Solana has surpassed the long-awaited $200 threshold, sparking what many are calling a “textbook breakout.” Solana is now in the driver’s seat for a possible push to new annual highs, fueled by growing institutional demand, a frenzy of developer activity, and game-changing infrastructure enhancements. This is more than simply a pump; it’s a movement, and the Solana price prediction and bulls are heated up.

From FTX Fallout to Full Recovery

Rewind to late 2022, when Solana (SOL) was left hobbling following the FTX crash, shedding more than 70% of its value in weeks. Critics wrote it off. But, during 2023 and 2024, Solana slowly recovered its reputation, thanks to a winning combination of lightning-fast transactions, low fees, and expanding ecosystem momentum.

Fast forward to mid-2025, and SOL is not just recuperating, but also prospering. The Solana price forecast discussion has evolved from “Will it survive?” Question: “How high can it go?”

Price Analysis: Breakout Fueled by Whale Wallets and ETFs

Solana’s recent climb was no accident. On-chain data shows aggressive accumulation from wallets holding 10,000+ SOL, while ETF inflows from firms like VanEck and Ark Invest are giving SOL fresh exposure to mainstream capital.

| Support Levels ($) | Resistance Levels ($) | Prediction Targets ($) |

|---|---|---|

| 190–195 | 230–250 | 275–300 |

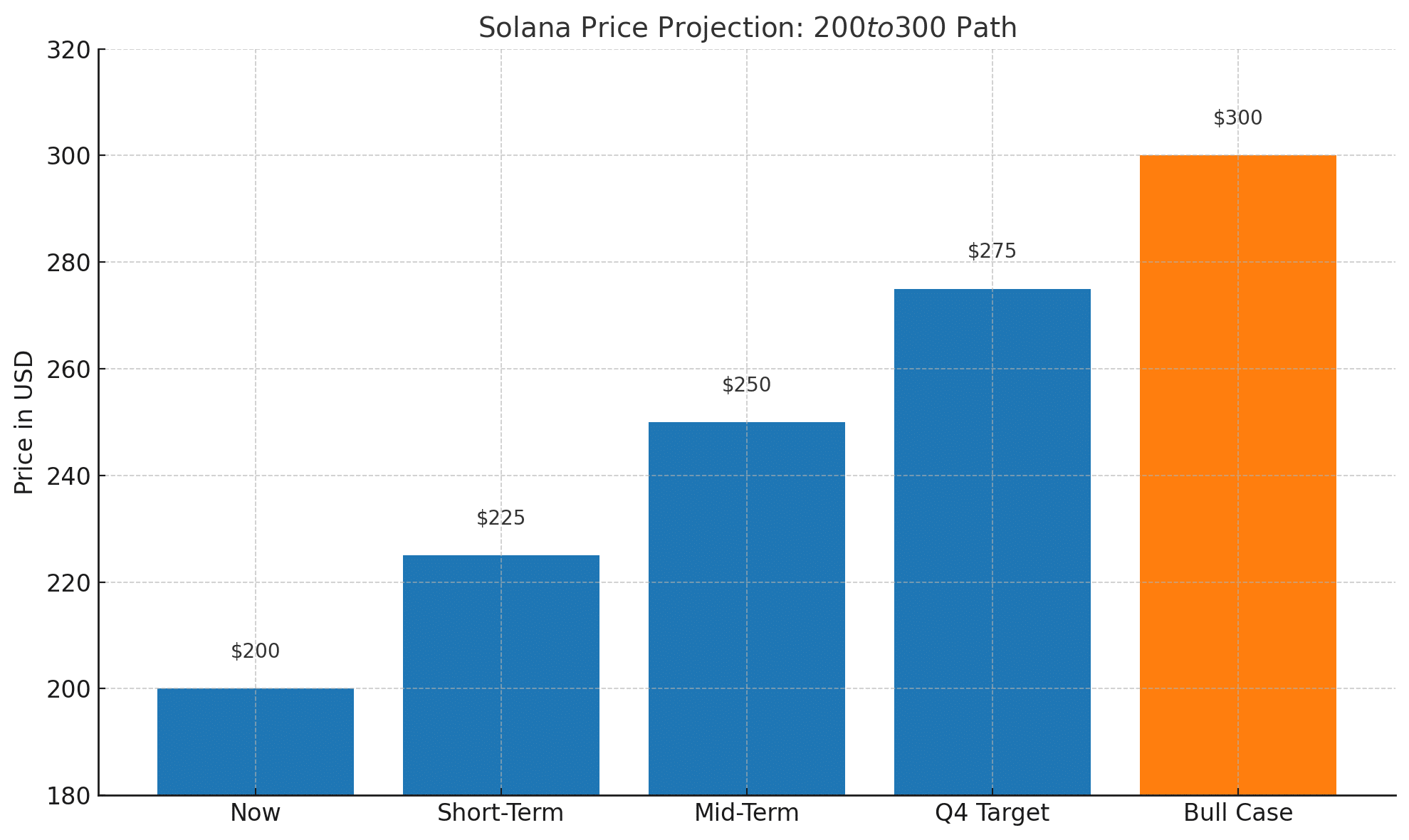

According to experts, “Solana price prediction models indicate a medium-term upside toward $250, and possibly $275 by Q4 2025.”

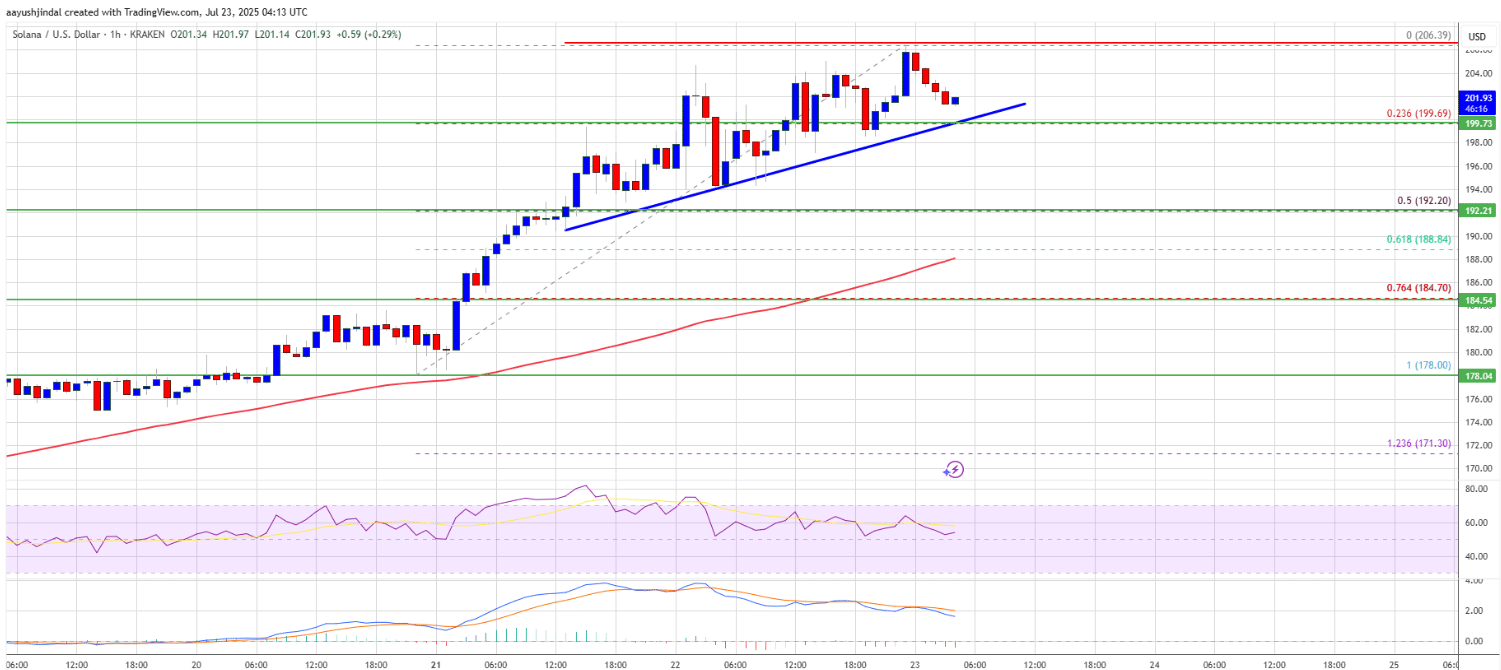

Meanwhile, the MACD has been positive for two weeks in a row, and the RSI is over 75, indicating strong purchasing momentum. Even with somewhat overbought signs, traders continue to keep long positions.

Infrastructure Boost: Jito’s BAM Launch

One major cause for the spike is the debut of Jito Labs’ Block Assembly Marketplace (BAM). The update introduces a whole new approach for validators and builders to interact with blocks, faster, cleaner, and more decentralized.

“Solana surged past an important price level at $200,” according to Nick Ruck of LVRG; “and this new infrastructure from Jito could greatly enhance transaction efficiency.”

The BAM system also lowers MEV risks and increases validator transparency, making Solana more appealing to institutional investors seeking dependability and scalability.

Ecosystem Momentum: Devs, DEXs, and Meme Coins

Solana is more than just a chart; it’s alive and well behind the surface.

Developer Activity: According to Santiment, Solana has just had its greatest level of development activity in two months.

User Growth: Active wallets on Solana have surpassed 1.7 million, with daily transactions typically exceeding 20 million.

Meme Coin Buzz: PENGU, BONK, and SmellsCoin are driving a mini-bull run in Solana, attracting new retail users.

According to CoinEdition, “Solana’s price push is being turbocharged by rising developer energy and a meme coin wave.”

Expert Views: Bulls in Full Control

Analysts across the board are boosting their targets. A crypto experts stated, “With Solana breaking key resistance and institutions accumulating, the $250-$300 zone is the next realistic target.”

Standard Chartered has added SOL to its mid-2025 watchlist, citing strong technicals and “underrated ecosystem growth.”

Even doubters are thawing. Former Ethereum maximalist James Kaleb stated, “At this point, ignoring Solana’s performance is just being stubborn.”

For Investors and Traders: What Now?

This rally is more than just noise; it is a signal. Solana is an appealing long-term investment due to its real-world usage, developer devotion, and institutional backing.

Traders still have meat on the bone.

Entry Zone: $195–$205

Target Zone: $230–$250

Stop-Loss Suggestion: Under $185.

Dollar-cost averaging remains a viable option for new purchasers hoping to catch the next leg of the Solana price prediction train.

Conclusion: Solana Price Prediction Not Slowing Down

Solana has surged beyond $200, and technicals, fundamentals, and market sentiment all indicate that the trip is far from over. With Jito’s BAM, a wave of meme coin action, institutional inflows, and optimistic analyst coverage, the next objective seems to be $250-$300.

Investors may wish to lock in. Because this is more than simply a pump; it is the culmination of Solana price prediction’s redemptive journey.

Read more on Solana DeFi.

FAQs

Q1: What triggered Solana’s breakout above $200?

A mix of institutional inflows, Jito’s BAM launch, and developer activity pushed SOL past resistance.

Q2: What’s the latest Solana price prediction?

Experts are eyeing $250–$275 by Q4 2025 if momentum holds.

Q3: Is now a good time to buy Solana?

If you’re bullish long-term, yes. Dips near $195 could be good DCA entry points.

Glossary

Jito BAM: A new Solana upgrade to improve block building and reduce MEV.

RSI: Relative Strength Index, indicates overbought or oversold conditions.

ETF: Exchange-traded fund, used here to give institutions exposure to Solana.

MACD: A trend-following indicator signaling buying/selling momentum.