According to the source, the cryptocurrency market witnessed a significant upheaval following Argentine President Javier Milei’s promotion of the $LIBRA token. This endorsement led to a meteoric rise and subsequent catastrophic fall in $LIBRA’s value, resulting in substantial financial losses for investors, including prominent figures and large-scale holders.

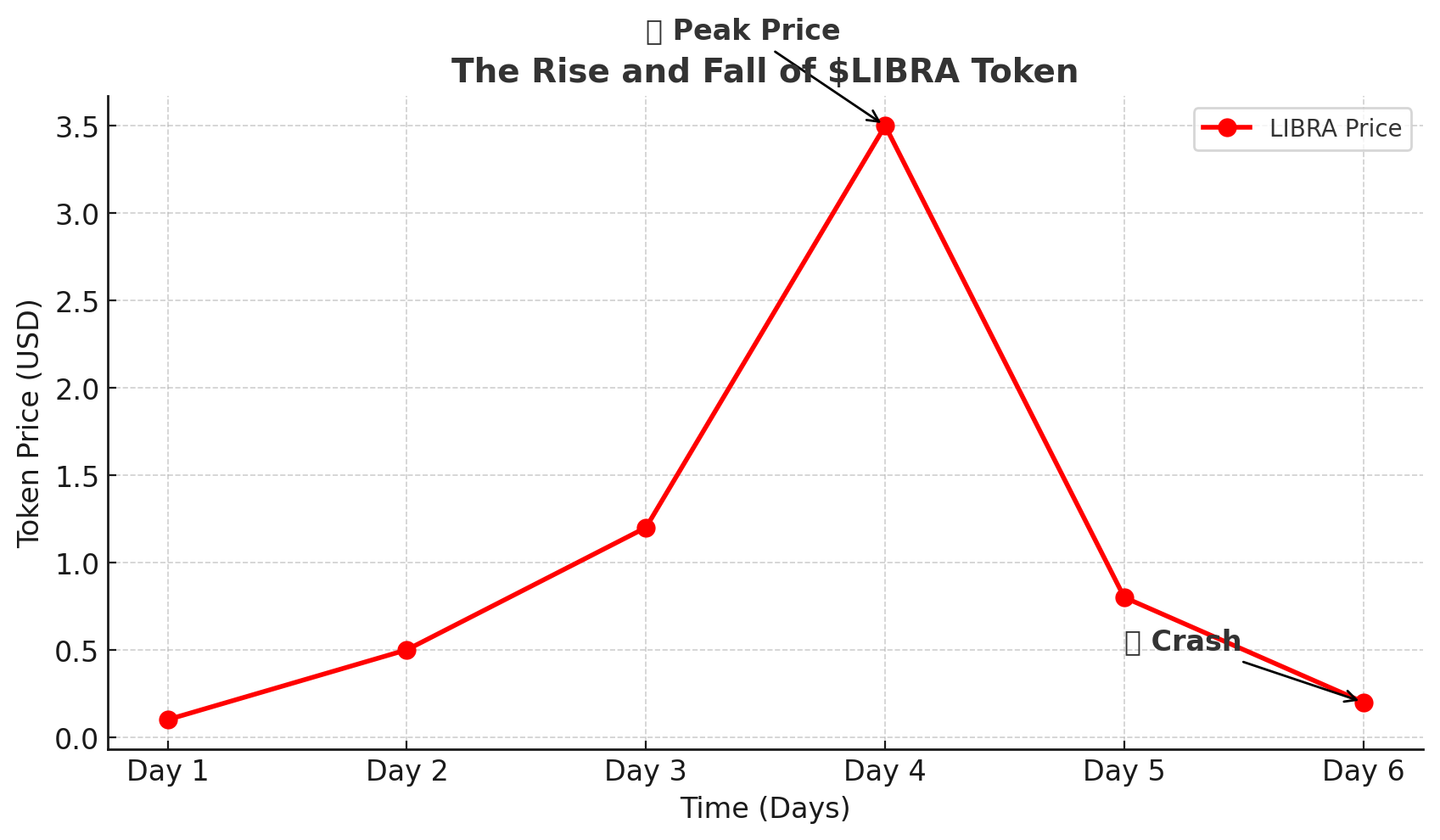

The Meteoric Rise and Fall of $LIBRA

On February 14, 2025, President Javier Milei took to his official social media platforms to endorse a new cryptocurrency, $LIBRA. He described it as a private initiative to stimulate Argentina’s economy by funding small businesses and entrepreneurial ventures. This presidential endorsement led to an immediate surge in $LIBRA’s value, with its market capitalization soaring to an estimated $4.5 billion within hours. However, this rapid ascent was short-lived. Key stakeholders, who held significant portions of the token, liquidated approximately $90 million worth of $LIBRA, causing its value to plummet and leaving numerous investors with substantial losses.

Whale Investors: The Biggest Casualties

Among the most affected were “whale” investors—entities holding large quantities of the cryptocurrency. One notable case involved a whale who initially invested 17,450 SOL (approximately $3.25 million) into $LIBRA. Following the token’s crash, this investor sold their holdings for just 3,200 SOL (around $595,000), culminating in a staggering loss of $2.65 million.

Another prominent figure, David Portnoy, faced losses exceeding $5 million due to the $LIBRA collapse. In an unexpected move, Hayden Mark Davis, one of the project’s key promoters, compensated Portnoy with $5 million in USDC. This act of restitution was unique, as no other investors received similar compensation, leading to widespread criticism and raising questions about preferential treatment.

The Aftermath: Legal and Political Repercussions

The fallout from the $LIBRA debacle extended beyond financial losses. President Milei faced severe backlash for his role in promoting cryptocurrency. Critics accused him of participating in a “rug pull” scam—a fraudulent scheme where developers hype up a project to attract investments before withdrawing funds and abandoning the project. Legal complaints were filed, alleging fraud and criminal association, and opposition lawmakers called for his impeachment. In response, President Milei denied any involvement in the development of $LIBRA and initiated an anti-corruption investigation to address the allegations.

Investor Impact: A Closer Look

The $LIBRA collapse had a profound impact on the investor community. Data revealed that nearly 75,000 traders suffered losses, with the total financial damage estimated at approximately $286 million. The breakdown of affected investors is as follows:

| Loss Range | Number of Traders |

|---|---|

| Over $1 million | 25 |

| $10,000 to $50,000 | 2,409 |

| Up to $10,000 | 71,369 |

The average loss per trader was approximately $3,833, underscoring the widespread devastation among both small and large investors.

Market Dynamics: The Role of Meme Coins

The $LIBRA incident highlights the volatile nature of “meme coins”—cryptocurrencies that gain popularity primarily through social media hype and endorsements rather than intrinsic value or technological innovation. These tokens are often characterized by their rapid price fluctuations and susceptibility to market manipulation. The $LIBRA case serves as a cautionary tale, emphasizing the risks of investing in assets lacking fundamental backing and transparency.

Conclusion: Lessons Learned

The $LIBRA fiasco underscores the critical importance of due diligence in the cryptocurrency space. Investors are urged to thoroughly research projects, assess the credibility of endorsements, and be wary of tokens that experience rapid, unexplained price increases. The incident also highlights the need for regulatory oversight to protect investors from fraudulent schemes and ensure greater crypto market transparency.

As the dust settles, the $LIBRA episode serves as a stark reminder of the potential pitfalls in the fast-evolving world of digital currencies, reinforcing the adage that not all that glitters is gold.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs on the $LIBRA Token Collapse

1. What caused the massive crash of the $LIBRA token?

A rapid sell-off triggered the crash after an initial surge caused by Argentine President Javier Milei’s endorsement. Large investors, or “whales,” liquidated their holdings, leading to a market collapse.

2. How much money did investors lose in total?

Approximately $286 million was lost by around 75,000 traders, with some whales suffering multi-million-dollar losses.

3. Why did one investor receive compensation while others didn’t?

Crypto influencer David Portnoy received $5 million in USDC from a key $LIBRA promoter, but no other investors were compensated, leading to allegations of favoritism.

4. What lessons can be learned from the $LIBRA crash?

Investors should be cautious of tokens promoted by public figures, conduct thorough research, and be wary of meme coins that experience rapid, hype-driven price spikes without strong fundamentals.

Glossary of Key Terms

Whale – A large investor holding a significant amount of cryptocurrency whose trades can heavily influence the market.

Rug Pull – A type of crypto scam where developers or insiders pump up a project’s value and then sell off their holdings, causing a crash.

Meme Coin – A cryptocurrency that gains popularity through internet culture and social media rather than fundamental value or technological innovation.

Market Manipulation – Unethical practices, like artificially inflating or deflating a token’s price, to deceive investors.

Pump-and-Dump – A scheme where an asset is hyped up to drive its price higher, followed by a massive sell-off that crashes the price.