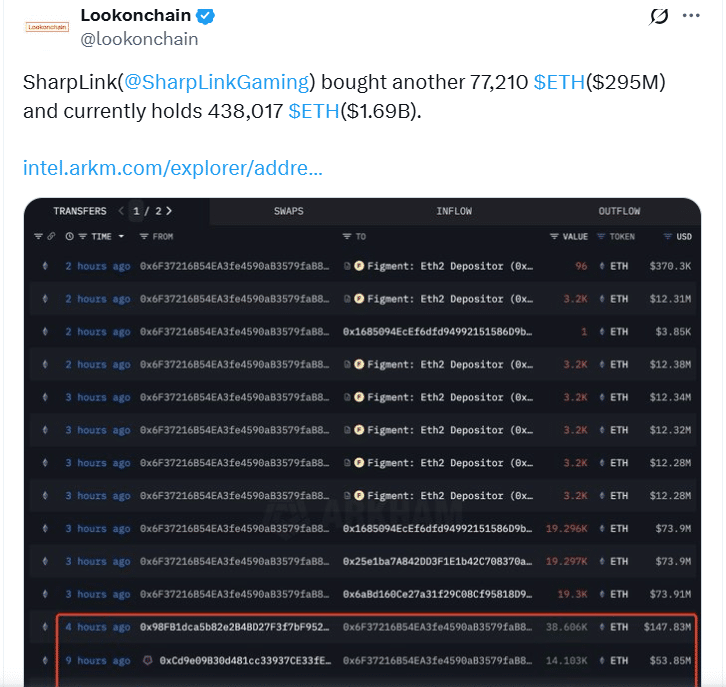

SharpLink’s newest Ethereum purchase has reintroduced $ETH into the limelight, sparking debates about institutional adoption and staking growth. The company’s move to buy 77,210 ETH, worth around $295 million, quickly placed it among the top corporate holders of the cryptocurrency.

This action has boosted the Ethereum price prediction, with analysts believing the large-scale purchase will have a substantial influence on the market.

“SharpLink’s aggressive Ethereum purchase is a clear signal that institutional investors are viewing Ethereum as more than just a speculative asset,” according to a senior strategist. The company staked the full transaction almost immediately, demonstrating its long-term commitment to the network and bolstering the notion that Ethereum is maturing into a yield-generating treasury asset.

Ethereum Purchase: Staking and Supply Dynamics

Supply limitations are frequently considered in Ethereum price prediction models, and SharpLink’s Ethereum purchase is especially relevant in this regard. The firm’s one transaction exceeded the entire net ETH issued in the preceding month. With freshly purchased tokens now locked inside staking contracts, there are less ETH accessible for trading, reducing the overall circulating supply.

Ethereum’s change to a proof-of-stake network has already decreased sell pressure by promoting long-term holding, and actions like SharpLink’s strengthen this trend. “This purchase not only highlights Ethereum’s growing appeal, but also reinforces the importance of staking as part of its ecosystem,” said a blockchain expert who tracks institutional inflows.

Institutional Adoption Broadens

SharpLink’s Ethereum purchase approach is consistent with a wider trend of firms utilizing Ethereum for long-term portfolio growth. Since beginning its accumulation strategy in June, the firm’s ETH holdings have increased from roughly 188,600 to over 438,000 ETH. This positions it as the second-largest publicly known corporate holder of Ethereum, trailing just one other important participant in the industry.

Other businesses have begun to investigate similar tactics, diversifying beyond Bitcoin to incorporate Ethereum in their treasury holdings. This transition reflects Ethereum’s larger role as the foundation for decentralized banking, smart contracts, and stablecoin ecosystems.

The expanding wave of institutional participation has reignited Ethereum price prediction disputes, as investors consider the influence of huge corporate holdings on market dynamics.

Market Impact and Future Outlook

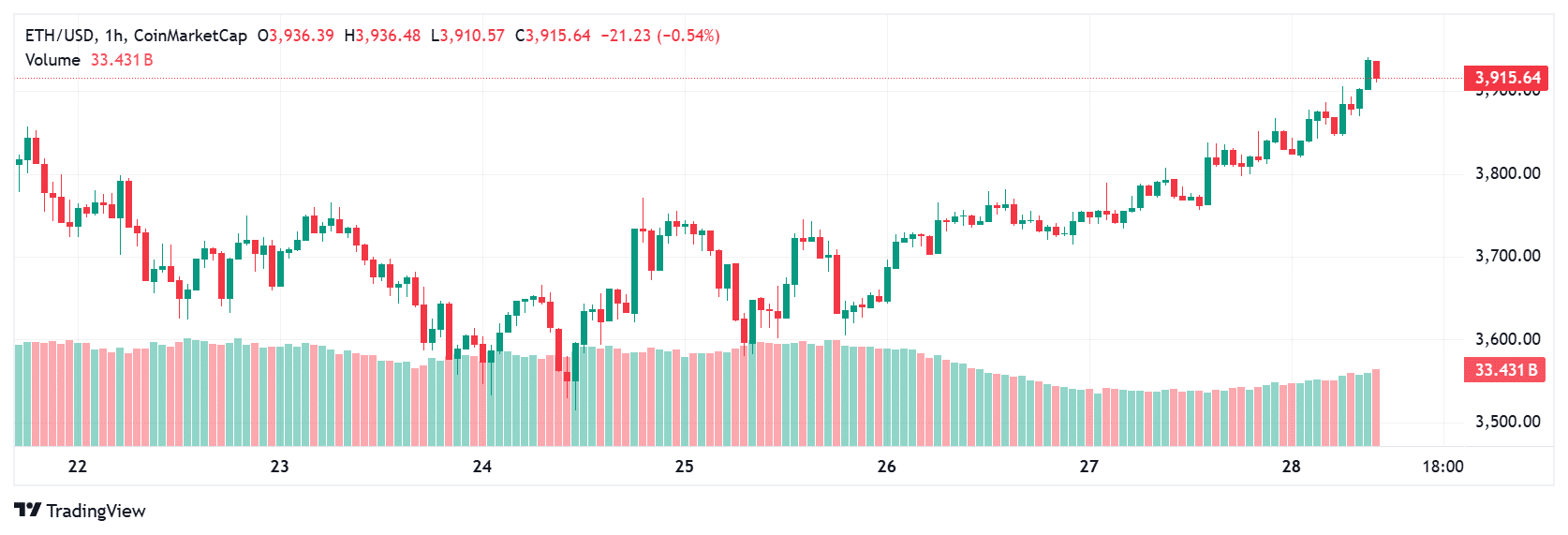

The market’s reaction to SharpLink’s Ethereum purchase was quick, with Ethereum surging immediately after the news surfaced. Analysts feel that the whale activity might serve as a positive stimulus, especially if more institutions follow suit.

The staking benefits created by these holdings, which currently total hundreds of ETH, motivate corporate organizations to keep rather than sell, resulting in more price support.

Looking ahead, Ethereum price prediction models indicate that persistent institutional demand may drive ETH into a higher trading range. The network’s position as the backbone of decentralized finance provides it a distinct advantage, which experts expect more corporations to notice.

However, they caution that macroeconomic variables, legislative changes, and network upgrades will continue to influence Ethereum’s price trend in the coming quarters.

Conclusion

SharpLink’s $295 million Ethereum purchase marks a watershed event for the cryptocurrency, cementing its position as a long-term institutional asset. By staking its assets, the business has proved its belief in Ethereum’s capacity to create long-term gains while ensuring the network’s security. As other institutions adopt similar techniques, supply-demand dynamics may improve further, boosting market optimism.

FAQs

Q1: Why is SharpLink’s Ethereum purchase significant for Ethereum?

The purchase locks a substantial amount of ETH into staking, reducing circulating supply and signaling strong institutional confidence.

Q2: How does staking impact Ethereum price prediction models?

Staking reduces available supply and incentivizes long-term holding, which can lead to upward price pressure.

Q3: Are other companies adopting Ethereum treasury strategies?

Yes, several corporations are diversifying into Ethereum due to its yield potential and role in decentralized finance.

Glossary

Ethereum price prediction: Forecasts and analysis projecting future ETH price movements based on market trends.

Staking: The process of locking ETH into a proof-of-stake network to secure it and earn rewards.

Institutional adoption: Large corporations or financial institutions integrating cryptocurrencies into their portfolios.

Whale activity: Large-scale buying or selling by entities holding significant amounts of a cryptocurrency.