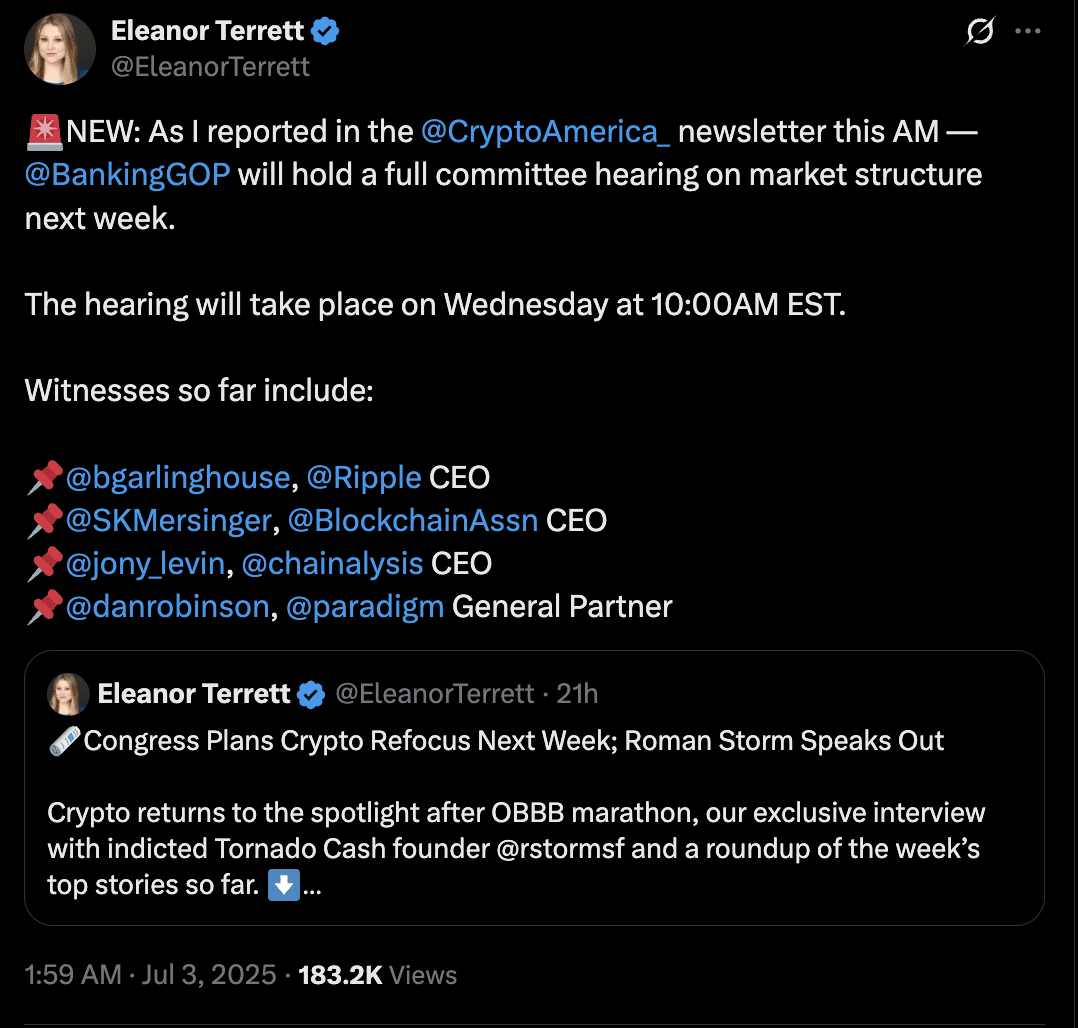

According to reports, the U.S. Senate Banking Committee is preparing to host a critical hearing on July 9, 2025, focused entirely on the structure and future of crypto market rules. Set for 10:00 a.m. EST, the hearing comes amid growing pressure on lawmakers to provide clearer regulatory guidance for the digital asset industry, following several failed legislative attempts in the past year.

Leading voices from the crypto sector, including Ripple CEO Brad Garlinghouse and Chainalysis CEO Jonathan Levin, will testify. They’ll be joined by Blockchain Association CEO Summer Mersinger and Paradigm’s Dan Robinson. Their input is expected to shape how the Senate approaches drafting comprehensive crypto market rules for trading, custody, and compliance.

Testimony to Center Around Clarity and Compliance

The witnesses will likely emphasize the need for federal-level clarity on how digital assets are classified, taxed, and overseen. Garlinghouse is expected to call for the consistent application of securities laws and clearer distinctions between utility tokens and securities. Jonathan Levin may highlight compliance strategies for anti-money laundering and terrorist financing, core pillars of any future crypto market rules.

Summer Mersinger and Dan Robinson are expected to urge lawmakers to strike a balance between enabling innovation and enforcing safeguards. Both have previously advocated for transparent but flexible crypto market rules that align with global standards while preserving U.S. competitiveness.

Recent Legislative Setbacks Fuel Senate Action

Congress has struggled to implement clear crypto market rules, despite mounting calls for reform from both industry and regulatory stakeholders. Notably, Senator Cynthia Lummis’s proposed tax amendment aimed at clarifying digital asset treatment failed to gain approval, emphasizing continued resistance within the Senate. In addition, President Trump’s broader legislative package, the “One Big Beautiful Bill,” excluded any language related to crypto, leaving the industry without a clear regulatory path.

These missed opportunities have added urgency to the upcoming hearing. Lawmakers now appear ready to re-engage with the topic, making the July 9 session a potential turning point in defining long-awaited crypto market rules.

GENIUS and CLARITY Acts Offer a Framework

Two key bills, the GENIUS Act and the CLARITY Act, could offer the foundation for formal crypto market rules. If passed, GENIUS would proceed to the President’s desk while CLARITY would move to the Senate floor. Together, these acts aim to standardize definitions, regulatory responsibilities, and compliance expectations across the digital asset ecosystem.

The GENIUS Act focuses on innovation, while the CLARITY Act is designed to provide comprehensive oversight for digital asset custody, trading, and issuance. Both bills could significantly reduce uncertainty and lay the groundwork for national crypto market rules that protect investors while allowing the sector to thrive.

Conclusion: Path Forward for Crypto Market Rules

Following the hearing, lawmakers are expected to use the gathered testimony to refine legislation. Committee staff may draft new bills or amend the GENIUS and CLARITY Acts based on insights from the session. Ideally, this process will result in bipartisan support for federal crypto market rules that can be implemented swiftly and effectively.

While disagreement remains over the role of the SEC versus the CFTC in regulating digital assets, most observers agree that progress is needed, and fast. The hearing offers an opportunity to define jurisdictional clarity and outline practical steps for implementation.

Summary

The U.S. Senate Banking Committee will hold an important hearing on July 9, 2025, to discuss the structure and future of crypto market rules, with testimony expected from industry leaders like Ripple CEO Brad Garlinghouse and Chainalysis CEO Jonathan Levin. This hearing follows failed legislative attempts, such as Senator Lummis’s crypto tax amendment, and aims to bring clarity through potential bills like the GENIUS and CLARITY Acts.

FAQs

Why is the July 9 hearing important?

It represents a major opportunity for the Senate to establish clear crypto market rules based on direct industry feedback.

Who will testify at the hearing?

Executives from Ripple, Chainalysis, Blockchain Association, and Paradigm are scheduled to provide insights.

What are the GENIUS and CLARITY Acts?

They are legislative proposals aimed at creating a regulatory framework for digital assets in the U.S.

How could new rules affect crypto businesses?

Clear crypto market rules would improve legal certainty, attract investment, and allow businesses to innovate responsibly.

Glossary

Crypto Market Rules – Legal and regulatory frameworks that govern how digital assets are traded, stored, and taxed in the U.S.

GENIUS Act – Proposed legislation designed to promote innovation and clarity in digital asset laws.

CLARITY Act – A legislative effort to provide specific guidelines for digital asset custody, classification, and trading.

Ripple – A U.S.-based blockchain company that specializes in cross-border payment solutions.

Chainalysis – A blockchain analytics firm that helps regulators and businesses monitor crypto transactions.