The U.S. Securities and Exchange Commission (SEC) has recently postponed its decisions on several cryptocurrency exchange-traded fund (ETF) applications, including those for XRP, Solana (SOL), Litecoin (LTC), and Dogecoin (DOGE). This move has significant implications for investors and the broader cryptocurrency market.

Understanding the SEC’s Decision

On March 11, 2025, the SEC announced delays in approving several cryptocurrency ETFs. Grayscale’s XRP and Cboe BZX Exchange’s spot Solana ETF filings are among the affected applications. Decisions are now expected in May 2025.

Bloomberg ETF analyst James Seyffart commented that such delays are standard procedure and do not necessarily indicate a negative outcome. He noted that the final deadlines for these decisions extend until October 2025.

Factors Influencing the Delay

Several factors may have contributed to the SEC’s decision to delay these ETF approvals:

Regulatory Scrutiny: The SEC continues to exercise caution in approving cryptocurrency-related financial products, aiming to ensure investor protection and market stability.

Leadership Transition: The SEC is undergoing a leadership change, with President Donald Trump’s nominee, Paul Atkins, awaiting confirmation as the new chair. This transition may have contributed to the postponement.

Market Dynamics: The cryptocurrency market’s volatility and evolving nature necessitate thorough evaluation by regulatory bodies before approving new investment vehicles.

Potential Impact on the Cryptocurrency Market

The SEC’s delay in approving these ETFs has several implications:

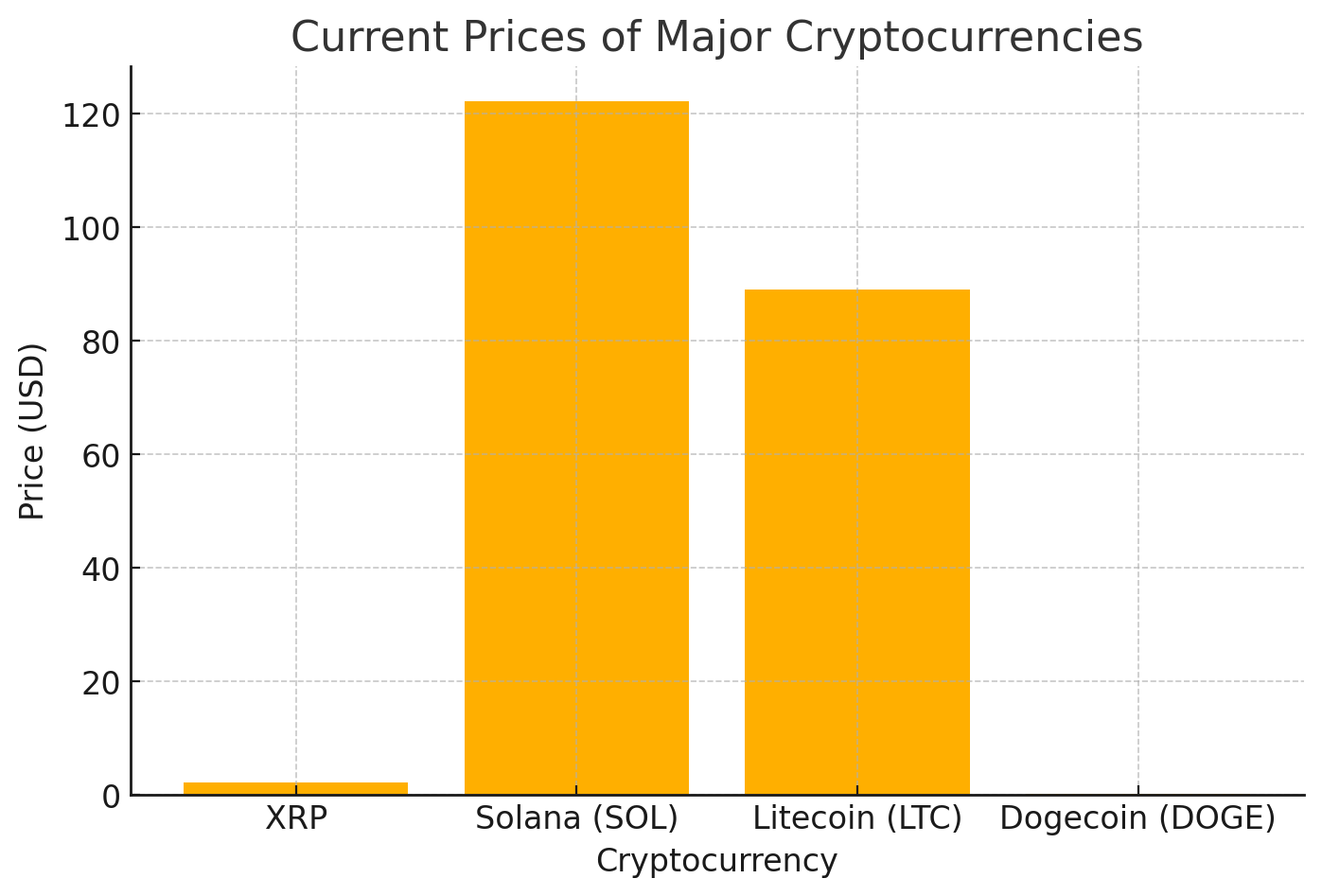

Investor Sentiment: The postponement may lead to short-term uncertainty among investors, potentially affecting the prices of the involved cryptocurrencies.

Market Maturity: The delay underscores the need for a more mature and regulated market infrastructure to support such investment products.

Future Approvals: The outcome of these ETF applications could set precedents for future cryptocurrency-related financial products, influencing the regulatory landscape.

Comparison of Affected ETFs

Below is a comparison of the key details of the affected ETF applications:

| ETF Applicant | Cryptocurrency | Current Status | New Decision Deadline |

|---|---|---|---|

| Grayscale | XRP | Delayed | May 2025 |

| Cboe BZX | Solana (SOL) | Delayed | May 2025 |

| Canary Capital | Litecoin (LTC) | Delayed | May 2025 |

| Grayscale | Dogecoin (DOGE) | Delayed | May 2025 |

Summing Up

While the SEC’s delay in approving XRP, Solana, Litecoin, and Dogecoin ETFs may cause short-term uncertainty, it highlights the agency’s commitment to regulatory diligence. Investors should keep a close watch on further developments, as the eventual outcome could shape the future of cryptocurrency ETFs and mainstream adoption.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

Q1: What is an exchange-traded fund (ETF)?

A1: An ETF is an investment fund that tracks the performance of a specific asset or group of assets and is traded on stock exchanges. It allows investors to gain exposure to the underlying assets without owning them directly.

Q2: Why did the SEC delay the approval of these cryptocurrency ETFs?

A2: The SEC delayed the approvals to conduct a more comprehensive review of the applications, ensuring they meet regulatory standards and adequately protect investors.

Q3: How does this delay affect individual investors?

A3: The delay may prolong the availability of regulated investment vehicles for these specific cryptocurrencies, limiting options for investors seeking exposure through ETFs.

Q4: When can we expect a final decision on these ETFs?

A4: The SEC has extended the decision deadlines to May 2025, with final decisions anticipated by October 2025.

Q5: What impact could the approval of these ETFs have on the cryptocurrency market?

A5: Approval could lead to increased institutional investment, enhanced market liquidity, and broader acceptance of the involved cryptocurrencies.

Glossary of Key Terms

Exchange-Traded Fund (ETF): A type of investment fund traded on stock exchanges, designed to track the performance of a specific asset or group of assets.

Securities and Exchange Commission (SEC): The U.S. federal agency responsible for enforcing federal securities laws and regulating the securities industry.

Cryptocurrency: A digital or virtual currency that uses cryptography for security and operates independently of a central authority.

Investor Sentiment: The overall attitude of investors toward a particular security or financial market, influencing trading behaviors.

Market Liquidity: The extent to which an asset can be quickly bought or sold in the market without affecting its price.