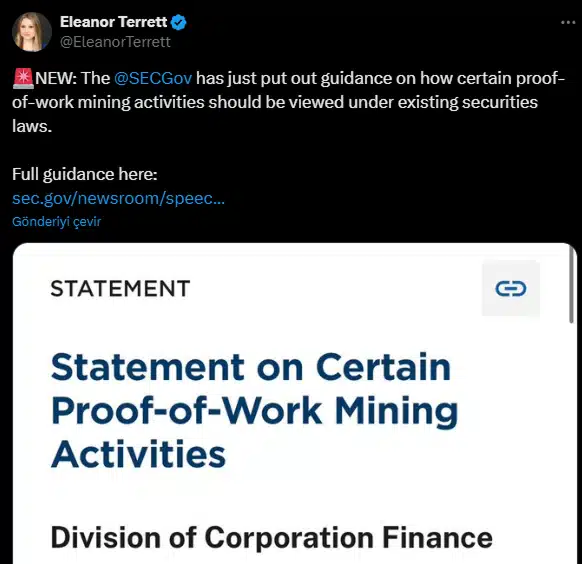

In a landmark development for the cryptocurrency mining sector, the U.S. Securities and Exchange Commission (SEC) has officially stated that Proof-of-Work (PoW) mining activities do not violate securities regulations. This declaration offers long-awaited clarity and legal reassurance to miners of major PoW-based assets like Bitcoin (BTC), Litecoin (LTC), and Bitcoin Cash (BCH).

According to The Bit Journal, the SEC’s announcement removes a major layer of regulatory uncertainty that has loomed over the mining industry for years. By clarifying that PoW mining does not fall under the scope of securities law, the agency has effectively opened the door for miners to operate and expand their activities with confidence.

Market Reactions: Mixed Signals

Following the SEC’s statement, the crypto markets showed mixed responses. Surprisingly, large-cap PoW cryptocurrencies experienced minor pullbacks. Bitcoin fell by 1.4% to $83,993, Dogecoin dropped 2.8% to $0.1666, and Bitcoin Cash slipped 2.5% to $333.94.

However, the spotlight quickly turned to smaller PoW altcoins, which surged in response. Nexa led the pack with an 18% gain, reaching $0.0051496, while SatoXcoin and Radiant both posted gains of nearly 8%. This shift indicates growing investor interest in lesser-known PoW assets, now seen as higher-potential plays in a newly legitimized sector.

Strengthening Bitcoin’s Commodity Status

The SEC’s stance further solidifies Bitcoin’s status as a commodity rather than a security—an important distinction for institutional investors. While price volatility remained muted among top-tier PoW coins, the surge in lower-cap alternatives shows a possible realignment of investor strategy, potentially favoring innovation and upside over legacy names.

A Step Toward Regulatory Clarity

The SEC’s announcement is the latest in a series of moves suggesting that U.S. regulators are moving toward a more structured and transparent approach to crypto oversight. Just this week, the SEC also dropped its appeal in the long-running Ripple case, another sign that the agency is ready to define clearer boundaries in the evolving digital asset landscape.

Previously, the SEC had declared that certain meme coins would not be classified as securities either. These cumulative actions indicate a regulatory shift away from ambiguity and toward greater compliance-friendly transparency.

A Green Light for PoW Miners and Investors

For PoW miners, the implications are substantial. Without the threat of securities violations hanging overhead, mining operations can now expand more freely, attracting capital and building infrastructure with legal certainty.

From an investor standpoint, the regulatory green light could encourage fresh interest in both well-established and emerging PoW coins. While major assets like Bitcoin may not experience explosive short-term gains, the overall boost in credibility for PoW-based assets could drive long-term market participation.

As The Bit Journal notes, such developments are critical for building investor trust and supporting sustainable growth in the crypto ecosystem.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!