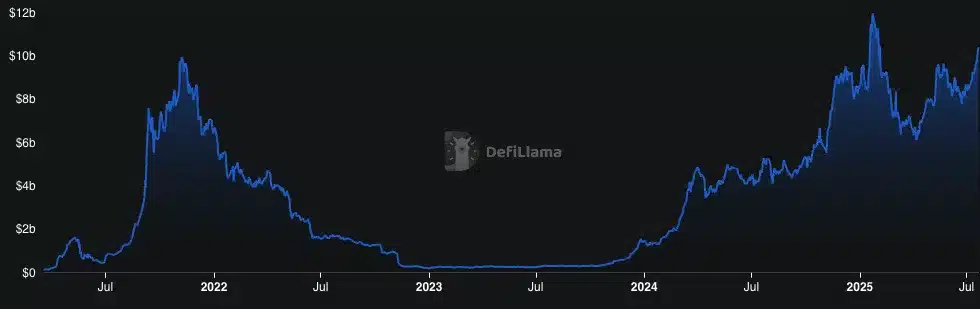

Solana’s decentralized finance (DeFi) ecosystem reached a new peak as its Total Value Locked (TVL) surpassed $10 billion. This marks the highest Solana DeFi TVL in six months, reflecting rising investor confidence and market momentum. The recent price rally of SOL, trading above $200, has also driven this notable growth in DeFi engagement.

Solana DeFi TVL Sees Six-Month Breakout

Solana DeFi TVL has reached $10.453 billion, the highest level since January 2025. SOL is among the coins that are recovering and this move has seen the coin rise past the 203 mark by 12% just in a day. The increase in the value of the token greatly increased the assets related to the DeFi protocols within the Solana system.

The increased TVL stems from price appreciation and expanding user activity on Solana’s DeFi platforms. Users deposited more tokens, stablecoins, and memecoins into lending pools and smart contracts. This sharp increase signals fresh capital inflows and renewed utility across the network.

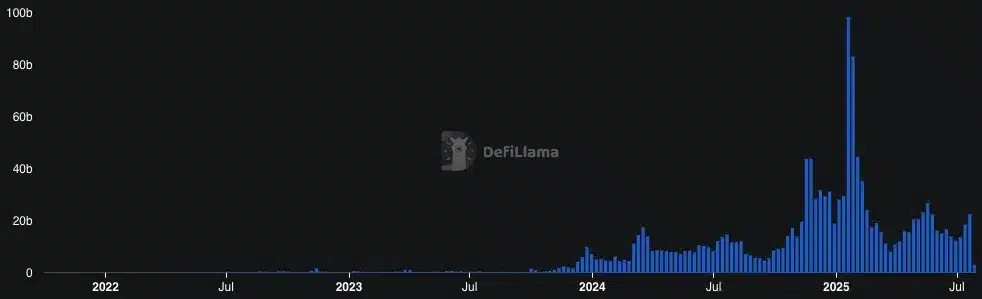

Raydium, Orca, and Meteora led the surge, handling most of the decentralized exchange (DEX) traffic on Solana. These platforms processed $8.4 billion, $5.9 billion, and $5.3 billion in weekly volume, respectively. However, the overall DEX volume of $22.58 billion remains below January’s record of $98.28 billion.

SOL Price Surge Adds Fuel to DeFi Expansion

SOL price jumped 12% in a single day, pushing it past $200 for the first time since February. It currently trades around $203 with daily trading volume exceeding $12 billion on Binance. The bullish breakout has attracted institutional and retail investors alike.

This rally has been attributed to growing anticipation surrounding the launch of Block Assembly Marketplace. The platform aims to deliver faster and fairer transactions, adding another use case for SOL. Meanwhile, DeFi Development Corp reportedly increased its SOL holdings, further validating market sentiment.

Capital inflows into Solana-based investment products also rose sharply this week. Over $40 million entered Solana-backed funds, raising their total assets under management to $1.8 billion. This has given further momentum to both price and DeFi participation.

ETF Buzz and On-Chain Support Fuel Optimism

Investor interest surged after the VanEck Solana Spot ETF (VSOL) appeared on the DTCC website. Though not yet approved, this listing sparked speculation of an imminent green light. ETF analyst James Seyffart noted, “It’s usually the first step before approval.”

VanEck Solana Spot ETF(VSOL) is listed on DTCC website. It means the spot ETF approval is so close.$SOL to $1500 🚀🚀

LFG! pic.twitter.com/2ejdMZ9S7v

— Crypto Hedgehog (@kirpullah) July 22, 2025

Crypto analyst Ali emphasized the importance of SOL holding above $189 for sustained growth. On-chain data reveals over 8 million SOL were accumulated near the $190 level, forming key price support. Maintaining this base could open room for further upside towards the $220 resistance.

Once Solana $SOL breaks above $189, there’s little standing in the way of a continued rally. pic.twitter.com/IOwvdPMMJ7

— Ali (@ali_charts) July 21, 2025

While indicators show overbought conditions, any pullback may find support around $185. Still, current momentum suggests investors are prepared to absorb short-term corrections. The Solana DeFi TVL increase reflects broader network strength, supported by deep liquidity and long-term potential.

Summary

Solana’s DeFi TVL has climbed to $10.453 billion, hitting a six-month high due to SOL’s price jump and renewed market interest. It has moved above $200, and its value has been actively supported by funds finding their way into it and heavy DEX activity. With Solana preparing to receive ETF approval, analysts and on-chain data potentially assume that this is an opportunity for further upside, and the ecosystem could be at its defining moment.

FAQs

1. What is Solana DeFi TVL?

Solana DeFi TVL refers to the total value of assets locked in DeFi protocols on the Solana network.

2. Why did Solana’s DeFi TVL rise recently?

The increase is mainly due to SOL price gains and rising user deposits into Solana’s DeFi ecosystem.

3. How does SOL price affect TVL?

Since many DeFi protocols hold SOL, any rise in its price boosts the overall TVL on the network.

4. Are Solana-staked tokens included in TVL?

No, SOL staked for network validation isn’t counted in DeFi TVL metrics.

5. What’s driving Solana’s current momentum?

The ETF rumors, large fund inflows, and project launches like Block Assembly are fueling Solana’s growth.

Glossary of Key Terms

Solana DeFi TVL – The total value of tokens deposited in decentralized finance protocols on Solana.

DEX – Decentralized Exchange, where users trade crypto assets without intermediaries.

ETF – Exchange-Traded Fund, which tracks the price of an asset and is traded on stock exchanges.

Staking – Locking up cryptocurrency to help secure a network in return for rewards.

On-Chain Data – Information recorded directly on the blockchain for transparency and analysis.