Solana price breakout gains momentum as technical patterns align with bullish fundamentals, driving investor interest across its growing crypto ecosystem. SOL is posting fresh gains with the asset trading up 10.9% this week as a bullish trend in the crypto market continues to catapult the token higher against key resistance areas in the $179 region.

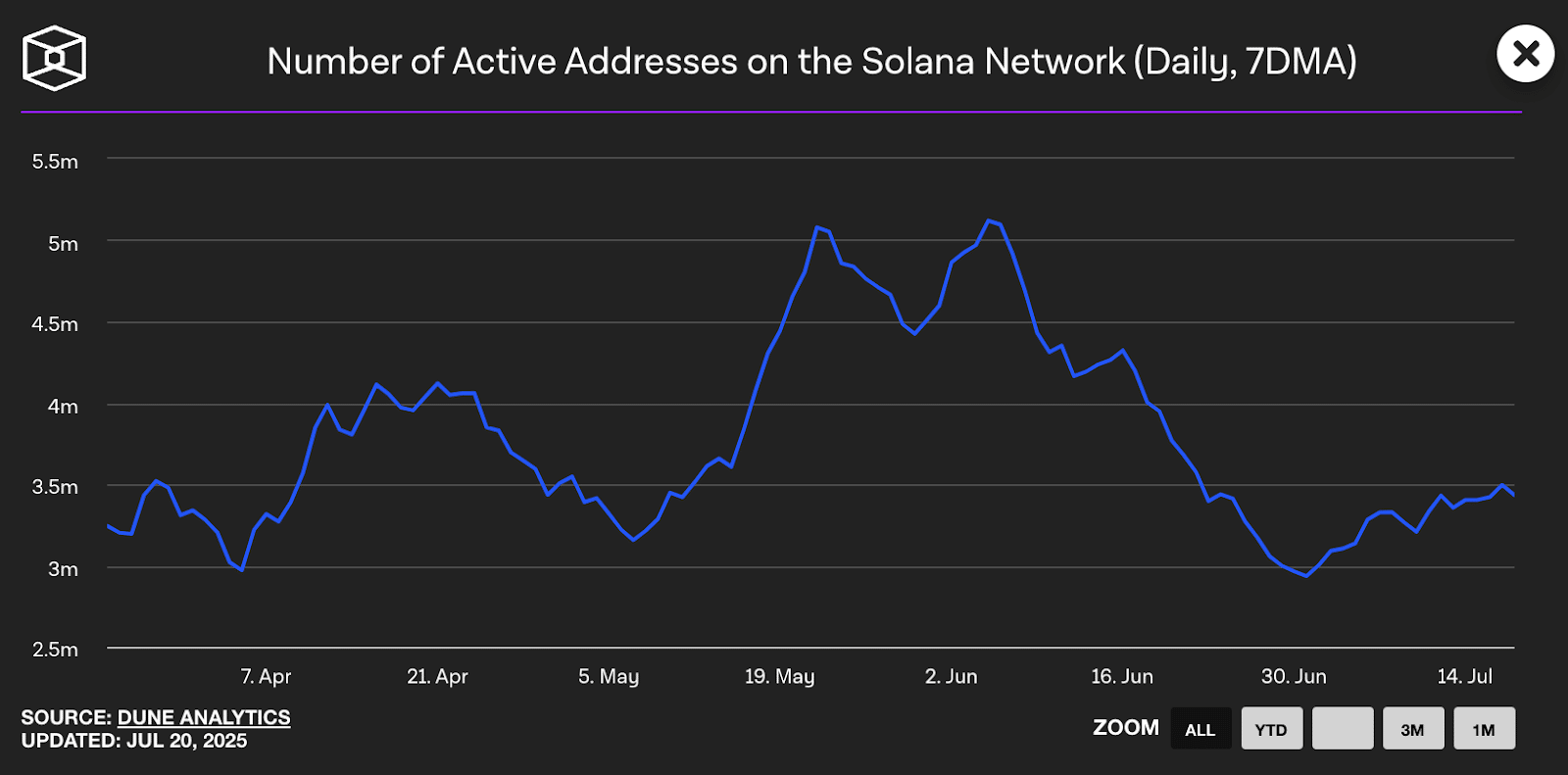

The upswing has been sustained by the betterment of on-chain fundamentals, such as a rise of Total Value Locked (TVL) of over 6 billion to more than 9 billion and the presence of more than 3.3 million returning active wallets signaling further user engagement. The recent rally has set the stage to what many analysts term a possible Solana price breakout.

Cup and Handle Signals Solana Price Breakout

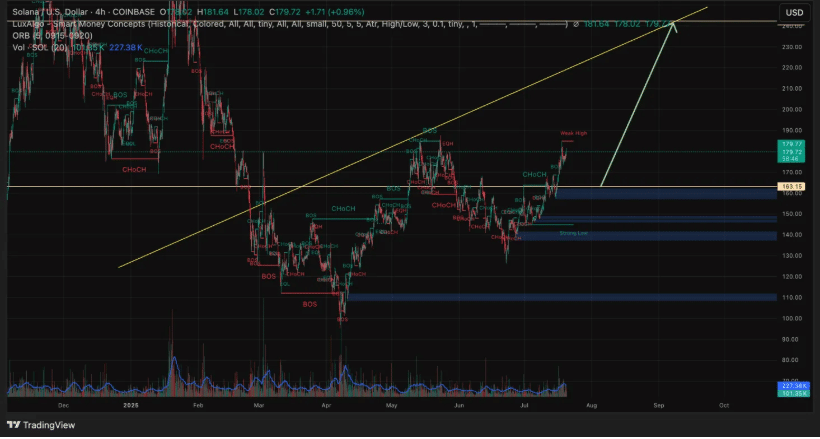

Technically, SOL is in a crucial crossroad, as it is now pushing the balance point to the resistance at around $179 levels after consolidating in a tight band at around $145 and $175. Analysts indicate that Solana could break out of this area with references to multi-year cup and handle pattern as one of the most bullish continuation patterns in technical analysis.

Crypto strategist Elina Morozov observed that this is a setup that has taken years to develop. It is the typical accumulation phase followed by shallow pullback on the handle that comes before big parabolic moves.

As the weekly chart of Solana looks like a perfect cup and handle, traders are looking at ambitious upside prices. The first break out is at 189. In case of surpassing, the next resistance levels are $235 and $263, and further long-term prospects extend to $295, $360, and even $402. These are some of the levels that are normally quoted in the predictions which require the anticipated Solana price break out.

$SOL Solana Weekly Update 🪙

Massive cup and handle forming on the weekly timeframe ☕️

A new ATH would put this above 295 🐂 pic.twitter.com/LVkaSCu4JG

— CJ (@CJsCalls) July 19, 2025

Macro Trends Support Solana Price Breakout Potential

Analysis of volume profile adds to the bullist version. Large-volume trading around the $145 area gives a solid support layer, and thinner order books at higher prices make it probable that gains could accelerate after breaking resistance further strengthening the argument of a Solana price breakout.

Further, macro-based considerations, the pause by the Federal Reserve, and an envisaged rate reduction of 30-50 basis points by the end of Q4 2025, are making high-beta assets more attractive such as Solana.

The second leg of the liquidity wave in support of digital assets is also anticipated with liquidity advancements that are being achieved in global markets, in part, due to the significant monetary easing act that was sought by central banks. These positive factors present a macro environment that enhances the Solana price breakout thesis.

GENIUS Act Adds to Solana Price Breakout

In addition to price performance, Solana has been equaled by technical advances well as on-chain and developmental force. As the number of developers and dApps grows, and as increasingly large institutional partnerships are entered into, the blockchain becomes an increasingly viable choice of scalable and efficient solution within the functioning of Layer-1.

GENIUS Act and other developments of regulatory focus are bringing a new layer of confidence, providing clarity that may drive a further institutional influx of money into Solana and other altcoins as the Solana price breakout story grows.

Conclusion

Based on the latest research, Solana price breakout appears increasingly likely as technical, on-chain, and macroeconomic signals align. With momentum building toward the $189 resistance, projections as high as $295 are in focus.

Stay up to date with expert analysis and price predictions by visiting our crypto news platform.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

Solana rose by 10.9% this week, but the price hits resistance at $179 as the Total Value Locked and the activity of returning wallets increases. Technical indicators point out a multi year cup and handle pattern, indicating a possible cross-over headed to $295 and above. The bullish view is also enhanced by macro conditions and regulatory clarity. In the meantime, the Solana ecosystem token,

FAQs

1. What’s driving the Solana price breakout?

Strong on-chain growth, a cup and handle pattern, and favorable macro conditions are fueling the breakout.

2. What are Solana’s key resistance levels?

Key levels are $179 and $189, with upside targets at $235, $263, and $295.

Glossary Of Key Term

Solana (SOL)

A fast, low-fee Layer-1 blockchain.

TVL (Total Value Locked)

Assets locked in DeFi on a blockchain.

Cup and Handle

Bullish chart pattern signaling breakout.

Volume Profile

Shows where most trading occurred.

Federal Reserve Pause

Temporary halt in interest rate changes.

GENIUS Act

Regulatory bill bringing crypto clarity.