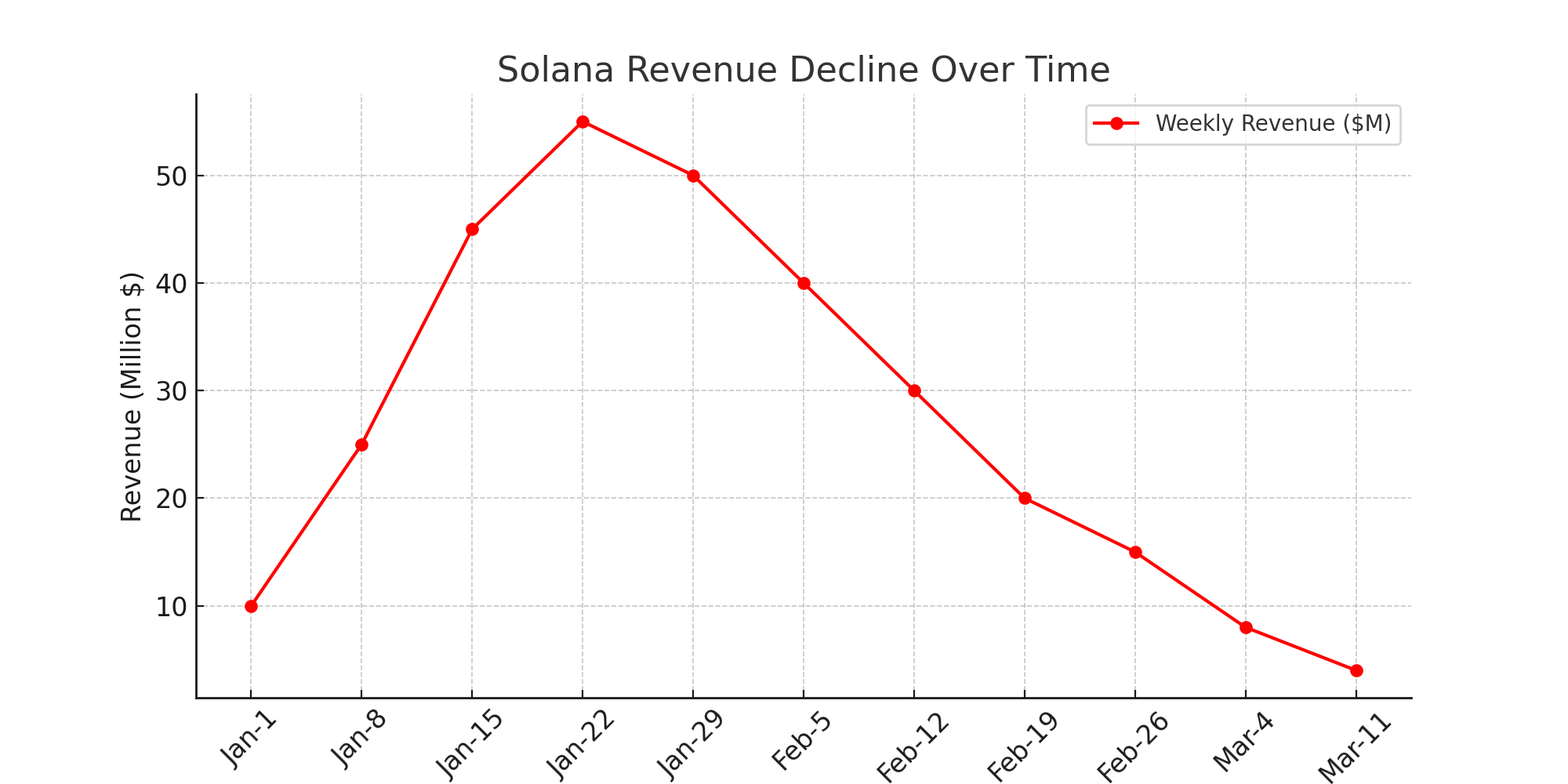

Solana, a blockchain renowned for its high-speed transactions and vibrant ecosystem, experienced an unprecedented surge in network revenue earlier this year. The rise was largely fueled by the booming meme coin sector, which saw explosive growth in activity and trading volume. However, as speculative interest waned, Solana’s revenue has suffered a steep decline.

Recent data shows a staggering 93% drop in weekly network earnings, highlighting the volatile nature of the cryptocurrency space. With market dynamics shifting, stakeholders are now debating the long-term implications for Solana’s economic model and ecosystem stability.

Solana’s On-Chain Revenue Crashes Amid Meme Coin Slowdown

SOL’s on-chain revenue saw record-breaking highs, hitting $55.3 million per week in mid-January 2025, primarily driven by the rapid minting and trading of meme coins. This short-lived rally was fueled by platforms such as Pump.fun, which facilitated easy meme coin creation and trading, attracting speculative traders eager to capitalize on the trend. However, as the initial hype faded, network activity declined significantly. By mid-March, Solana’s weekly revenue had collapsed to just $4 million, marking a dramatic 93% downturn.

According to DeFiLlama data, this drop represents the lowest revenue figures since September 2024. The fading enthusiasm for meme coins suggests a return to more sustainable blockchain use cases, though concerns remain about Solana’s dependency on speculative trends to drive network fees and developer incentives.

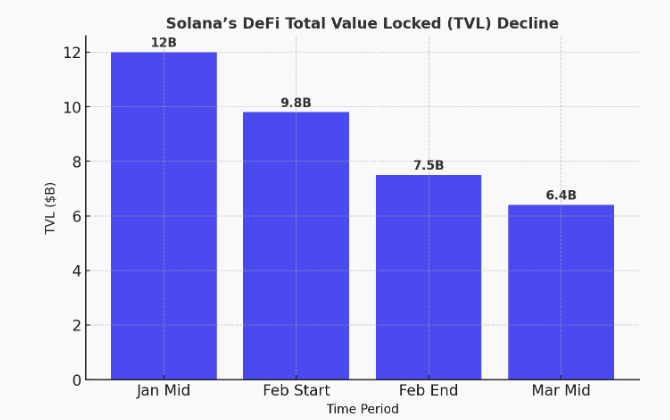

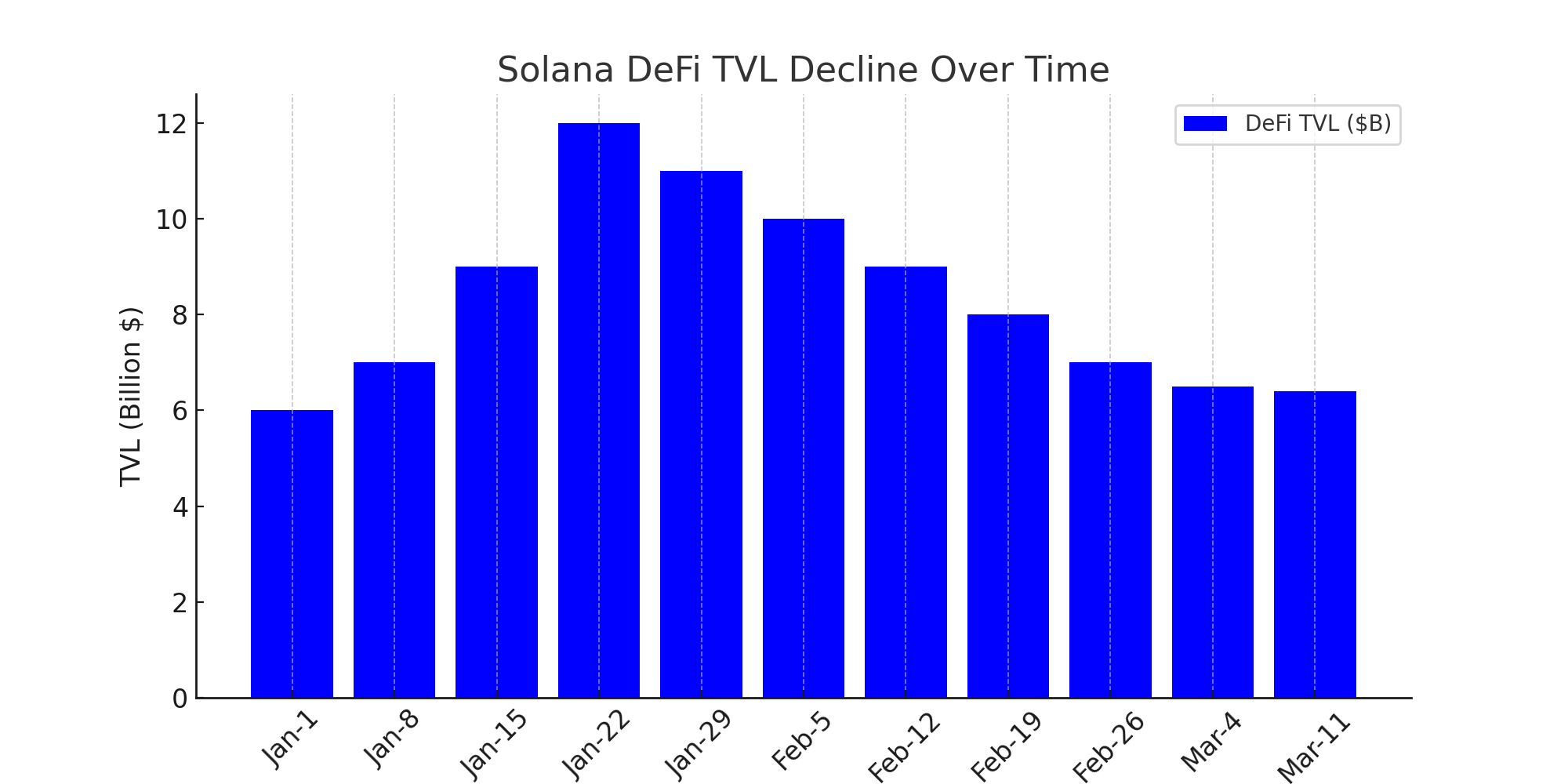

SOL’s DeFi TVL Sinks Nearly 50%, Dropping from $12B to $6.4B

Total value locked (TVL) within Solana’s decentralized finance (DeFi) ecosystem has suffered a similar fate, plunging nearly 50% from $12 billion at its peak to approximately $6.4 billion in March 2025. This decline is closely linked to the overall decrease in trading activity, particularly in the meme coin sector, which had contributed significantly to transaction fees and liquidity pools.

A report by VanEck highlights that meme coin trading accounted for approximately 80% of Solana’s revenue at its height, indicating a high level of dependency on this niche market. With liquidity draining from these assets, DeFi protocols on Solana have faced reduced transaction volumes, impacting yields and staking rewards for participants.

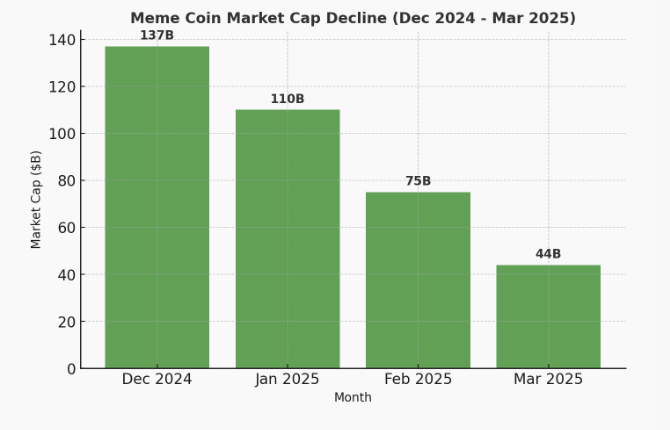

Meme Coin Market Cap Plummets by 68% Amid Crypto Market Correction

The broader meme coin sector has also seen a significant contraction, shedding 68% of its total market capitalization since December 2024. At its height, the meme coin market was valued at $137 billion, driven by speculative enthusiasm and high-profile endorsements. However, by March 2025, this figure had dropped to just $44 billion, reflecting a sharp correction in sentiment.

Notably, U.S. President Donald Trump and First Lady Melania Trump had launched their own tokens, $TRUMP and $MELANIA, in mid-January, coinciding with the peak of the meme coin craze. However, both tokens have since collapsed in value—$TRUMP is down 86% from its peak, while $MELANIA has lost 95% of its value. This downturn underscores the fleeting nature of meme coin trends and their susceptibility to market speculation rather than fundamental utility.

Impact on SOL Price

The drastic decline in Solana’s revenue and DeFi activity has also taken a toll on the price of SOL, the native token of the network. In mid-January, when meme coin trading was at its peak, SOL reached an all-time high of $293. However, as speculative interest in meme coins faded and transaction volumes decreased, the cryptocurrency has faced significant downward pressure.

As of mid-March 2025, SOL is trading at $122, marking a 58% drop from its January highs. Market analysts suggest that the sharp decline is linked to reduced network activity, as lower transaction fees mean fewer incentives for validators and developers. While institutional interest in Solana remains strong, the network must now prove its ability to sustain long-term value beyond hype-driven cycles. The coming months will be crucial in determining whether SOL can recover its momentum or continue its downward trajectory.

Solana Community Debates Proposal to Overhaul SOL Tokenomics

With the recent downturn, the Solana community is now actively engaged in discussions regarding a major governance proposal aimed at reshaping the network’s tokenomics. The proposed Solana Improvement Document (SIMD)-0228 introduces a dynamic inflation model that adjusts token emissions based on staking participation rather than following a fixed inflation schedule.

The proposal, spearheaded by Multicoin Capital’s Tushar Jain and Vishal Kankani alongside Anza economist Max Resnick, seeks to provide long-term economic sustainability by making Solana’s monetary policy more adaptable to market conditions.

Currently, SOL inflation is set at 4.6% annually, decreasing by 15% per year until reaching a stabilized rate of 1.5%. If the new model is implemented, Solana’s token supply dynamics would be more closely aligned with staking demand, potentially mitigating extreme market fluctuations.

Institutional Interest in Solana ETFs Remains Strong

Despite the downturn in revenue and DeFi activity, institutional interest in Solana remains robust. Investment firm Franklin Templeton recently filed for the Franklin Solana Trust in Delaware, signaling continued confidence in the blockchain’s long-term viability. Other major financial institutions, including Canary Capital and Grayscale, have also submitted ETF applications for Solana, following in the footsteps of VanEck, which pioneered the movement in mid-2024.

These filings suggest that traditional finance players view Solana as a strong contender in the blockchain space, particularly for asset management and institutional-grade investments. If approved, SOL ETFs could provide a new avenue for capital inflow, counterbalancing the recent declines in retail-driven trading activity.

Conclusion

The recent downturn in Solana’s network revenue, DeFi activity, and meme coin market cap highlights the volatile nature of the cryptocurrency industry. While the blockchain experienced massive gains during the meme coin frenzy, its reliance on speculative trading has proven unsustainable.

However, with institutional players continuing to express interest and governance proposals aiming to refine SOL’s economic model, the network may find a more stable path forward. As market conditions evolve, the coming months will be critical in determining whether Solana can transition from hype-driven booms to sustainable growth.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. Why did Solana’s revenue drop so significantly?

SOL’s revenue decline was primarily due to the fading meme coin frenzy, which had driven speculative trading activity. As interest in meme coins cooled, transaction volumes and fees on the network dropped sharply.

2. How does the drop in Total Value Locked (TVL) impact SOL’s ecosystem?

A lower TVL means reduced liquidity in DeFi protocols, leading to lower yields for stakers and liquidity providers. This can make the ecosystem less attractive to investors and developers.

3. Is Solana’s price decline linked to the meme coin crash?

Yes, SOL’s price fell in tandem with declining meme coin activity, as the network’s revenue and transaction fees dropped. Reduced on-chain activity led to lower demand for SOL, contributing to its price decline.

4. What steps is Solana taking to stabilize its economy?

The SOL community is discussing a new tokenomics model that adjusts inflation dynamically based on staking demand. Additionally, institutional interest in SOL ETFs may provide a new source of capital inflow.

Glossary

Total Value Locked (TVL): The total capital held within a blockchain’s DeFi ecosystem.

Meme Coins: Cryptocurrencies often created for fun or speculation rather than fundamental use.

Staking: The process of locking up tokens to support network security and earn rewards.

ETF (Exchange-Traded Fund): A financial product that tracks the value of an underlying asset, like a cryptocurrency.

Inflation Model: A system that dictates the issuance of new tokens in a blockchain ecosystem.