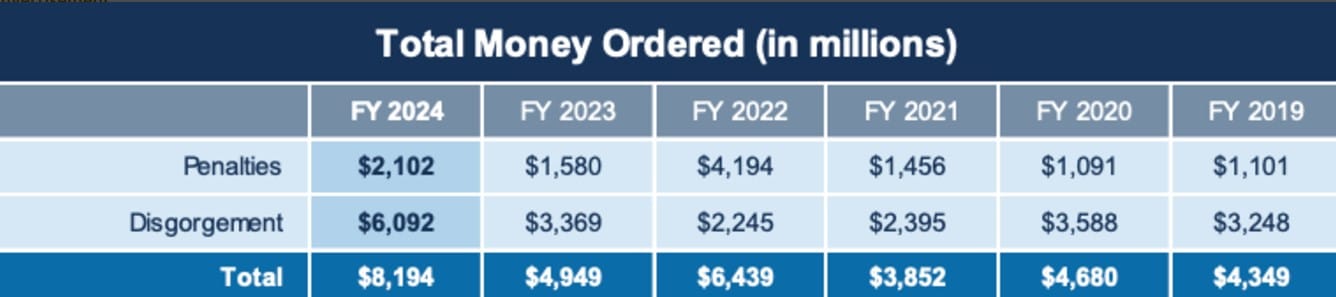

The SEC achieved a historic milestone by securing $8.2 billion in financial remedies for fiscal year 2024, emphasizing intense scrutiny of cryptocurrency. In an unprecedented move, this record-setting figure eclipses all prior agency achievements, largely fueled by a landmark settlement with troubled blockchain project Terraform Labs. While intensifying oversight of the volatile crypto market, regulators probed numerous entities to protect investors and uphold transparency.

Terraform Labs: The Catalyst for Record Penalties

The SEC achieved a historic milestone by securing $8.2 billion in financial remedies for fiscal year 2024, emphasizing intense scrutiny of cryptocurrency. In an unprecedented move, this record-setting figure eclipses all prior agency achievements, largely fueled by a landmark settlement with troubled blockchain project Terraform Labs.

While intensifying oversight of the volatile crypto market, regulators probed numerous entities to protect investors and uphold transparency. The outcome underscores the SEC’s widening purview over emerging technologies and reinforced penalties for transparency breaches impacting the financial system’s integrity.

The decline in Enforcement Actions Amidst Rising Penalties

Interestingly, while the total financial remedies escalated to unprecedented levels, enforcement actions declined rather significantly from the previous year by 26%, amounting to a mere 583 cases. This divergence intimates a strategic realignment within the SEC towards addressing high-impact infractions carrying substantial penalties, most notably those occurring within the burgeoning cryptocurrency sphere.

The agency procured $2.1 billion in penalties as well as a landmark $6.1 billion in disgorgement, corroborating its dedication to restoring ill-gotten profits to victimized investors.

Impact on the Cryptocurrency Industry

he SEC’s aggressive stance has sent shockwaves throughout the nascent cryptocurrency industry. In a notable example, eToro, a leading online brokerage platform, consented to discontinue providing the vast majority of digital currencies to American clients and remitted a $1.5 million fine as stipulated in an agreement with the SEC.

The regulatory body alleged that eToro had functioned as an uncertified brokerage and clearinghouse for crypto assets deemed to represent securities. This settlement underscores the SEC’s intensifying endeavours to compel adherence to securities regulations within the evolving crypto sphere.

Guidance for Crypto Traders

Cryptocurrency traders must perform thorough research before acting to avoid legal trouble down the road. While volatility provides opportunities for profits, the evolving regulations mandate working with exchanges committed to transparency. Individual traders hold responsibility for understanding where digital assets stand legally, plus monitoring shifting compliance demands. Wise traders pick outlets demonstrating openness about their operations and emphasis on obeying rules.

The Final Thoughts

The $8.2 billion in financial remedies from the SEC for 2024 signalled a pivotal moment in crypto regulation. Most notably, the unprecedented penalty against Terraform Labs demonstrated the lengths regulators would go to enforce rules and shield the public. Both industry players and individuals must keep evolving with reforms while closely watching for compliance twists and turns. Cutting-edge technologies often blur guidelines at first, but accountability serves future innovation and trust.

Stay tuned to TheBITJournal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!