According to new filings, the Solana ETF delay and the Truth Social Bitcoin ETF now face longer reviews by the U.S. Securities and Exchange Commission (SEC). The SEC paused final decisions and gave itself more time. These delays impact applications from Grayscale, Truth Social, Bitwise, and other entities seeking to launch spot ETFs for Solana and Bitcoin.

Why the Solana ETF Delay and Bitcoin Pause Matter

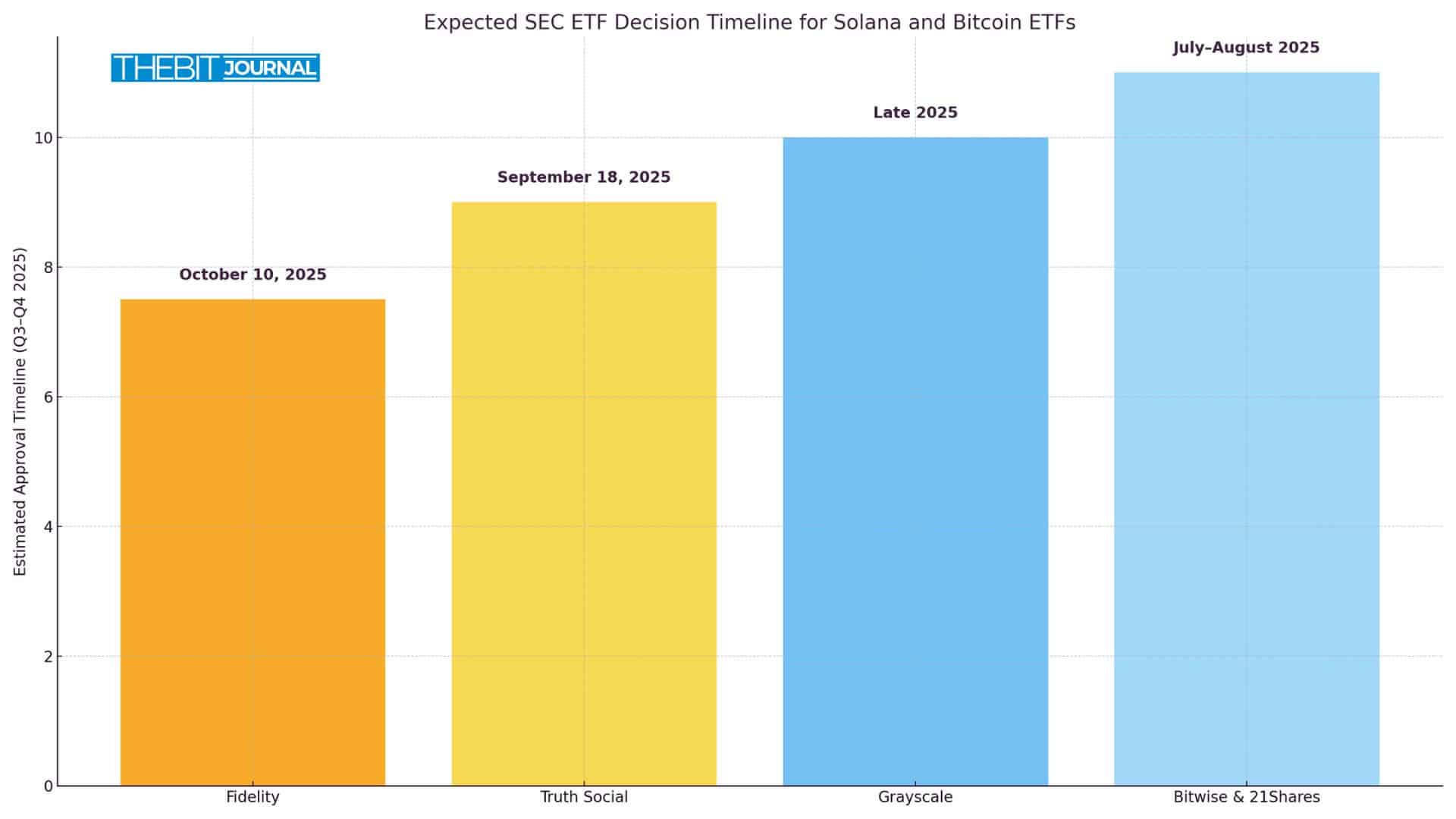

The Solana ETF delay highlights that the SEC remains slow to act on altcoin funds. Grayscale asked to turn its Solana Trust into a spot ETF. The SEC pushed that decision to October 10, 2025. It also delayed a ruling on the Truth Social Bitcoin ETF until September 18, 2025.

Bitwise, 21Shares, and Fidelity also received delays on their Solana ETF filings. The SEC requested public comments on how these funds will protect users and store their assets.

SEC Timeline for Delayed ETF Proposals

| ETF Filing | Type | New Deadline | Issuer |

|---|---|---|---|

| Grayscale Solana ETF | Spot Solana | October 10, 2025 | Grayscale |

| Truth Social Bitcoin ETF | Spot Bitcoin | September 18, 2025 | Trump Media |

| Bitwise & 21Shares Solana ETF | Spot Solana | Late 2025 | Bitwise, 21Shares |

| Fidelity Solana ETF | Spot Solana | July–August 2025 | Fidelity |

Fidelity had to pause its filing in July after the SEC raised additional questions.

What Experts Say

The market didn’t panic. Bitcoin held near $63,000, and Solana stayed above $140. Many traders saw the Solana ETF delay as usual.

Bloomberg ETF analyst James Seyffart said:

“Delays were expected. I wouldn’t read much into it.”

SEC Commissioner Hester Peirce, known as “Crypto Mom,” told Bloomberg:

“People have to be patient. We’re still working through legal questions and policy issues.”

What the Solana ETF Delay Means for Crypto

When the SEC delays a decision, it typically requests additional time to review the structure and safety of the fund. That’s what happened with the Solana ETF delay. The SEC seeks to understand how these ETFs would manage staking rewards, protect wallets, and handle redemptions.

Analysts at Bloomberg believe the SEC will approve Solana ETFs before the end of the year. They give it a 90% chance of approval by the end of Q4 2025.

If the SEC approves these ETFs, users could buy Solana or Bitcoin through regular brokers without using a crypto wallet.

Quick Notes for Investors

- In July, the SEC shared new guidelines for crypto ETFs. This helps applicants write clearer proposals.

- One fund, the REX-Osprey Sol + Staking ETF, already offers SOL exposure and a 7.3% reward.

Conclusion

Based on the latest research, the Solana ETF delay reflects the SEC’s steady approach to approving crypto funds. While the process takes time, it demonstrates that regulators aim to address key legal and investor protection issues before granting broader market access. The delay does not signal rejection. Instead, it provides both issuers and investors with an opportunity to prepare for a more stable entry into regulated altcoin investment.

Summary

The SEC has postponed decisions on both the Truth Social Bitcoin ETF and several Solana ETF proposals, including Grayscale’s, citing the need for deeper review. These delays are part of a routine process and not rejections. Investors and analysts remain optimistic about approvals by the end of 2025. The Solana ETF delay signals growing institutional interest in crypto, while the SEC works to ensure safe and transparent market participation.

To get more detailed insights into the world of cryptocurrencies, check out our latest articles.

FAQs

Why did the SEC delay these ETF decisions?

It required additional time to review the legal structures and public comments.

Does the Solana ETF delay mean rejection?

No. The SEC often uses its whole review period.

When will the SEC give a final ruling?

Bitcoin: September 18, 2025. Solana: October 10, 2025.

What happens if ETFs get approved?

Investors can buy Solana or Bitcoin through broker platforms, just as they buy stocks.

Glossary of Key Terms

SEC: U.S. Securities and Exchange Commission, the financial regulator.

Spot ETF: A fund that holds the actual crypto asset (like Bitcoin or Solana).

Custody: How a fund stores and protects investor crypto.

Staking: Locking tokens to help the network and earn rewards.

Public Comment: The feedback process, which allows anyone to respond to a proposed ETF.