19, 2025

The SEC under his tenure, has stepped up its vigilance on crypto-related operations to instill greater transparency and also accountability in the murky sector. We know this approach is evident from the Nova Labs case, where this is yet another high-profile action to guarantee compliance with federal securities laws.

SEC’s Commitment to Enforcing Federal Securities Laws in Crypto

The violations alleged by the SEC include Section 5(a), Section 5(c) and Section 17(a)(2) of the Securities Act of 1933 and Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5 promulgated thereunder. The agency is seeking multiple remedies, including permanent injunctions, disgorgement of profits, pre-judgment interest, and civil penalties.

Nova Labs finds itself in the crosshairs of the SEC in a lawsuit that is a wake-up call of sorts for the industry in how to navigate regulatory scrutiny while treading the line of legal standards. It serves as a cautionary tale to the SEC that it will continue to experience against protecting investor interests and enforcing the federal securities laws in the crypto landscape.

Conclusion

The SEC’s action against Nova Labs aligns with its aim to guarantee observance and openness within the cryptocurrency sector. This instance emphasizes the commission’s heightened surveillance of associations that utilize deceptive plans or unregistered listings to appeal to unwary financial specialists. With Gary Gensler’s up-and-coming resignation as Chair, the high-profile claim against Nova Labs underlines the administration’s resolve to firmly establish its part as a managing power in the quickly developing and multi-faceted crypto world, where innovation regularly clashes with oversight. While crypto innovation flourishes, the SEC strives to balance the protection of financial specialists with support for reasonable advancement.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

What is Nova Labs accused of?

The SEC alleges fraud, unregistered crypto-asset offerings, and misleading investors about corporate partnerships.

What false claims did Nova Labs allegedly make?

The SEC claims Nova Labs falsely stated that companies like Lime, Nestlé, and Salesforce used its wireless network.

What penalties is the SEC seeking?

The SEC seeks injunctions, disgorgement of profits, pre-judgment interest, and civil penalties.

Why is this case important?

It highlights the SEC’s push for stricter oversight and accountability in the crypto industry.