Following the U.S. elections, there has been a significant increase in inflows to crypto asset investment products, reaching a record $1.98 billion, according to CoinShares data. This influx pushed the global Assets Under Management (AuM) for crypto to a historic high of $116 billion. While Bitcoin led the charge, Ethereum saw its largest inflows since July, driven by macroeconomic factors and political shifts in the United States. Other regions, like Switzerland and Germany, also received a notable share of these inflows.

CoinShares Report Reveals Top Inflows to Bitcoin and Altcoins

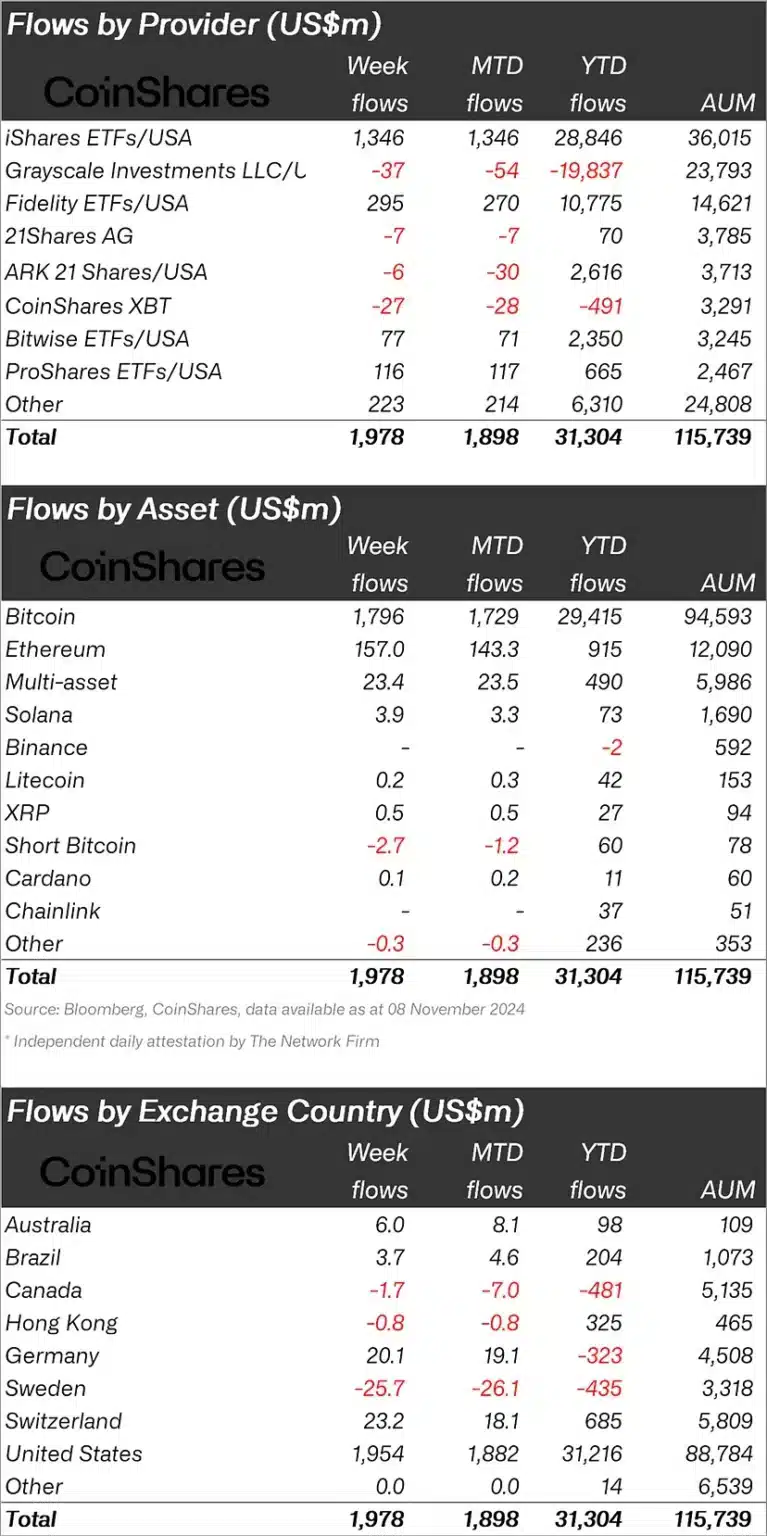

The CoinShares report shows that crypto assets have seen inflows totaling $1.98 billion since the U.S. elections, pushing the global AuM to a record level of $116 billion. Inflows were mainly concentrated in the U.S. at $1.95 billion, with Switzerland and Germany trailing behind with $23 million and $20 million, respectively. Bitcoin took the lead with a substantial $1.8 billion influx, supported by favorable macroeconomic trends and political changes in the U.S. Ethereum followed closely, attracting $157 million—the highest inflow since the launch of ETFs in July.

Altcoins See Growing Interest: Which Ones Are in the Spotlight?

Beyond Bitcoin and Ethereum, altcoins are attracting increasing attention. Solana led the pack with $3.9 million in inflows, followed by Uniswap at $1 million, and Tron at $500,000. Additionally, blockchain stocks saw investments worth $61 million. These inflows highlight growing investor interest in the crypto space, spurred by both price gains and increasing transaction volumes, which rose by $20 billion, marking the highest level since April this year.

The latest CoinShares report confirms that U.S.-based inflows primarily fueled these gains, suggesting that positive sentiment around macroeconomic conditions and major political shifts in the U.S. could be driving this demand. With Bitcoin leading, a host of altcoins is benefiting from this renewed institutional interest, underscoring the sector’s potential for continued growth.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!