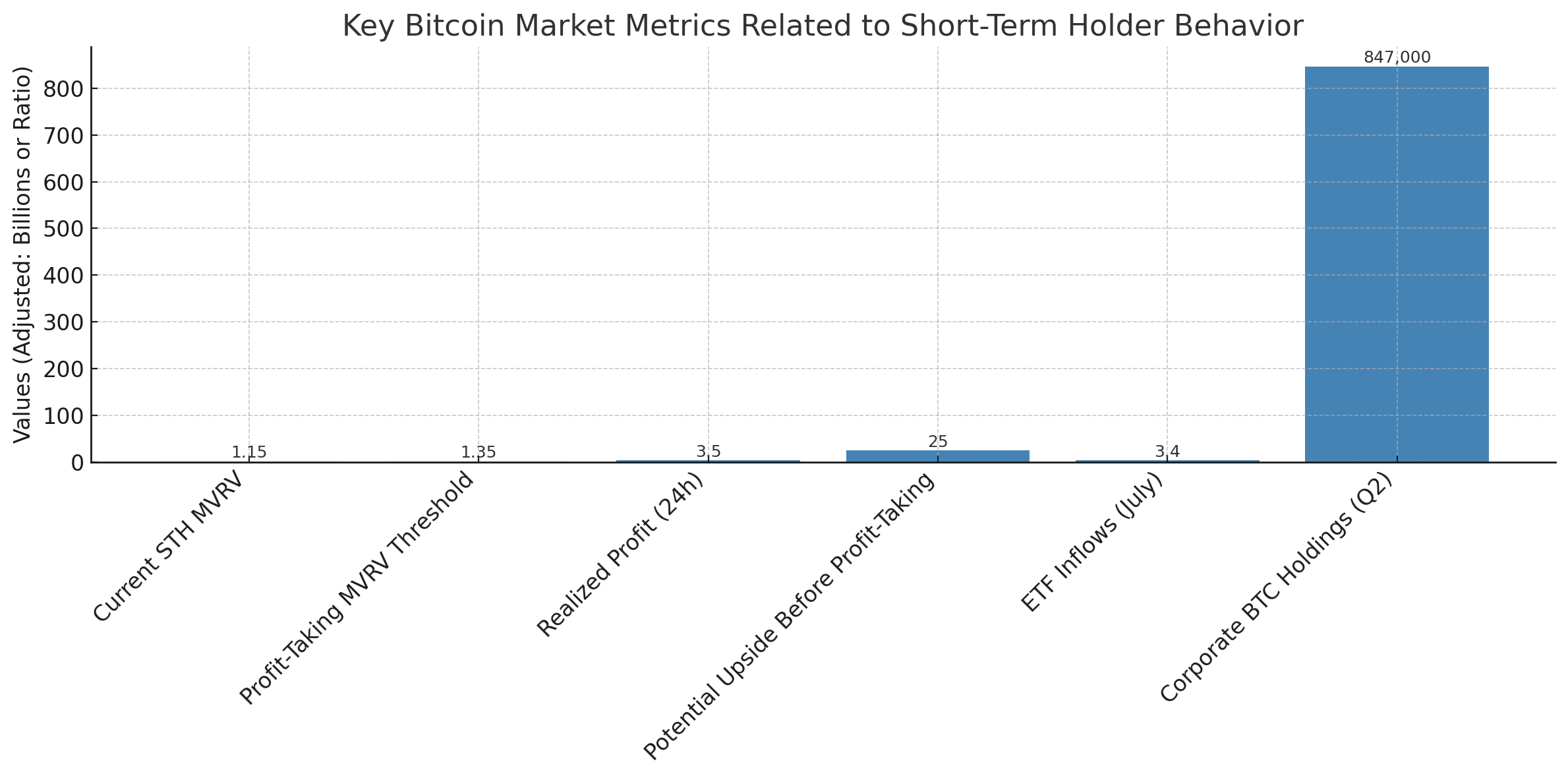

A new wave of confidence is sweeping across the cryptocurrency market, with new on-chain data indicating Bitcoin has further potential to rise before encountering severe resistance. According to analyst Darkfost, the short-term profit holding MVRV ratio, a critical valuation metric, is comfortably at 1.15, which is well below the customary profit-taking threshold of 1.35. This study suggests that Bitcoin still has up to 25% upside potential before short-term holders commence significant distribution.

This comes as Bitcoin continues to rise following its halving amid fresh institutional flows, positive regulatory attitude in the United States, and record ETF inflows. The keyword “Bitcoin short-term holders” is once again important for evaluating market momentum—and the present signal is green.

A Look Back: Historical MVRV Patterns and Short-Term Profit Timing

Short-term profit holders, wallets that have held BTC for fewer than 155 days, have historically exited the market when their average position has increased by 35% or more, which corresponds to an MVRV ratio greater than 1.35. In previous bull cycles, such as 2017 and late 2021, this signal foreshadowed local peaks and market slowdowns. However, the present 1.15 ratio suggests just a minor unrealized profit, indicating that the typical short-term profit investor has not yet achieved the peak incentive to sell.

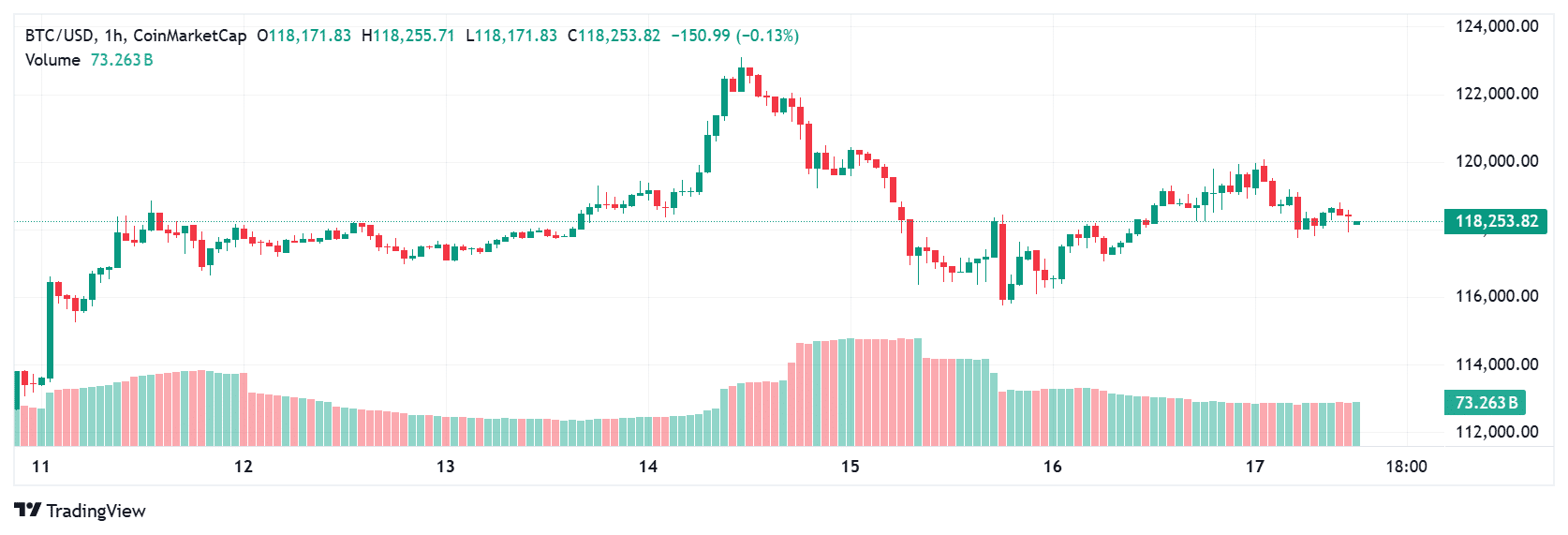

Glassnode statistics reveals that around 95% of short-term BTC investors are profitable, with the majority holding strong. According to a CryptoSlate article, Bitcoin has crossed critical cost-basis resistance zones, paving the way for a smoother route to $130,000-$135,000.

Price Momentum Builds Despite Miner and Long-Term Sell-Offs

While short-term investors remain cautious, some market participants have begun to take profits. Long-term holders have made more than $3.5 billion in gains, while miner outflows have increased, as seen by CryptoQuant’s miner position index (MPI) increasing over 2.7.

This suggests that, although the overall market attitude remains positive, some investors are taking advantage of recent highs. “It’s a healthy sign,” said Tony Sycamore, an analyst at IG Markets. “We are still in the middle of a momentum-driven leg, and it looks like [Bitcoin] can easily have a look at the $125,000 level.”

Meanwhile, ETF inflows continue to support price movements. In July alone, more than $3.4 billion poured into Bitcoin spot ETFs, fueled by both U.S. regulatory clarification during “Crypto Week” and increased institutional desire.

Institutions Are Still Accumulating, Quietly But Aggressively

Beneath the daily market activity, institutional purchasers and corporate treasuries are increasing their exposure. Barron’s reports that public businesses currently own more than 847,000 BTC, a 23% rise from Q1 2025. MicroStrategy, Tesla, and younger competitors like ServiceNow have been discreetly increasing their reserves.

According to Eric Demuth, CEO of Bitpanda, institutional investors and sovereign entities continue to invest in cryptocurrency. “The roadblocks have been removed.” This newfound interest, along with short-term profit investors’ behavioral patience, is keeping market momentum intact and volatility at a surprise low.

Near-Term Predictions and Resistance Levels

According to technical experts, the next big resistance zone is $130,000-$135,000, which corresponds to previous MVRV-based cycles. Should Bitcoin hit these levels, short-term profit holders are anticipated to take profits, resulting in localized pullbacks.

However, until then, the chances of a sustained upward rise are strong. Price models based on actual profit patterns, cost-basis clusters, and liquidity zones support this notion. Support zones are building between $111K and $116K, indicating that any declines will be greeted with strong buying pressure.

Conclusion: All Eyes on the Exit Window

Based on the latest research, short-term profit holders are still in the game, mining outflows are constant, and institutional inflows are increasing. The next weeks might provide one of the few “easy” rallies before the next macro drop. The next significant leg of Bitcoin’s journey will be determined by conduct rather than hype.

For both traders and long-term investors, monitoring the MVRV ratio and short-term profit indicators gives a key advantage. As Bitcoin short-term investors retain their footing, the setting is set for a methodical ascent rather than a euphoric sprint.

For more news and crypto insights, visit our platform.

FAQs

What is the MVRV ratio?

The MVRV (Market Value to Realized Value) ratio shows how much profit holders have on average. For short-term holders, a reading above 1.35 often signals profit-taking.

Why haven’t short-term holders sold yet?

Their unrealized profits are still modest (around 15%). Historically, major exits occur closer to 35% profit.

What price level could trigger selling?

On-chain data points to $130K–$135K as the level where many short-term holders may start taking profits.

Are institutions still buying BTC?

Yes. Corporate and institutional inflows remain strong, with ETF inflows over $3.4 billion this month alone.

Glossary of Key Terms

Short-Term Holder (STH) – A Bitcoin wallet holding BTC for less than 155 days.

MVRV Ratio – Compares the current market price to the average purchase price.

MPI (Miner Position Index) – Measures the volume of BTC transferred from miners to exchanges.

ETF Inflows – Capital entering exchange-traded funds, signaling institutional interest.

Realized Profit – Gains realized when coins are sold or moved from the original purchase wallet.