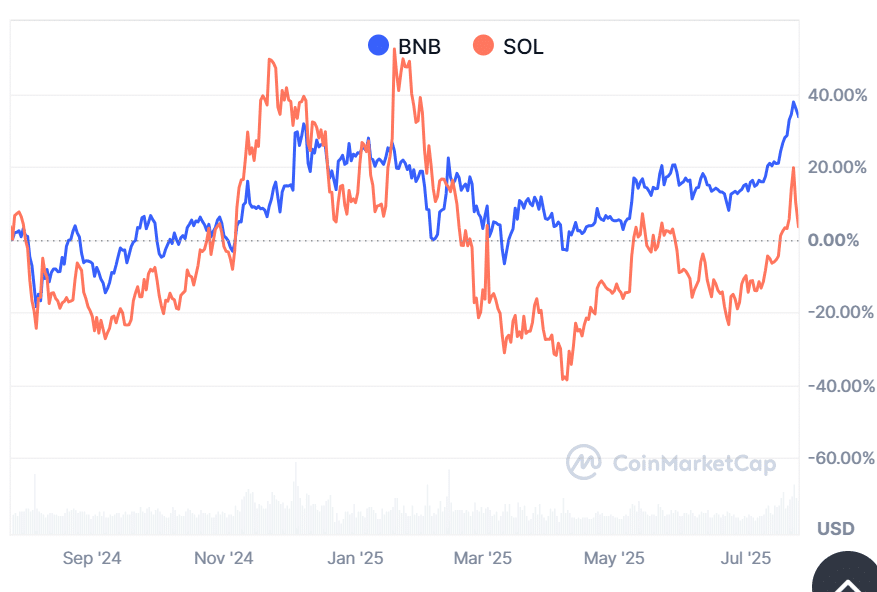

The race for the fifth-largest cryptocurrency by market value has heated up once more, with Solana closing in on recovering the $200 threshold. The Solana price prediction story has gained popularity as the blockchain network’s momentum continues to compete with Binance Coin (BNB) for domination.

With significant institutional interest, a developing decentralized finance (DeFi) ecosystem, and increased market liquidity, the next few weeks might be critical for Solana’s future.

Solana’s Market Cap Flips BNB, but Can It Hold?

Solana’s market value just surpassed BNB’s, establishing it as a candidate for long-term domination in the altcoin market. The switch happened when Solana’s trading volume increased and liquidity improved on key exchanges, giving a strong signal to investors.

Experts believe that this move is more than just a price increase. “Solana’s fundamentals have never been stronger, and its growing ecosystem makes it a legitimate competitor to BNB,” stated one crypto market expert.

The most recent data reveal that Solana’s Total Value Locked (TVL) on DeFi platforms has crossed the $11 billion mark, indicating substantial network activity. BNB, despite its centralized exchange backing and token burn mechanism, has lagged behind in DeFi adoption. This discrepancy might have an impact on the continuing battle for the top five slot.

Market Trends Fuel Bullish Solana Price Prediction

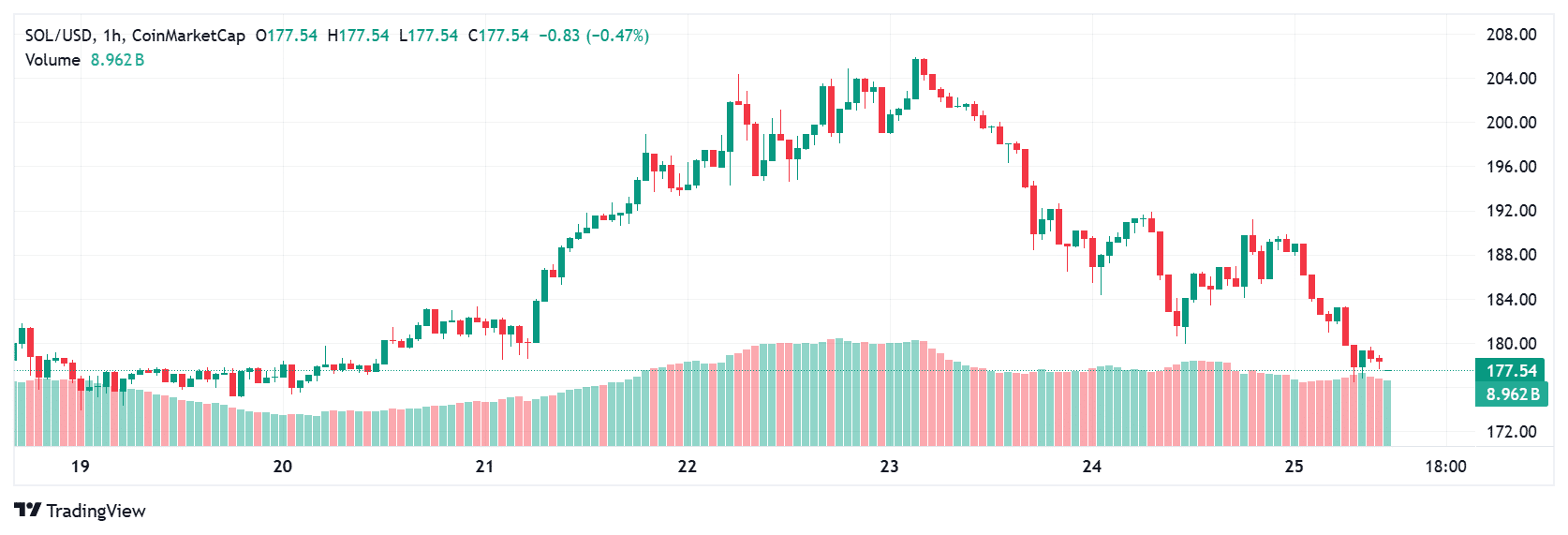

The Solana price prediction prognosis remains positive as technical signs and wider market factors combine in its favor. Analysts note that the support zone between $175 and $180 has remained stable throughout recent market dips, setting the stage for a possible breakthrough. Momentum indicators such as the MACD and trade volume show positive divergence, while the Relative Strength Index (RSI) remains high despite slight retracements.

Institutional players have also taken note. “Solana is now a serious layer-1 network with proven scalability and developer adoption,” said one senior investment expert. This support is critical as institutional money continues to pour into assets with compelling use cases.

Price Table: Solana vs. BNB Market Capitalization

| Asset | Market Cap (USD) | TVL (USD) | DeFi Activity |

|---|---|---|---|

| Solana | $107.3 Billion | $11.1 Billion | High |

| BNB | $105.6 Billion | $6.8 Billion | Moderate |

Note: Figures based on aggregated data from top market analytics platforms.

Predictions: Can Solana Break the $220 Barrier?

The Solana price prediction range remains positive, with experts expecting a climb to $220-$270 if the network continues its present performance. The increase in DeFi participation, as well as the further expansion of NFT and gaming initiatives on Solana’s blockchain, are expected to be important drivers of future price appreciation.

BNB, on the other hand, remains a formidable competitor, having just reached a record high over $800. Its token burn scheme and exchange domination offer it a competitive advantage, but the result of this struggle is far from certain.

A Fruiting Opportunity for Investors

For traders and investors, Solana’s potential upside is appealing. The blockchain’s cheap transaction costs and high throughput capabilities have made it a popular platform for developers. This increases its long-term value proposition and may result in more institutional adoption in the coming months.

Conclusion

The competition between Solana and BNB is one of the most closely followed stories in cryptocurrency today. Solana’s foundations, robust developer environment, and booming DeFi industry offer it an advantage in the short future. However, BNB’s exchange support and tokenomics keep the rivalry intense. The Solana price projection trend is positive, but staying above BNB will need continued network development and investor trust.

FAQs

Can Solana maintain its position above BNB?

Solana’s strong DeFi growth and liquidity suggest it could, but BNB’s competitive tokenomics make it a close race.

What is the long-term Solana price prediction?

Analysts expect Solana to potentially reach $220–$270 in the coming months if bullish conditions persist.

Is Solana’s network adoption outpacing BNB?

Yes, particularly in DeFi and NFT activity, which strengthens Solana’s market position.

Glossary

Total Value Locked (TVL): The amount of assets held within DeFi protocols on a blockchain network.

Market Capitalization: The total value of a cryptocurrency calculated by multiplying the current price by circulating supply.

MACD (Moving Average Convergence Divergence): A technical indicator used to determine trend direction and momentum.

Relative Strength Index (RSI): A momentum indicator that measures overbought and oversold levels.