According to the latest updates, the SEC has approved crypto ETF redemptions through in-kind transfers. This means big trading firms can now receive Bitcoin or Ethereum instead of cash when redeeming shares. The change supports better pricing, lower costs, and stronger trust in crypto investment products.

What Are Crypto ETF Redemptions?

Crypto ETF redemptions allow large financial firms called authorized participants to exchange ETF shares for tangible crypto assets like Bitcoin or Ethereum. This process is known as in-kind redemption. Instead of receiving U.S. dollars when pulling value from a crypto ETF, these firms now get the actual tokens held by the fund.

Until recently, all spot crypto ETFs in the U.S. used cash-only redemptions. That meant funds had to sell crypto, convert it to fiat, and then deliver cash when investors wanted to exit. This extra step added tax consequences, trading fees, and price differences between the ETF and the real market value of Bitcoin or Ethereum.

Now, with in-kind redemptions in place, ETF managers can transfer crypto directly. This model already works well in commodity-based ETFs, such as gold and oil. By using the same structure, crypto ETFs now operate with more efficiency, fewer fees, and greater trust from institutional players.

Why the SEC Made This Change

The U.S. Securities and Exchange Commission reviewed global standards and studied how in-kind redemptions work in other markets. Most commodity and equity ETFs use in-kind systems because they are faster, cheaper, and easier to track. After months of discussion with major ETF issuers including: BlackRock, Fidelity, and ARK 21Shares, the SEC found that crypto ETFs could safely adopt the same method.

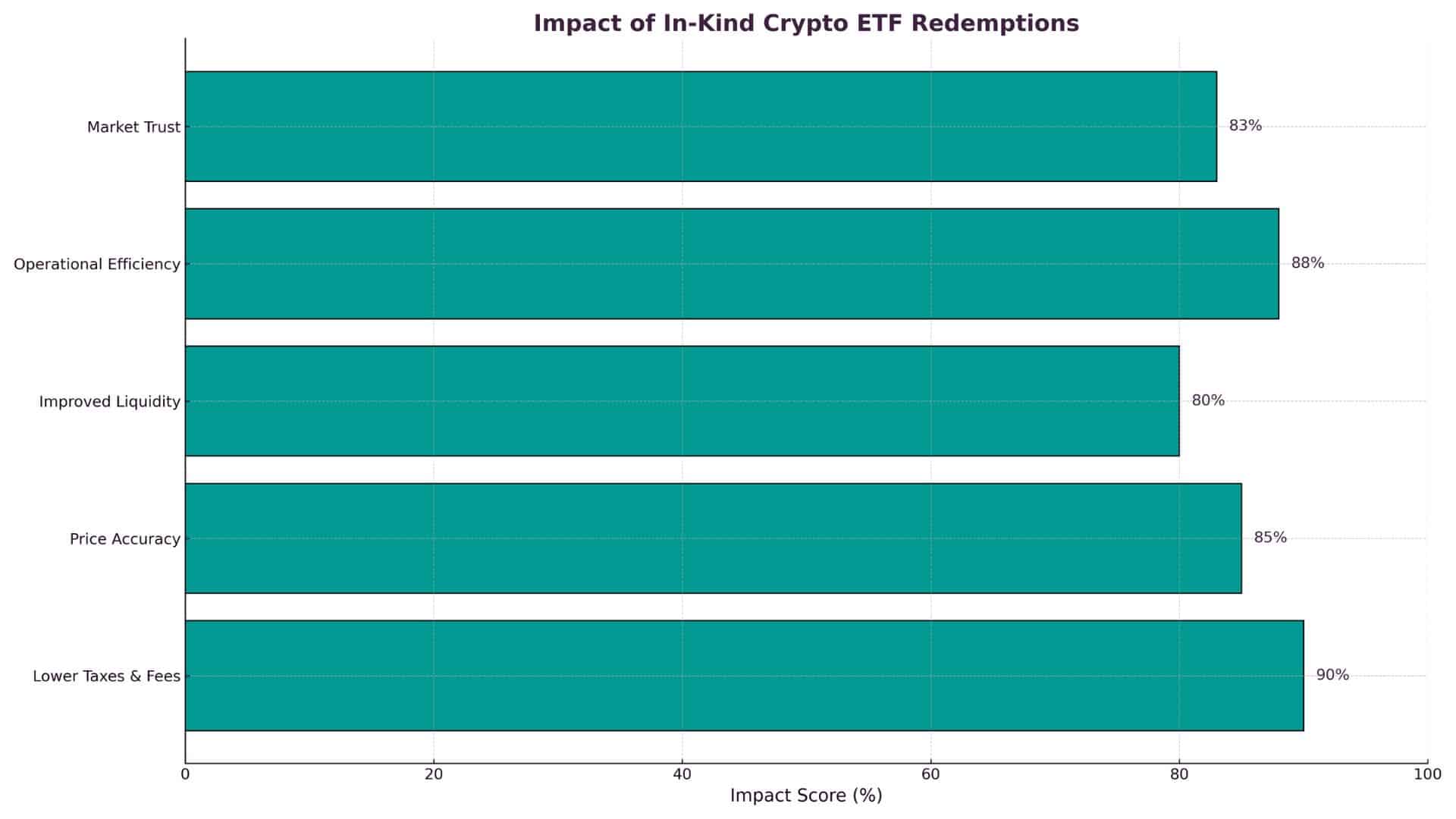

The decision came after ongoing pressure from the industry to match the structure of traditional ETFs. Many asset managers argued that cash-only redemptions created unnecessary costs and risks. They also said that in-kind redemptions would support more accurate pricing and stronger market liquidity.

Paul Atkins, a former SEC commissioner, supported the decision. He said:

“This puts crypto ETFs closer to how traditional commodity funds work.”

By approving in-kind crypto ETF redemptions, the SEC made a clear statement: crypto is no longer an experiment—it’s now a serious part of the broader investment world.

Benefits of Crypto ETF Redemptions

1. Lower Taxes and Fees

Firms avoid selling crypto to get cash. That saves money on taxes and trading fees. It also makes trades cleaner and faster.

2. Better Prices

ETF share prices stay closer to the real value of Bitcoin or Ethereum. This helps everyone understand the value of the ETF.

3. More Liquidity

Funds can move crypto faster. That keeps the market strong and easier to use.

Hester Peirce, SEC Commissioner, said:

“In-kind redemptions are coming. We just needed the right setup to support them.”

Who Will Benefit the Most?

Authorized participants, large firms that manage ETF shares will benefit first. They can now move assets more freely. They also get tax benefits.

Every day, investors may not use in-kind redemptions directly. But they still gain from better trade prices, smoother buying and selling, and more trusted ETFs.

Eric Balchunas, a Bloomberg analyst, said:

“This is a big deal. It brings crypto funds in line with how ETFs are supposed to work.”

What’s Next for Crypto ETFs?

Big names like BlackRock, VanEck, and Fidelity have already filed new ETF plans. These now include in-kind redemptions. New funds for other tokens like Solana or $XRP could also follow this model.

Reuters reported that SEC staff accepted changes in ETF filings. This opens the door to more approvals in the coming months.

Conclusion

Based on the latest research, crypto ETF redemptions create a simpler, cheaper, and more trusted system for handling crypto funds. They help large investors reduce costs and improve trade accuracy. As more ETF providers adopt this model, the overall market may become more stable and efficient. This shift also shows growing support from regulators and a stronger future for crypto investing.

Summary

The SEC has approved in-kind crypto ETF redemptions, allowing direct swaps of ETF shares for Bitcoin or Ethereum. This change lowers costs, improves pricing accuracy, and aligns crypto ETFs with traditional fund models. While it mainly helps large investors, retail traders may benefit from smoother trades and tighter spreads. The move signals growing trust in crypto and could lead to more ETF products shortly.

To get more detailed insights into the world of cryptocurrencies, check out our latest articles.

FAQs

What does in-kind crypto ETF redemption mean?

It means ETFs give actual Bitcoin or Ethereum to firms instead of cash.

Who uses in-kind redemptions?

Authorized participants—large firms that help manage ETFs.

Will small investors benefit?

Yes. They may see better prices and more trusted ETF products.

Will other crypto ETFs use this model?

Yes. New ETF proposals already include this in-kind method.

Glossary

ETF (Exchange-Traded Fund): A fund that holds assets and trades on stock markets.

Redemption: Taking back the value of ETF shares.

In-Kind: Receiving crypto instead of cash.

Authorized Participant: A firm that creates or redeems ETF shares.