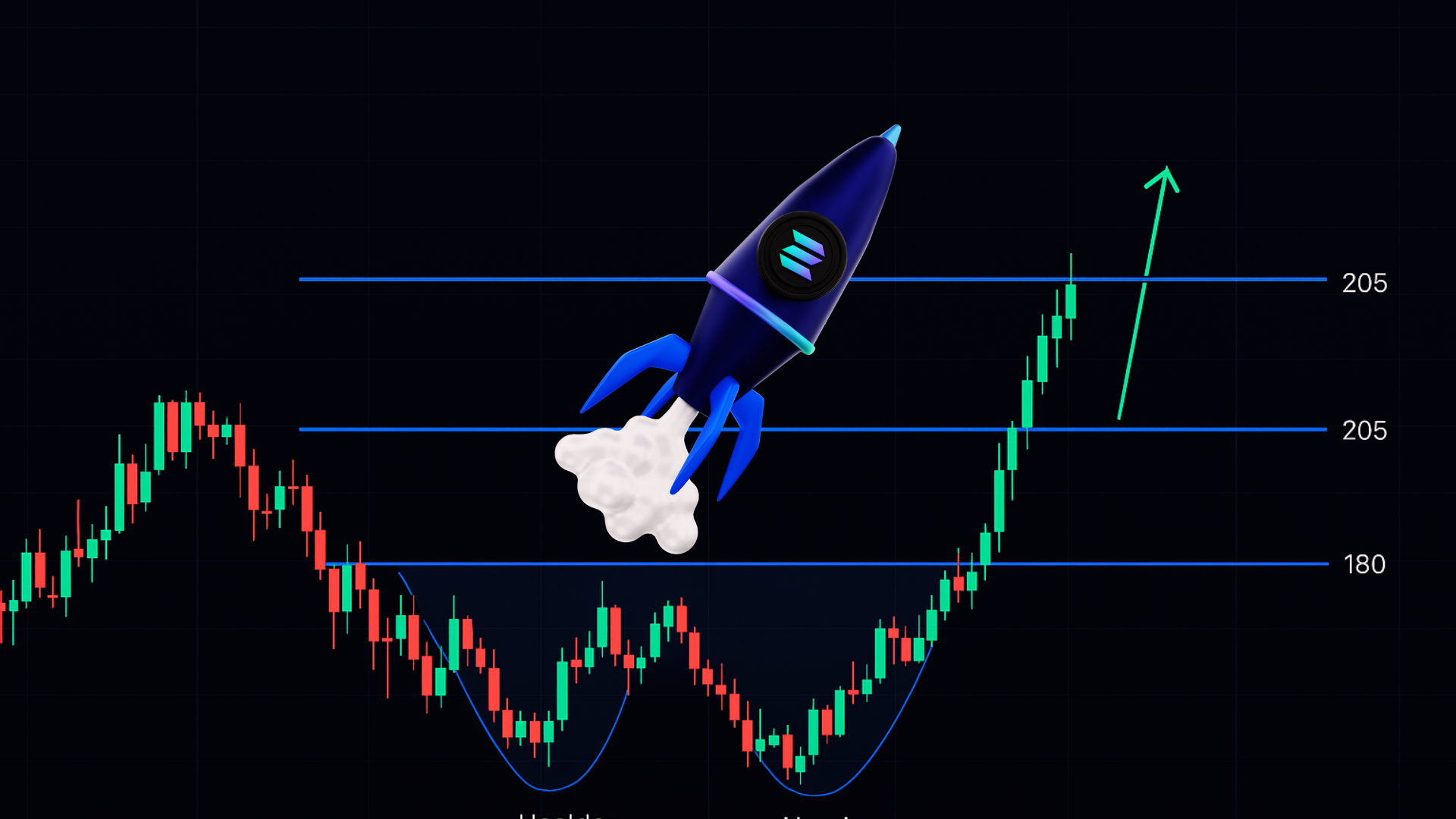

According to TradingView data, the Solana price prediction appears strong following the price’s breakout past the significant $180 level. This move aligns with a chart pattern known as an inverse head and shoulders, which typically indicates a potential rise toward $220.

As big investors continue to buy more SOL and the network improves its capacity, many experts believe this could mark the start of a strong upward trend, signaling a bullish price prediction.

Why Does the $180 Breakout Matter for Solana?

Solana’s breakout above isn’t just a technical achievement; it also shows a change in how investors feel about the market. Solana saw a gain of over 31% last month. Experts see $187 as a solid support, with the next hurdles at $192 and $205.

If Solana can rise past these points, it could head toward $220, supporting the bullish Solana price prediction outlook. Chart experts point out that Solana has clearly broken through the neckline of an inverse head and shoulders pattern on its daily chart.

This pattern usually signals a potential upward move. If SOL stays above the $180 support level, the price could continue to rise, with $223 seen as a possible short-term target based on SOL price prediction trends.

How Are Institutions Influencing Solana’s Price Trajectory?

Big investors are quickly showing more trust in Solana. DeFi Development Corp, a company listed on Nasdaq, is close to owning 1 million SOL, worth about $187 million.

At the same time, Bit Mining has announced plans to raise $200–300 million to build a large Solana reserve. Crypto analyst Ali (@ali_charts) said that if Solana moves past $200, there won’t be much stopping it from reaching new record highs.

This rising interest from big investors is seen in many Solana price prediction reports as a strong reason the price could keep going up. The buying happening at these price levels is seen as a sign that big investors are planning to hold SOL for the long term.

This supports the idea in many Solana price prediction views that if Solana clearly breaks above $200, it could soon move toward the $250 mark.

| Metrics | Value |

| Key Resistance Broken | $180 |

| Consolidation Range | $185 to $190 |

| Technical Pattern | Inverse Head and Shoulders |

| Near-term Breakout Target | $220 |

| Breakout Zone | $200 to $205 |

| Medium-term Price Outlook | $250–$300 |

What Role Do Technical Upgrades Play in Solana’s Momentum?

Solana’s fundamental strength improved recently after a 20% increase in block capacity, raising it to 60 million compute units. According to Helius CEO Mert Mumtaz, this upgrade helps the network handle more transactions in each block, making it faster and more efficient.

Mert Mumtaz explained that “every transaction uses compute units, similar to how a car uses fuel.” With the recent increase, Solana can now handle more complex transactions each second, improving overall network performance.

This upgrade makes Solana more scalable and ready for wider use. In terms of Solana price prediction, improvements like this often come before or during strong price gains, as they boost investor trust by making the network more reliable.

Are There Short-Term Risks?

Even with a positive outlook, Solana might still face short-term drops. The nearest support levels are around $190 and $188. If it can’t move above $200, the price could briefly fall, with $184 likely to act as the next strong support level. If Solana falls below $184, it could slip further toward $175.

Still, experts believe any dip in this range would probably be short-lived because of the solid foundation and growing support from big investors backing the Solana price prediction.

The market mood is positive but cautious. RJT (@RJTTheOG) shared on X that Solana quietly performed well on this bull run. He believes that if it goes above $295, the next possible target could be $500.

Conclusion

Based on the latest research, Solana price prediction remains positive, supported by strong chart patterns, rising interest from big investors, and upgrades to the network. Solana’s jump above $180 has brought traders back into focus, and now many are watching closely to see how it behaves near the $200 mark.

If SOL manages to climb past the $200–$205 range and hold steady, it could make its way toward the $220–$223 zone. With support from DeFi Development Corp and Bit Mining, along with Solana’s recent network improvements for better scalability, both the fundamentals and the charts point to strong potential ahead.

Even though the crypto market can be unpredictable, signs suggest that Solana’s rise may not be just a quick jump. It could be the start of a steady and lasting upward move.

Catch up on this to explore how Solana’s earlier Cup and Handle setup and rising TVL build the base for today’s $220 breakout move.

Summary

According to experts, Solana price prediction remains strong after it crossed $180 and formed a bullish chart pattern called an inverse head and shoulders. The price has a chance to hit $220 if it breaks above $200. DeFi Development Corp and Bit Mining are buying large amounts of SOL, adding confidence. A recent network upgrade also boosted transaction capacity. Analysts believe Solana’s rise may continue, supported by solid fundamentals and growing institutional interest.

FAQs

1. What is the Solana price breakout level?

Solana has broken above the $180 resistance level.

2. What chart pattern is supporting the bullish Solana price prediction?

An inverse head and shoulders pattern has formed on the daily chart.

3. What is the next major Solana price prediction target?

Analysts predict $220 as Solana’s next target.

4. How much SOL does DeFi Development Corp plan to hold?

Nearly 1 million SOL is worth about $187 million.

5. What technical upgrade boosted Solana’s capacity?

A 20% block capacity increase raised compute units to 60 million.

6. How does the upgrade affect performance?

It allows Solana to handle more transactions per second efficiently.

Glossary

Inverse Head and Shoulders- A bullish chart pattern that often appears before an upward price surge.

Compute Units- The processing power used to run transactions on the Solana network.

Technical Upgrade- An improvement to a blockchain’s infrastructure that boosts performance.

Block Capacity- The total number of compute units a block can handle, higher means faster transactions.

Scalability- The network’s ability to handle more users and transactions without slowing down.