Sol Strategies, a Toronto-based crypto holding company, has significantly increased its Solana (SOL)holdings. The firm has accumulated nearly 190,000 SOL, now valued at approximately $44.3 million. This move comes as the company prepares for a potential Nasdaq listing and navigates leadership changes.

Sol Strategies Expands Solana Holdings Amid Risks

Sol Strategies made a rapid acquisition strategy of Solana by utilizing debt funding to finance its purchases. A $25 million debt facility served the firm in expanding its asset base, similar to how Microstrategy operates with Bitcoin. Solana’s current acquisition strategy may cause the asset’s price to rise or create financial trouble when market conditions worsen.

Since its market launch, Solana has maintained stronger resistance to price fluctuations than other alternate coins. The token has shown better performance this week despite its 9% decrease since other cryptocurrency prices dropped by double digits. Solana’s market outcomes are consistently defined by institutional backing and deliberate financial commitments.

Leadership changes, such as Sol Strategies’ CIO Moe Adham stepping down, add another layer of uncertainty. The company’s long-term vision remains intact, but internal shifts could impact decision-making. Investors will closely monitor how these factors influence Sol Strategies’ future moves.

Sol Strategies Strengthens Solana’s Position

Sol Strategies has intensified its Solana investment, acquiring 40,300 SOL in the latter half of January. This purchase alone cost $9.93 million, reinforcing the company’s bullish stance on Solana. The firm’s total SOL holdings now stand at 189,968, making it a major institutional player.

The company’s HODL stock has mirrored Solana’s price movements, surging over 2,300% in just six months. This correlation indicates strong investor confidence in Sol Strategies’ crypto-focused strategy. However, any downturn in Solana’s price could directly impact the stock’s performance.

Using debt financing to fund these purchases introduces potential risks. While the strategy could yield significant gains, a market downturn could force the company to liquidate its holdings. If Solana’s price does not rally, the debt burden could become a critical challenge for Sol Strategies.

SOL’s Market Performance

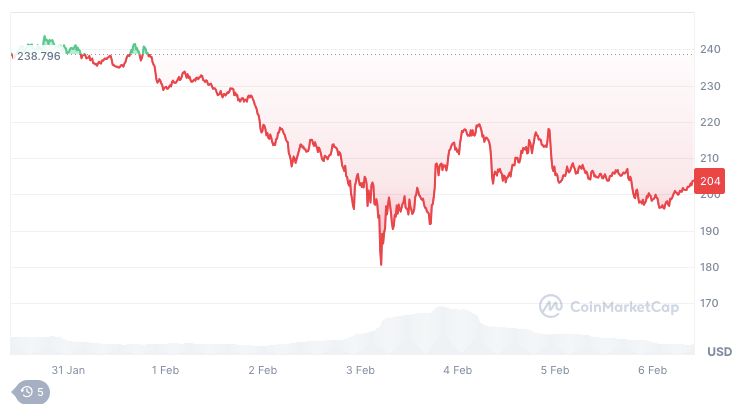

Solana’s price action remains a key factor in determining the success of this strategy. It has gained 112% in 2024 but struggles to break through consolidation. The SOL/BTC pair remains in a tight range with no clear breakout.

Despite its strong presence in meme coins, decentralized exchanges (DEX), and DeFi, Solana has yet to achieve sustained upward momentum. Even major events, such as the TRUMP meme coin launch, have failed to push the price beyond its historical resistance levels. Solana’s current valuation remains similar to its price four years ago, raising investor concerns.

Market sentiment plays a crucial role in Solana’s trajectory. While Bitcoin continues to attract institutional inflows, altcoins like Solana often follow its lead. If Bitcoin maintains its upward trend, Solana could benefit from increased investor interest.

Institutional Involvement in Solana

Solana’s sustained growth depends fundamentally on getting institutional backing. Bitcoin and other high-cap cryptocurrencies experience rising capital investment, demonstrating a strong belief in the cryptocurrency market. More financial investments directed towards Solana will help develop its market position.

Microstrategy demonstrates leadership by procuring large amounts of Bitcoin when market values decline. Through its investment strategy, Sol Strategies demonstrates that it foresees Solana as a valuable asset for the long run. Solana could establish itself among primary institutional assets when other organizations choose this investment strategy.

Institutional confidence remains at risk since market fluctuations can negatively impact their decisions. Failing the growth of Solana may lead institutions to invest in stable assets. Solana’s institutional support will experience key tests during the following months to reach its next level of success.

External Factors Could Impact Solana’s Growth

Sol Strategies’ aggressive accumulation comes with inherent risks. The firm may face liquidity concerns if Solana’s price does not rise as expected. Debt financing adds another layer of uncertainty, making it essential for the market to cooperate.

A potential sell-off by Sol Strategies could negatively impact both Solana’s price and the company’s stock. Market conditions will be crucial in determining whether this investment strategy succeeds. If demand for Solana weakens, Sol Strategies might have to adjust its approach.

External factors, such as regulatory developments and macroeconomic conditions, could influence market trends. While Solana remains a strong blockchain project, external forces could shape its price movements. Investors will closely monitor these dynamics to assess the long-term viability of Sol Strategies’ bet.

Conclusion

Sol Strategies’ decision to increase its Solana holdings signals confidence in the asset’s future. However, market conditions and debt financing introduce potential risks. Institutional support remains a critical factor that could determine Solana’s long-term success.

Sol Strategies’ investment could yield significant returns if Solana’s price gains momentum. However, a downturn could force the company to reassess its holdings.

FAQs

What is Sol Strategies?

Sol Strategies is a Toronto-based crypto holding company that invests in digital assets like Solana (SOL).

How much Solana has Sol Strategies acquired?

The company has accumulated nearly 190,000 SOL, valued at around $44.3 million.

How is Sol Strategies funding its Solana purchases?

It uses a $25 million credit line, similar to Microstrategy’s strategy with Bitcoin.

Why is Sol Strategies increasing its Solana holdings?

The company believes in Solana’s long-term potential and expects its value to rise.

How has Sol Strategies’ stock performed recently?

The stock (HODL) surged over 2,300% in six months, closely tracking Solana’s price movements.

References

Glossary

Sol Strategies: A Toronto-based crypto holding company investing in digital assets.

Debt Financing: Borrowing funds to invest, often with expectations of future profits.

Institutional Support: Investments from large financial firms, hedge funds, and companies into cryptocurrencies.

Consolidation Phase is when an asset trades within a narrow range without a clear trend.

Liquidity Concerns: The risk of being unable to sell assets quickly without impacting price.

Market Sentiment: Investor outlook that affects asset prices.