The American informant has communicated his interests about the financialization of the crypto space, yet added that he sees immense commitment in the innovation.

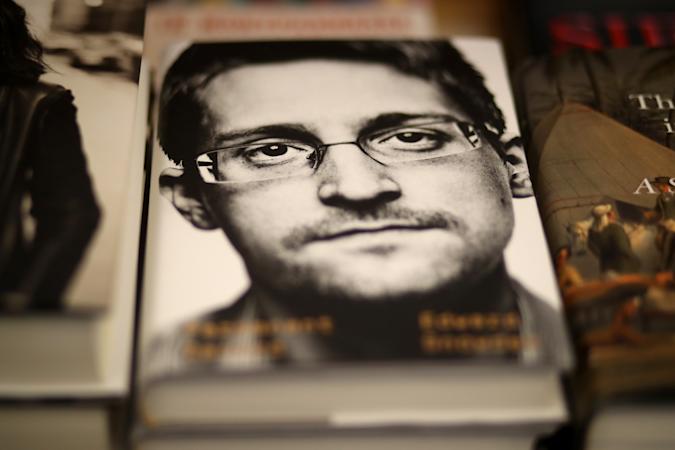

Edward Snowden says he has faith in the crypto development, yet he thinks there are a significant obstacles to address throughout the next few years.

Talking in a virtual meeting at Consensus 2022 in Austin today, the American informant and President of the Freedom of the Press Foundation shared his considerations on the commitment of the arising innovation and gave an unmistakable admonition about the risks of a world absent any trace of monetary security as for crypto.

Snowden, who stood out as truly newsworthy when he released characterized National Security Agency records specifying observation practices of U.S. residents in 2013, depicted Bitcoin’s public nature as a “center imperfection” and said that the most compelling motivation for why it could fizzle is on the grounds that it isn’t private. “It is flopping as an electronic money framework since cash is generally planned to be mysterious,” he said, referring to the Bitcoin whitepaper (Satoshi Nakamoto broadly promoted Bitcoin as “a shared electronic money framework.”)

However he said he saw issues with Bitcoin’s public record, Snowden explained that he was “a lot of a fan” of the innovation and made a correlation among gold and digital currencies, noticing that the borderless idea of Bitcoin and crypto all the more extensively is “something shocking.” Shortly after the conversation, Snowden posted a tweet depicting gold as “Bitcoin that can’t be sent over the Internet.”

He likewise namechecked a few different developments in the digital money space, including the protection coins Zcash and Monero. Snowden as of late uncovered that he made Zcash under the pen name Dobbertin, and during the conversation he said that he was “truly dazzled” by its zero-information evidence innovation when he initially read the whitepaper.

Expounding on his perspectives on the commitment of crypto innovation, Snowden added that numerous crypto resources are “nearer to cash” than monetary standards. “Individuals don’t figure out the distinction yet cash is a thing that holds esteem, a symbolic that can be traded that isn’t freely constrained by any focal power,” he said.

He likewise cautioned of the risks of the financialization of the crypto business. He said that the space was turning out to be progressively partitioned “on account of the financialization of cryptographic money” and implied that he thinks clients are not zeroing in sufficient on the actual innovation.

“Users are not contemplating what are the organizations that will serve us for a considerable length of time for moving worth,” he said. “I’m stressed over a world in which our cash is utilized against us.”

Snowden said that he desires to see individuals gain admittance to “free cash in the autonomy sense.” In what could be deciphered as a support of the more extensive crypto environment as opposed to any one explicit resource, he recommended that having various resources that could go about as cash was something beneficial for the world. “I think the more contest we have there, then, at that point, all the better,” he said.