Recent reports predict that Solana DeFi TVL will soon surpass the $10 billion mark. A significant milestone for the entire ecosystem, it also reflects increased misuse in terms of decentralized finance on Solana, leveraging new funds, tools, network improvements, and fresh liquidity.

What’s Behind the Rise in Solana DeFi TVL?

Memecoins and Trading Volume Boost Activity

High trading volumes around tokens like TRUMP and MELANIA contributed significantly. These pairs alone represented over 18% of Solana’s DEX volume, driving a daily peak of nearly $10.5 billion, more than triple that of Ethereum.

“TRUMP pairs account for 18.5% of Solana’s total trading volume today,” noted Tom Wan, a crypto analyst.

Stablecoin Supply Hits Record

Solana’s stablecoin supply exceeded $10 billion for the first time, with USDC and USDT leading the charge. The liquidity helped reinforce price floors and support lending, farming, and staking protocols. More stablecoins typically suggest more trust and participation in the chain’s DeFi system.

Liquid Staking Platforms Expand

Liquid staking protocols, such as Jito and Marinade, allowed users to lock SOL and earn rewards without sacrificing liquidity. Jito alone accounts for roughly $3 billion in total value locked, signaling broad user trust and utility.

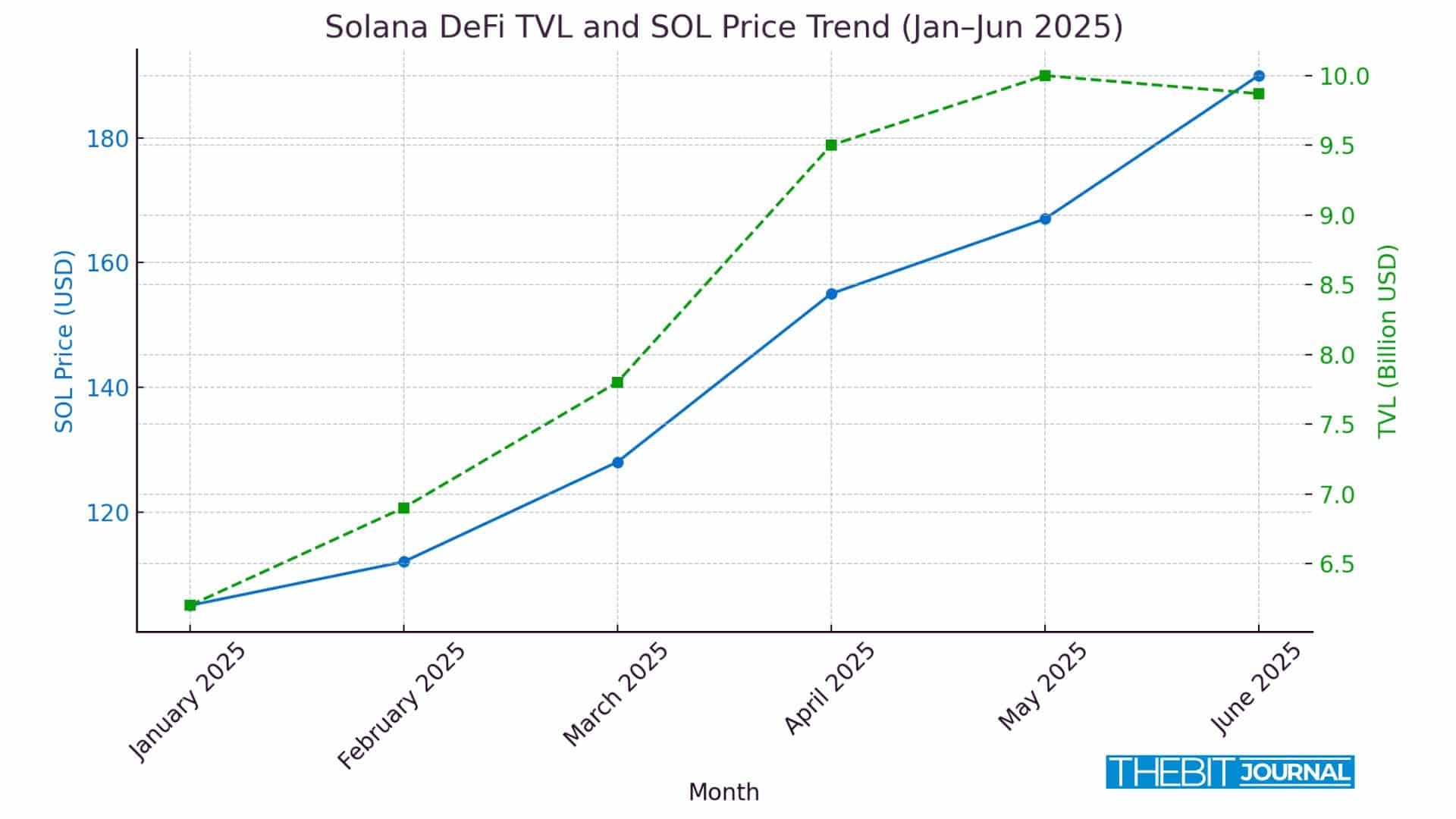

Solana DeFi TVL Gains Parallel SOL Price Surge

A recent performance looker on Solana shows a clear pattern: the Surging Solana DeFi TVL within\, the Value of SOL: from $105 to $190, ditto bang to TVL-scaled figure points moved upward, increased from $6.2 billion to almost $10 billion in the same period.

According to these patterns, investor trust in Solana DeFi ecosystem is closely tied to demand for the token. Continued participation in lending, staking, and swapping supports both network growth and the appreciation of SOL’s price.

See the 6-month trend in the updated table below:

| Date | SOL Price (USD) | Solana DeFi TVL (Billion USD) |

|---|---|---|

| January 2025 | 105 | 6.2 |

| February 2025 | 112 | 6.9 |

| March 2025 | 128 | 7.8 |

| April 2025 | 155 | 9.5 |

| May 2025 | 167 | 10.0 |

| June 2025 | 190 | 9.87 |

These persuasive numbers, which are based on monthly averages from CoinMarketCap and DeFiLlama, paint a vivid picture of how on-chain growth influences market sentiment and SOL’s pricing trajectory.

Quotes from the Ecosystem

“Solana is becoming more liquid and more useful. It’s now home to real flows, not just experiments,” said a DeFi analytics lead.

“SOL has been one of the strongest-performing high-market-cap tokens,” noted Ryan Lee, Chief Analyst at Bitget.

Key Takeaways and What to Watch

- Solana DeFi TVL reflects real user demand for faster, lower-cost transactions.

- Platforms like Jito and Raydium continue to attract liquidity and daily volume.

- Stablecoin activity plays a key role in boosting both protocol usage and SOL price.

Tracking memecoin interest, staking participation, and stablecoin shifts will help determine if the current TVL growth sustains or slows in the coming months.

Conclusion

Based on the latest research, Solana DeFi TVL reflects vigorous user activity supported by stablecoin inflows, staking growth, and increased trading. While hitting the $10 billion mark is indicative of growing adoption, the future holds for liquidity, efficiency in the network, and development of the protocol. Therefore, traders and builders will need to look out for such metrics in the future to gauge how long this momentum lasts.

Summary

Recently, Solana’s total value surpassed $10 billion, driven by stablecoins, intense trading, and liquid staking platforms, such as Jito. This achievement manifests a new high in terms of user engagement and the forward-bent interest of people in Solana’s ecosystem.

Daily volumes in DEXs and protocol activities back both TVLs and SOL price ascension. Although momentum favors a strong outlook, it will ultimately be determined over time through the retention of liquidity, upgrades to the networks, and the development of significant new users and developers for various DeFi products.

For more updates and detailed insights into the world of cryptocurrencies, check out our latest articles.

FAQs

What is Solana DeFi TVL?

It refers to the total assets deposited in decentralized finance apps on the Solana blockchain.

Why did Solana DeFi growth accelerate so quickly?

A mix of stablecoin liquidity, new staking options, and memecoin activity fueled the rise.

Is Solana DeFi growth stable?

TVL can change rapidly if capital flows out, especially when trading volumes decline or users migrate to other chains.

Glossary

TVL: Total value locked in DeFi smart contracts.

Stablecoin: Cryptocurrency pegged to a fiat currency, often used for liquidity.

Liquid Staking: A way to stake tokens and still use them in DeFi applications.

DEX: Decentralized Exchange, where users trade crypto without intermediaries.