SharpLink Gaming has raised its stock sale limit from $1 billion to $6 billion to strengthen its ETH treasury. This has made the company the biggest corporate Ethereum holder in the entire world with more than 321,000 ETH. It is a daring step that puts Ethereum in the middle of its treasury plans, giving it sizeable exposure to crypto institutions.

$6 Billion Sale Target Shows Confidence in ETH Treasury Strategy

SharpLink Gaming updated its SEC filing on Thursday to reflect a significant capital raise increase through a new prospectus supplement. The firm raised its total equity sale ceiling from $1 billion to $6 billion under the same sales agreement. As of now, it has already sold $721 million and plans to sell an additional $279 million under the earlier authorization.

This decision aligns with SharpLink’s growing commitment to ETH as a core reserve asset for its corporate treasury. The company believes Ethereum offers financial and strategic advantages that outweigh other crypto or fiat reserves. Its ETH treasury continues to expand as part of a broader blockchain-focused initiative.

The capital influx supports SharpLink’s goal to solidify Ethereum’s role within its treasury and corporate structure. The company has consistently described ETH as a long-term store of value. The ongoing equity sales demonstrate strong confidence in Ethereum’s future relevance in digital finance.

Ethereum’s Institutional Appeal Gains Momentum

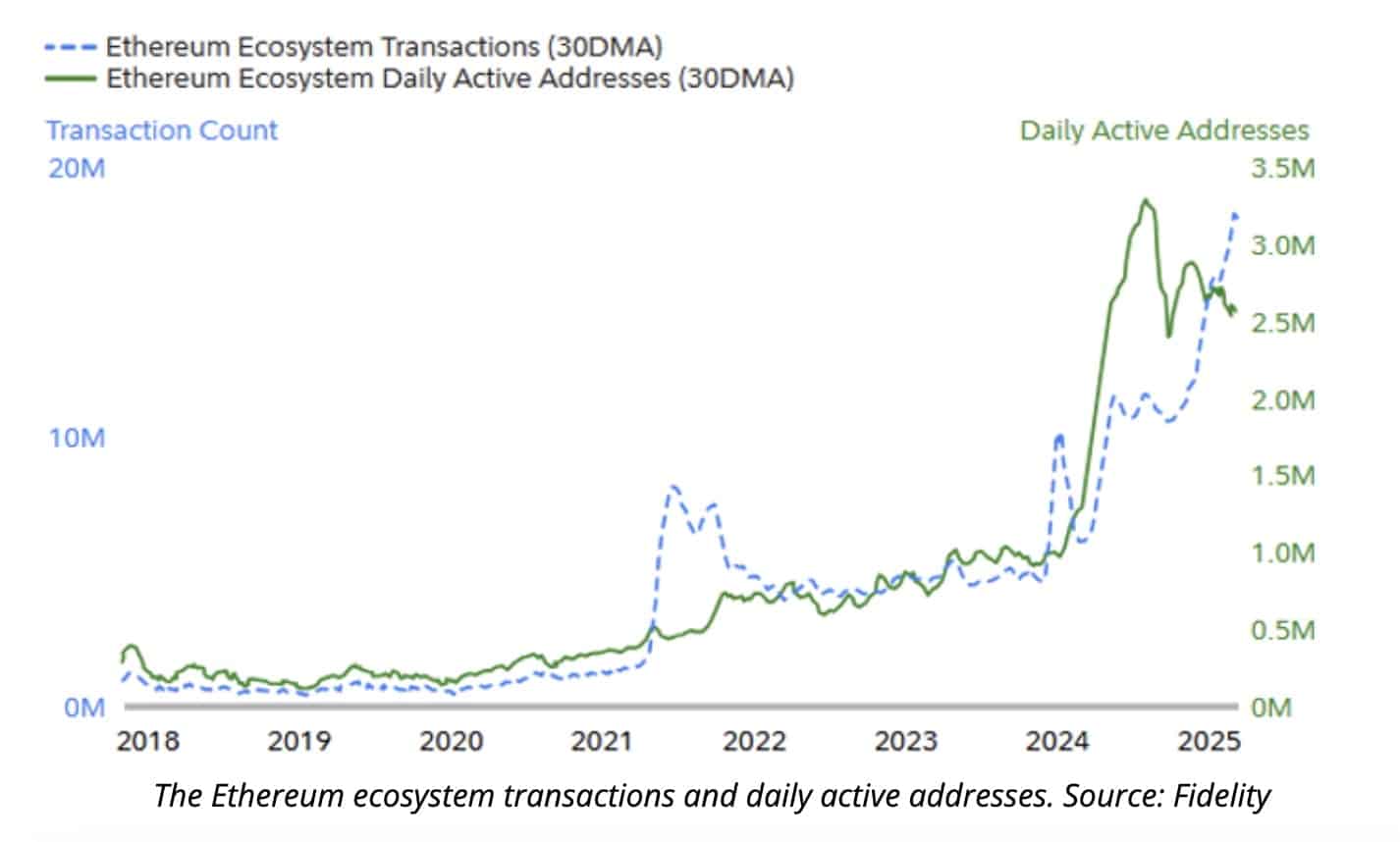

Ethereum has emerged as a preferred asset among institutions due to its utility, stability, and expanding role in financial infrastructure. A recent Electric Capital report notes Ethereum’s leading position in stablecoin issuance and yield-bearing digital dollars. It cites Ethereum’s unmatched accessibility, security, and neutrality across blockchain ecosystems.

With over $200 billion in stablecoins circulating on Ethereum, the network dominates digital dollar infrastructure. This includes over $4 billion in yield-bearing stablecoins, which draw attention from large asset managers. As the DeFi space matures, Ethereum’s usage increases in both lending and collateral services.

SharpLink’s ETH treasury positions it ahead of this shift, reflecting the belief that ETH may mirror traditional reserve assets like gold. Over $19 billion in DeFi loans are already backed by ETH, signaling its growing financial utility. SharpLink aims to lead in this transformation by maintaining a substantial ETH reserve.

Strategic Partnerships and Board Changes Highlight Commitment

In June, a $425 million private placement led by Consensys further strengthened SharpLink’s ETH treasury. Ethereum co-founder Joseph Lubin also joined SharpLink’s board as chairman, underlining the company’s strategic pivot. This leadership move signals deeper alignment with Ethereum’s long-term ecosystem growth.

SharpLink’s ETH treasury now surpasses $1.1 billion in value, reflecting a rapid accumulation trend over recent months. The firm sees Ethereum as essential to its business model, not just a speculative asset. This view mirrors MicroStrategy’s early bitcoin strategy, but tailored toward Ethereum’s growing ecosystem.

Company officials say the stock sale expansion provides flexibility for strategic ETH purchases aligned with market opportunities. SharpLink is actively exploring additional integrations of Ethereum-based tools into its marketing platforms. The firm believes ETH will unlock new value in affiliate marketing and digital asset management.

Summary

SharpLink Gaming has increased its equity sale target to $6 billion to grow its ETH treasury, now holding over 321,000 ETH. This move follows a $425 million investment led by Consensys and marks a major strategic shift. With Ethereum’s growing role in stablecoins and DeFi, the company aims to lead corporate adoption. SharpLink’s treasury model echoes early Bitcoin strategies but focuses on Ethereum as a modern digital reserve asset.

FAQs

Why is SharpLink raising its stock sale target to $6 billion?

SharpLink aims to expand its ETH treasury significantly and needs capital to purchase additional Ethereum for corporate reserves.

How much ETH does SharpLink currently hold?

SharpLink holds more than 321,000 ETH, currently valued at over $1.1 billion based on market prices.

What role does Ethereum play in SharpLink’s strategy?

Ethereum acts as a reserve asset and foundation for future blockchain integrations in the company’s marketing operations.

Did SharpLink receive any major investments recently?

Yes, Consensys led a $425 million private placement in June, which helped increase the company’s ETH holdings.

What makes ETH attractive for corporate treasuries?

ETH offers staking yield, collateral flexibility, and dominance in DeFi and stablecoin issuance, making it a promising digital reserve.

Glossary of Key Terms

ETH Treasury: Corporate reserves held in Ethereum (ETH), similar to cash or gold reserves in traditional finance.

Stablecoins: Digital tokens pegged to fiat currencies, primarily issued on blockchain platforms like Ethereum.

DeFi: Decentralized Finance; financial services built on blockchain protocols, offering lending, borrowing, and trading without intermediaries.

Prospectus Supplement: An SEC filing that updates the terms of a previously registered stock offering.

Private Placement: Sale of securities to select investors without a public offering, often used for strategic investments.