According to source, the first Solana futures ETFs from Volatility Shares have been listed by the Depository Trust & Clearing Corporation (DTCC), a major milestone that is important for cryptocurrency investment products. They are SOLZ and SOLT — proffer both regular and 2x leveraged exposure to Solana futures contracts.

Understanding Solana ETFs

Exchange-Traded Funds (ETFs) are basically investment funds traded on stock exchanges, just like individual stocks. They let investors gain exposure to some underlying basket of assets without owning them directly. Futures ETFs, in particular, don’t track the price of the asset itself but the price of futures contracts — agreements to buy or sell an asset at a set future date and price.

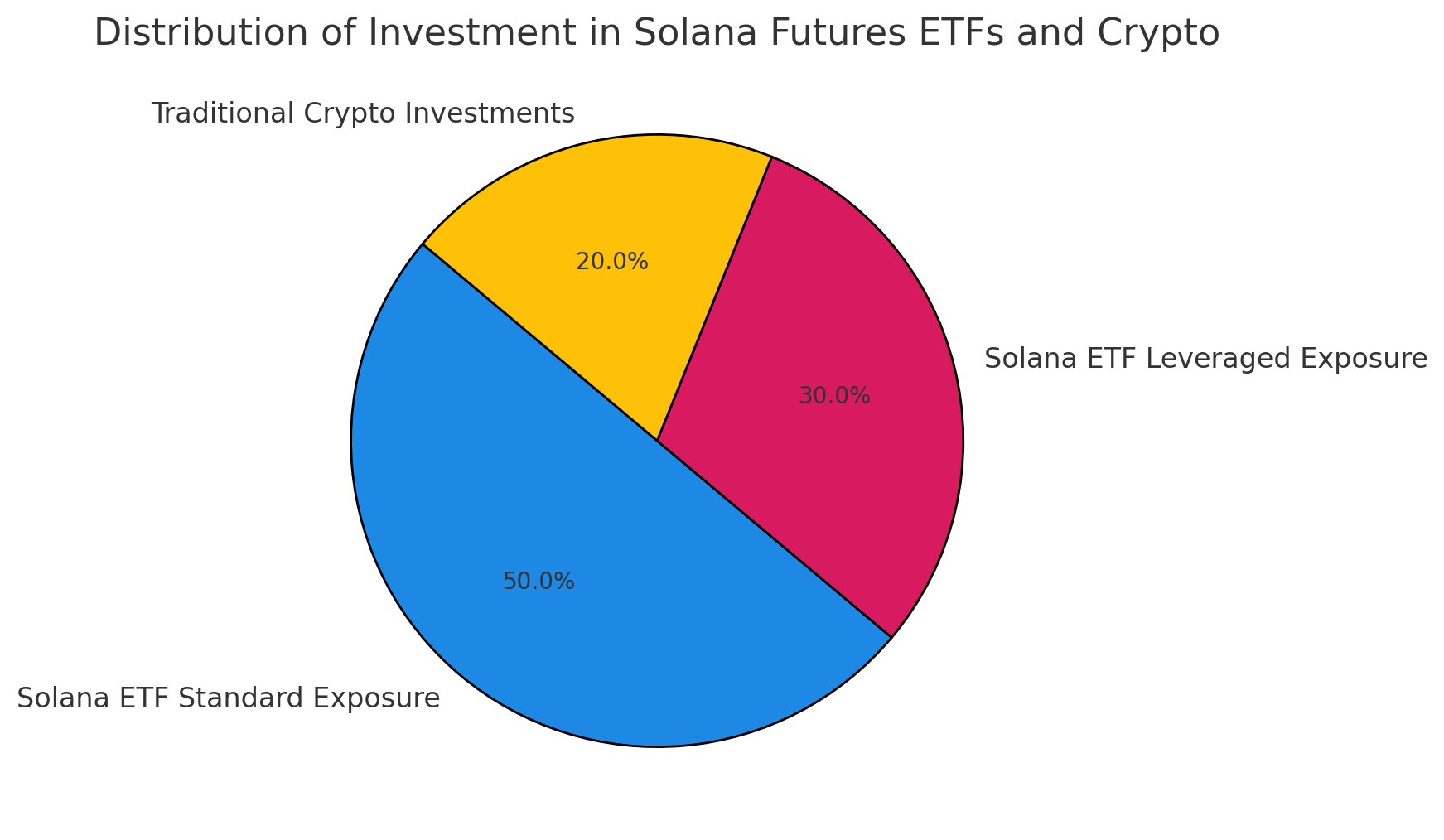

The Volatility Shares Solana ETF (SOLZ) delivers a 1x allocation to Solana futures and is designed to replicate the performance of its underlying contracts. The Volatility Shares Solana ETF (SOLT), on the other hand, is a product that delivers leveraged exposure and seeks to provide two times the daily return of the Solana futures contracts. This implies for every 1% gain (or loss) in the futures’ value, SOLT aims for a 2% gain, and vice versa.

The Path to DTCC Listing

Volatility Shares began the process in December 2024 when the company filed its plans with the Securities and Exchange Commission (SEC) for three Solana-focused ETFs, including a Solana inverse ETF that would increase in value when Solana futures dip. However, as there were no Solana futures contracts on CFTC-regulated exchanges at that time, questions were raised on the practicality of such ETFs.

This landscape changed earlier this month when Coinbase Derivatives LLC opened CFTC-controlled Solana futures contracts. By doing so, the development closed the long-standing issue of the lack of a regulated market for Solana futures, underpinning ETF products based on these contracts.

Implications for Investors

The listing of Solana futures ETFs on the DTCC heralds a critical turning point for institutional and individual investors alike. It demonstrates cryptocurrency assets’ increasing integration within traditional financial markets and their growing widespread acceptance. For those seeking exposure to Solana’s price fluctuations, these ETFs afford a regulated and accessible means without the intricacies of directly handling cryptocurrencies.

Products like SOLT are leveraged ETFs and can magnify returns, but can also exacerbate losses, and so are best suited for highly sophisticated investors who understand the nuances of these leveraged products. Investors are free to take a look into assessment of their investment goals and risk tolerance before putting their hands on these financial instruments.

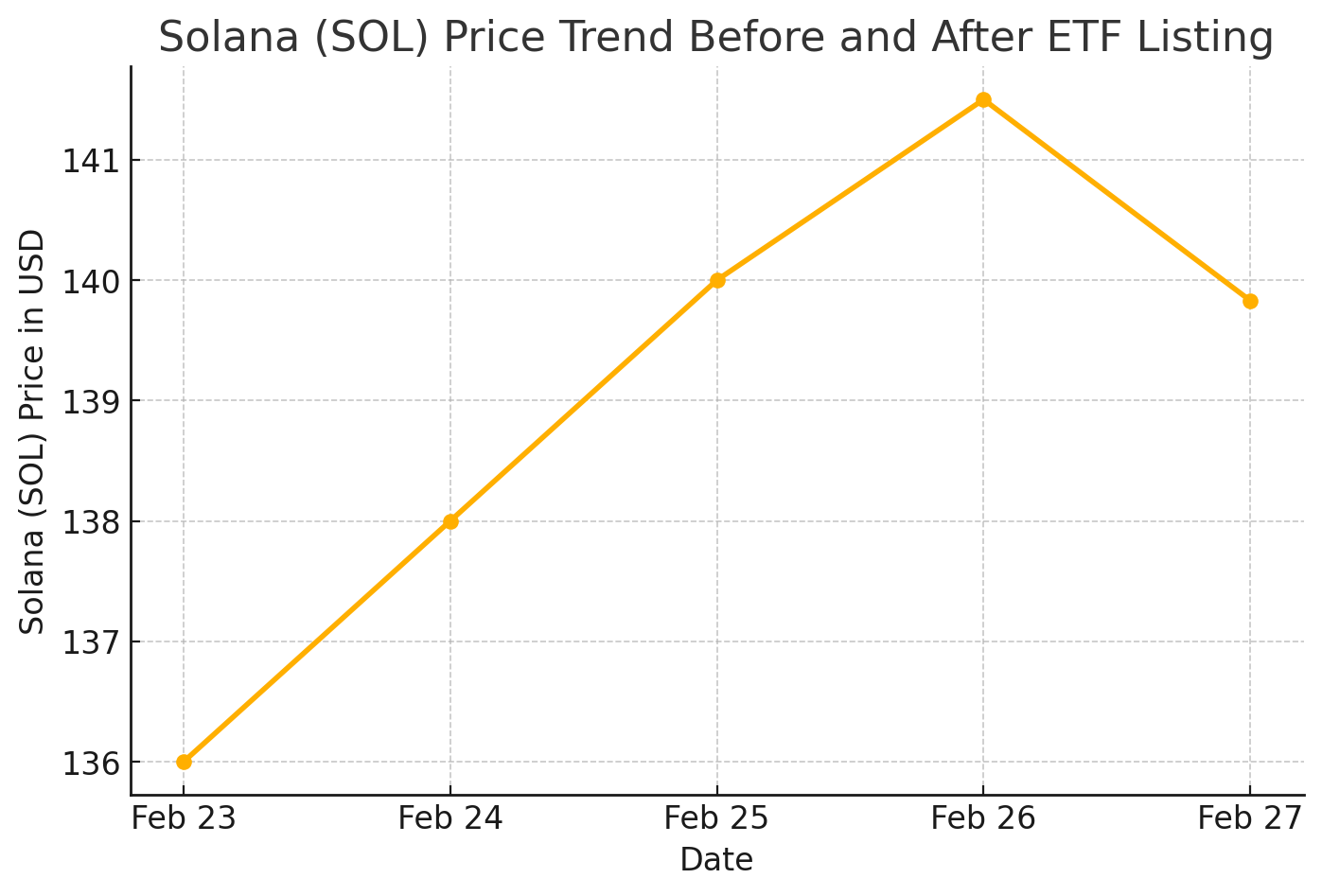

Current Solana (SOL) Price Overview

As of February 27, 2025, Solana (SOL) is trading at approximately $139.83, reflecting a slight decrease of 1.67% from the previous close. The day’s trading range has seen a high of $142.32 and a low of $130.15.

Solana (SOL) Price Table

| Date | Opening Price | Closing Price | Daily High | Daily Low |

|---|---|---|---|---|

| February 27, 2025 | $141.50 | $139.83 | $142.32 | $130.15 |

Looking Forward

The approval and launch of Solana futures ETFs may set a precedent for the approval and launch of additional cryptocurrency-based ETFs, including those that track spot prices. Such a development would help to bridge the gap between the traditional financial system and the growing digital assets market, giving investors new ways to access the crypto economy.

Given the ongoing changes in the regulatory landscape, it is important for market participants to be aware of developments impacting cryptocurrency investments. Under such circumstances, consulting with financial advisors and staying informed/educating yourself to keep up with the constantly changing dynamics of the situation would do you some good.

The Futures ETF listing from the DTCC represents a meaningful step toward the maturation of crypto as an investment, one that has been sought through growing institutional interest and access for investors looking for a vehicle.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates.

FAQs

What are Solana Futures ETFs?

Solana Futures ETFs are exchange-traded funds that follow the price of Solana futures contracts rather than the actual cryptocurrency. They use these platforms to give exposure to Solana without buying or holding SOL tokens.

What Are Solana Futures ETFs?

These ETFs track the prices of Solana futures contracts, which are agreements to purchase or sell SOL at a predetermined price at a specified future date. Some, such as SOLT, even provide leveraged exposure that further magnifies both gains and losses.

What is the significance of Solana Futures ETFs listing?

The listing signals increasing institutional acceptance of Solana as it joins the ranks of approved crypto for traditional investors to invest in through regulated financial products.

Without holding SOL can we trade Solana Futures ETFs?

Yes, these ETFs enable investors to take advantage of Solana’s price movement without ever having to purchase, store or manage actual SOL tokens.

Is it risky for Solana ETFs to be leveraged?

Yes, leveraged ETFs (including SOLT) magnify profits and losses. They’re only recommended to experienced traders who are aware of the risks that come with leverage.

Glossary of Key Terms

ETF (Exchange-Traded Fund) – A type of investment fund traded on stock exchanges, similar to individual stocks, allowing investors to gain exposure to an asset or group of assets.

Futures Contract – A financial agreement to buy or sell an asset at a predetermined price on a future date.

Leveraged ETF – An ETF that aims to deliver multiple times the daily performance of an asset, increasing both potential gains and losses.

DTCC (Depository Trust & Clearing Corporation) – A major financial services company that provides clearing and settlement services for securities, including ETFs.

CFTC (Commodity Futures Trading Commission) – A U.S. regulatory agency that oversees the derivatives and futures markets, ensuring compliance and security.

Volatility Shares – The financial firm that introduced the first Solana Futures ETFs, offering both standard and leveraged options.

Source