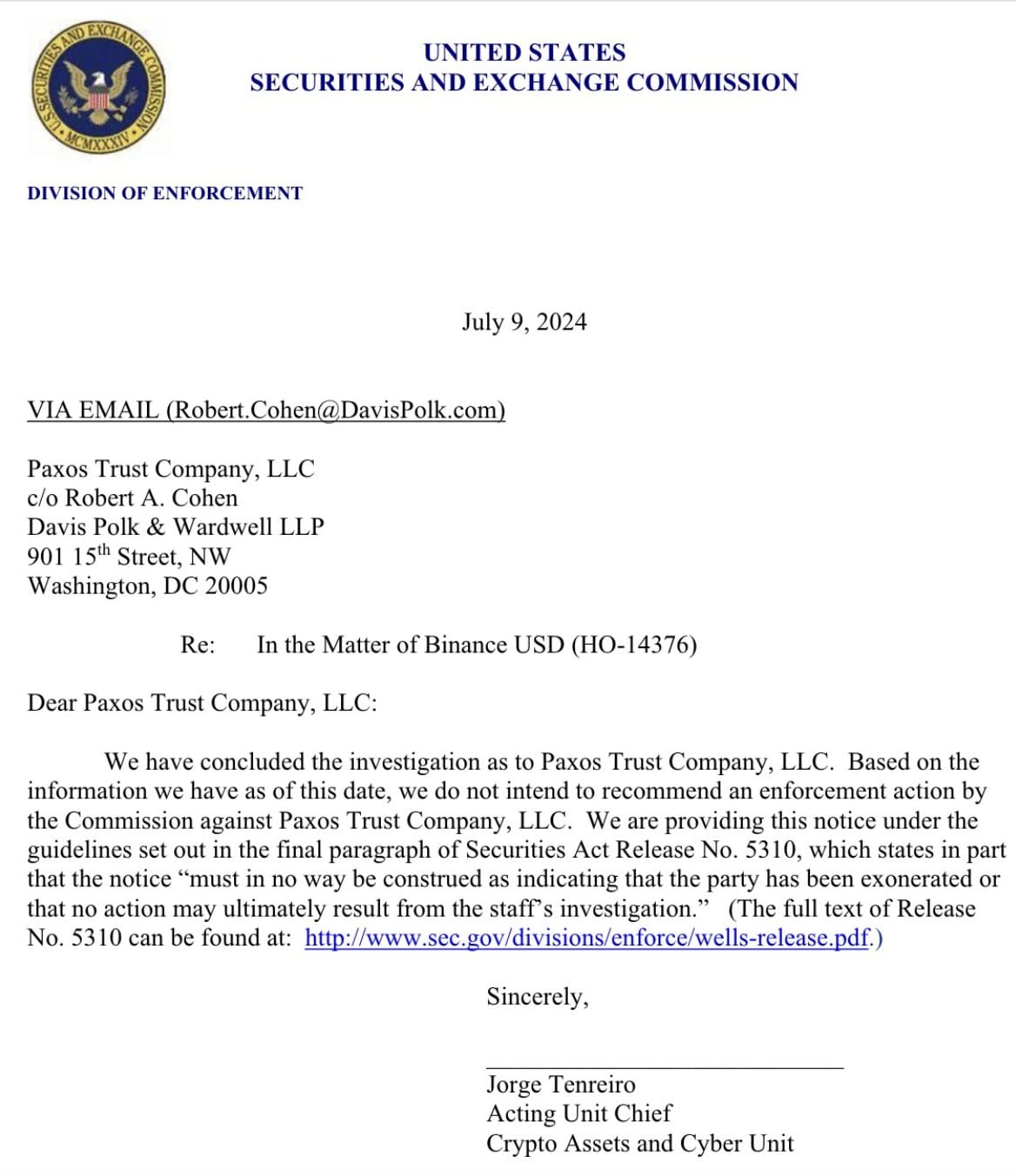

The Securities and Exchange Commission (SEC) has opted not to pursue enforcement action against Paxos, a leading stablecoin issuer. This decision marks the conclusion of an investigation that commenced with a Wells notice issued in February 2023, signalling a potential lawsuit over Binance USD (BUSD), which the SEC had identified as an unregistered security. Paxos, steadfast in its defence, has maintained that its USD-backed stablecoins do not fall under federal securities laws.

Legal Challenges and Regulatory Landscape

The SEC’s decision to drop its investigation into Paxos comes amidst a backdrop of evolving legal interpretations and precedents within the crypto sector. One pivotal ruling came in July 2023, when a federal judge ruled in SEC v. Ripple that XRP, the native token of Ripple Labs, did not meet the criteria to be classified as a security in its distribution and utilization across digital asset exchanges. This landmark decision set a precedent that has influenced subsequent legal determinations concerning the regulatory status of digital assets.

Moreover, the legal proceedings involving Binance have also shaped the regulatory discourse. In June 2024, a judge presiding over the SEC’s case against Binance referenced the Ripple ruling when dismissing a claim related to Binance USD. This dismissal underscored the shifting legal standards and interpretations surrounding digital currencies, highlighting the complexities that regulators and industry participants face in navigating the regulatory landscape.

Despite the SEC’s decision not to pursue enforcement action against Paxos, the regulatory scrutiny of the cryptocurrency sector remains intense. The SEC continues to pursue enforcement actions against other prominent crypto firms, including Ripple, Binance, Kraken, and Coinbase. These actions reflect ongoing efforts by regulators to assert oversight and enforce compliance with securities laws in the rapidly evolving digital asset market.

Implications for the Crypto Industry

The SEC’s resolution of the Paxos investigation carries significant implications for the broader cryptocurrency industry. It underscores the importance of clarity and consistency in regulatory interpretations regarding digital assets. Paxos’s successful defence against the Wells notice reaffirms its position on the regulatory status of BUSD and other stablecoins, providing clarity for market participants and investors alike.

“Paxos Trust Company has always maintained that its USD-backed stablecoins are not securities under federal securities laws and that the Wells Notice was unwarranted and unjustified,” said Paxos in a July 11 statement. “We are proud of our relentless advocacy for stable-value digital assets and that the SEC staff determined it will not bring an enforcement action against Paxos in connection with BUSD.”

Moving forward, stakeholders in the crypto ecosystem will likely continue to engage with regulators and policymakers to shape a regulatory framework that balances innovation with investor protection. The SEC’s decision not to pursue enforcement action against Paxos may prompt other stablecoin issuers and digital asset providers to review their compliance strategies and engage proactively with regulatory authorities to mitigate legal risks.

The regulatory landscape for digital assets remains fluid, with ongoing debates and discussions about classifying cryptocurrencies and enforcing securities laws. As regulatory frameworks evolve, market participants, including issuers, investors, and service providers, must stay vigilant and adaptable to navigate the complexities of compliance and regulatory oversight effectively.

Navigating Future Regulatory Challenges

The SEC’s decision not to pursue enforcement action against Paxos represents a pivotal moment in the regulatory evolution of the cryptocurrency industry. It reflects the ongoing challenges and debates surrounding the classification and regulation of digital assets in the United States. Paxos’s successful defence against the Wells notice underscores the importance of legal clarity and regulatory consistency in fostering innovation while protecting investors.

As the crypto industry continues to mature, stakeholders will play a crucial role in shaping regulatory policies that promote transparency, accountability, and market integrity. The resolution of the Paxos investigation reminds us of the dynamic nature of regulatory oversight in the digital age and highlights the need for continued dialogue between industry participants and regulatory authorities.

In conclusion, while the SEC’s decision not to pursue enforcement action against Paxos is a positive development for the company and the broader crypto community, it also underscores the ongoing challenges and uncertainties inherent in regulatory compliance within the digital asset market. Moving forward, stakeholders must remain proactive in navigating regulatory complexities to foster a thriving and compliant ecosystem for digital innovation. Keep Informed with The BIT Journal for the latest crypto news.