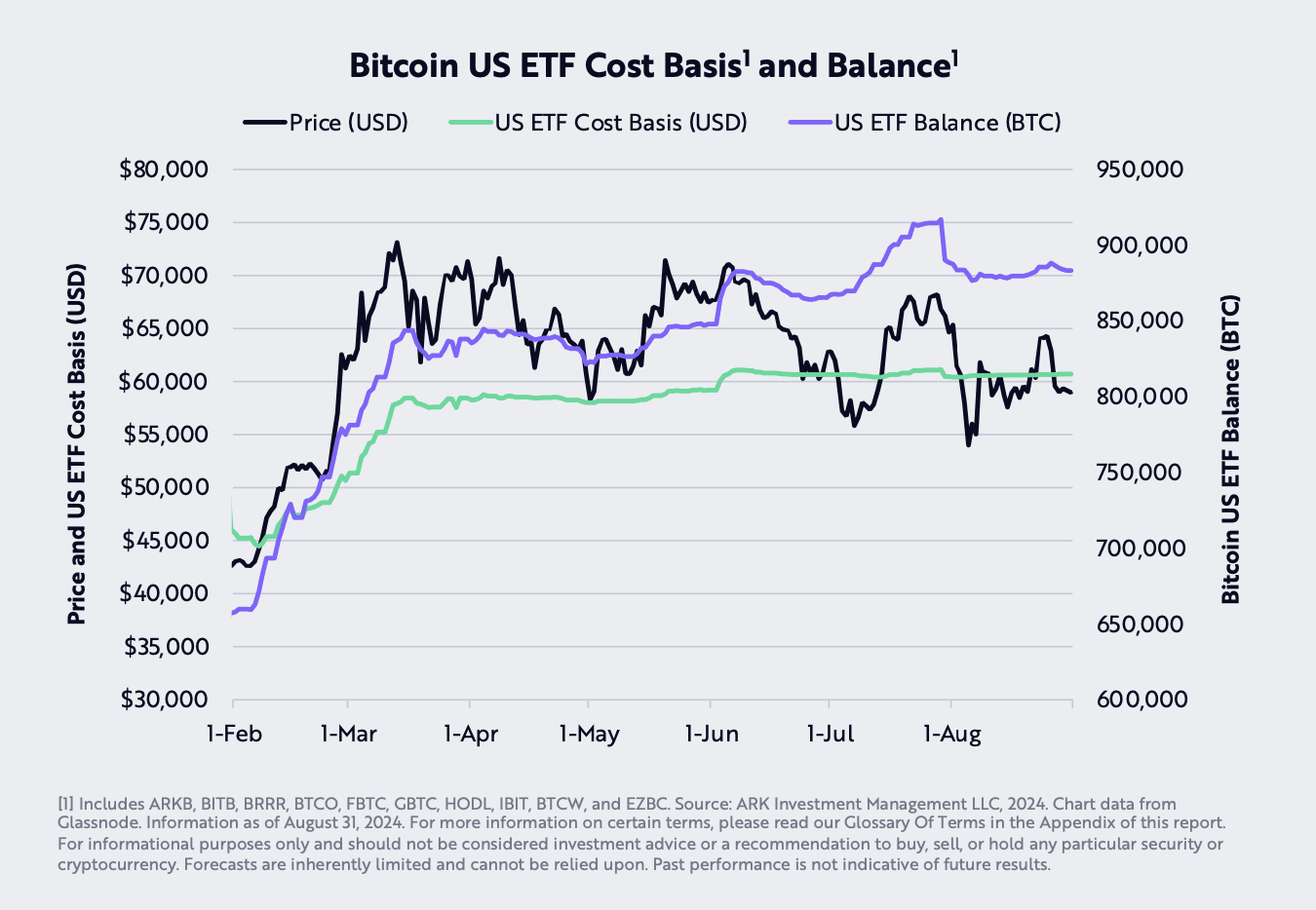

Ark Invest has published a warning report suggesting that investors in U.S. spot Bitcoin exchange-traded funds (ETFs) may currently be incurring losses. According to the company’s August Bitcoin monthly analysis, the average cost basis of participants in these ETFs surpassed Bitcoin’s market price by the end of August. This indicates that typical ETF investors might be in a negative financial position.

U.S. Spot Bitcoin ETF Investors Are in the Red

Ark Invest’s assessment is based on data collected since the launch of U.S. spot Bitcoin ETFs in January 2024. The company used a flow-weighted average price method to calculate the cost basis, considering the volume and timing of investments into these ETFs. This approach provides a more accurate representation of the average investment cost for ETF participants over time.

The report noted, “The estimated cost basis of U.S. spot ETF participants was higher than Bitcoin’s price at the end of August” and added, “This discrepancy suggests that the average investor holding these ETFs could be facing losses under current market conditions.”

Ark Invest’s findings highlight a bearish outlook on the short-term performance of U.S. spot Bitcoin ETFs. If Bitcoin’s price remains stagnant or continues to decline, the gap between the cost basis and the market price may widen, leading to further potential losses for investors. This scenario underscores the inherent risks associated with investing in crypto-based financial products, especially in volatile market environments.

Bitcoin’s Price Is the Key Factor

The launch of U.S. spot Bitcoin ETFs in January 2024 was intended to provide investors with a regulated and accessible tool to invest in Bitcoin without holding the asset directly. However, Ark Invest’s latest report has raised concerns about the profitability and sustainability of these investment vehicles in the current market climate.

Industry analysts emphasize that the performance of spot Bitcoin ETFs is closely tied to the price movements of the underlying asset. As a result, fluctuations in Bitcoin’s price significantly impact ETF investors’ returns. Ark Invest’s bearish stance may influence investor sentiment, potentially affecting capital inflows and outflows from these ETFs.

Ark Invest’s analysis offers a cautious perspective on the future of spot Bitcoin ETFs in the U.S. Investors are urged to closely monitor the market and Bitcoin’s price trends as they navigate the risks associated with these funds. With the current market dynamics in play, it remains to be seen how Bitcoin’s price movement will shape the future performance of these ETFs.