According to the report, the U.S. Securities and Exchange Commission (SEC) and Binance, the world’s largest cryptocurrency exchange, have jointly agreed to a 60-day pause in their ongoing legal battle. This decision comes as the SEC establishes a new Crypto Task Force to reshape the digital asset regulatory landscape.

Background: The SEC’s Case Against Binance

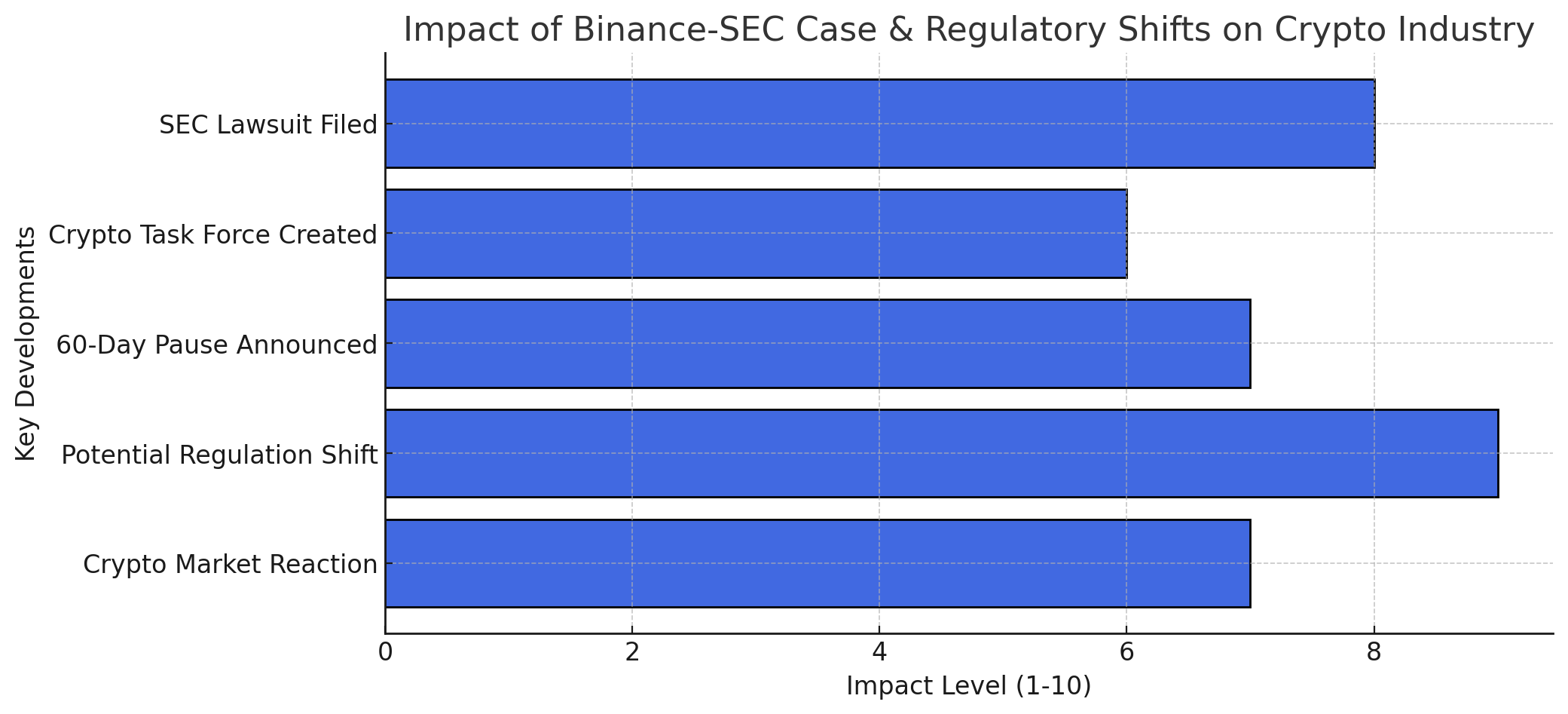

In June 2023, the SEC filed a lawsuit against Binance and its founder, Changpeng Zhao, alleging that the exchange had artificially inflated trading volumes, misused customer funds, and misled investors about its regulatory compliance. These allegations marked a significant escalation in the SEC’s scrutiny of the cryptocurrency industry.

A Strategic Pause: The 60-Day Suspension

On February 13, 2025, U.S. District Judge Amy Berman Jackson granted a 60-day stay in the SEC’s lawsuit against Binance. Both parties requested this pause to allow the SEC’s newly formed Crypto Task Force to review and potentially influence the regulatory framework governing cryptocurrencies. The task force’s work is anticipated to “impact and facilitate the potential resolution of this case.”

The Crypto Task Force: A New Direction for the SEC

The SEC’s Crypto Task Force, announced in January 2025, is led by Commissioner Hester Peirce, affectionately known in the industry as “Crypto Mom” for her supportive stance toward digital assets. The task force aims to provide clarity on the application of federal securities laws to the crypto market and to recommend practical policy measures that foster innovation while protecting investors.

Commissioner Peirce has outlined several priorities for the task force, including:

- Clarifying the status of different types of crypto assets under securities laws.

- Identifying areas that fall outside the SEC’s jurisdiction.

- Guiding crypto-lending and staking programs.

- Developing tailored disclosure frameworks for crypto offerings.

A Shift Toward Collaboration

The decision to pause the lawsuit and the formation of the Crypto Task Force has been met with optimism within the cryptocurrency industry. Many see these moves as indicative of a more collaborative and less adversarial approach by the SEC under the current administration.

A spokesperson for Binance stated,

“The SEC’s case has always been without merit, and we are eager to put this behind us and to continue our focus on keeping Binance the most secure, licensed, and trusted exchange in the world.”

The Future of Crypto Regulation

Establishing the Crypto Task Force and temporarily suspending the SEC’s lawsuit against Binance signal a potential shift in how cryptocurrencies will be regulated in the United States. By seeking input from a wide range of stakeholders, including investors, industry participants, academics, and other interested parties, the SEC aims to create a regulatory environment that balances investor protection with the need for innovation.

As Commissioner Peirce noted,

“This undertaking will take time, patience, and much hard work. It will succeed only if the Task Force has input from a wide range of investors, industry participants, academics, and other interested parties.”

Conclusion

The 60-day pause in the SEC’s lawsuit against Binance, coupled with the formation of the Crypto Task Force, marks a pivotal moment in the regulation of digital assets. These developments suggest a move toward a more nuanced and collaborative approach to overseeing the rapidly evolving cryptocurrency industry.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

1. What led to the SEC’s lawsuit against Binance?

The SEC sued Binance in June 2023, alleging that the exchange had artificially inflated trading volumes, misused customer funds, and misled investors about its regulatory compliance.

2. What is the purpose of the 60-day pause in the lawsuit?

The pause allows the SEC’s newly formed Crypto Task Force to review and potentially influence the regulatory framework governing cryptocurrencies, which may impact the resolution of the case.

3. Who is leading the SEC’s Crypto Task Force?

The task force is led by SEC Commissioner Hester Peirce, known for her supportive stance toward digital assets.

4. How has the cryptocurrency industry reacted to these developments?

The industry has responded positively, viewing the pause and the formation of the task force as signs of a more collaborative and less adversarial approach by the SEC.

Glossary of Key Terms

Cryptocurrency: A digital or virtual currency that uses cryptography for security and operates independently of a central authority.

Securities and Exchange Commission (SEC): A U.S. federal agency responsible for enforcing federal securities laws and regulating the securities industry.

Staking: The process of actively participating in transaction validation on a proof-of-stake (PoS) blockchain.

Stablecoin: A type of cryptocurrency that is pegged to a reserve asset, such as the U.S. dollar, to maintain a stable value.