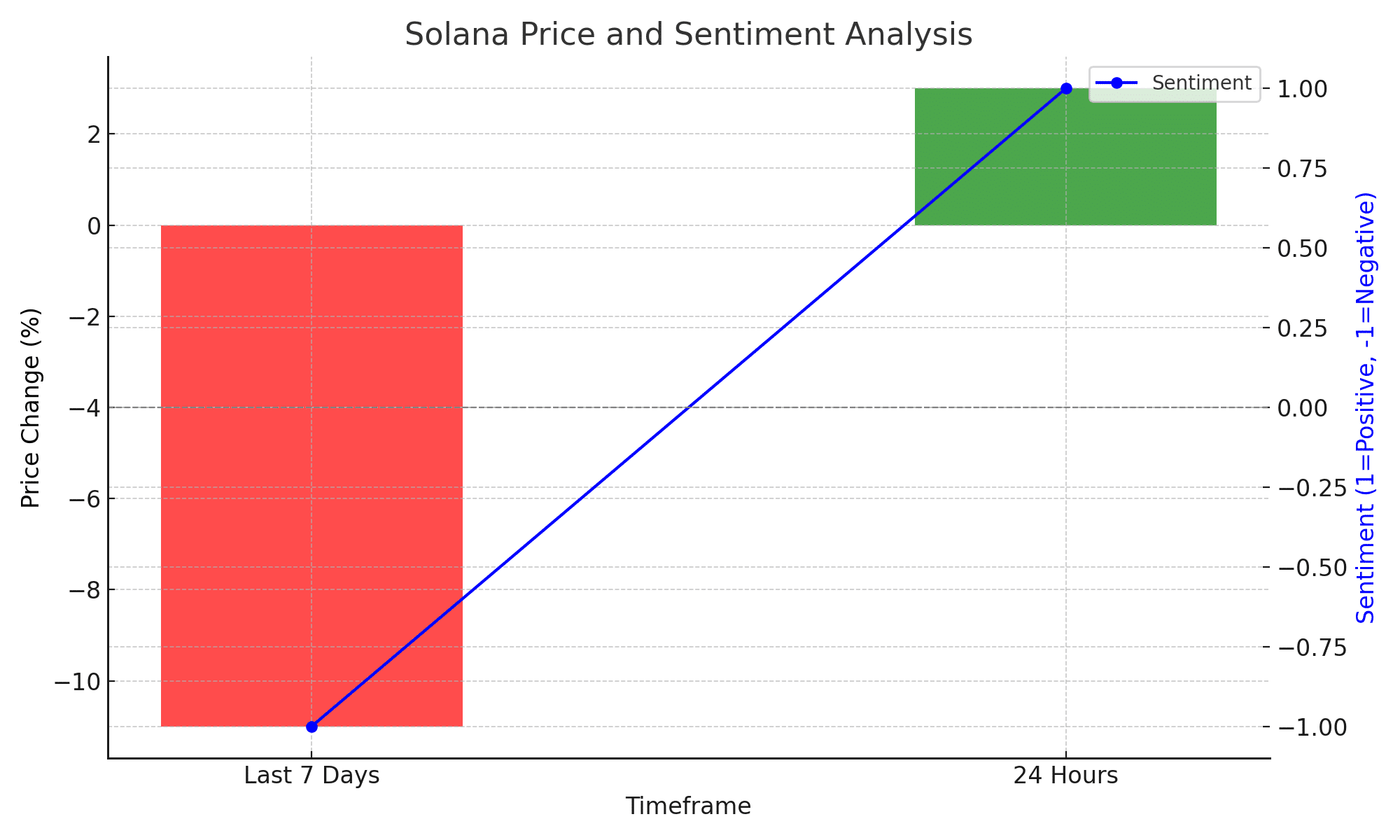

Solana price has been under significant downward pressure, recently declining more than 11% over the past week. As of now, the cryptocurrency is trading around $172, showing a slight 3% recovery in the last 24 hours. However, analysts warn that this bounce might be short-lived.

| Timeframe | Price Change | Sentiment |

| Last 7 Days | -11% | Bearish |

| 24 Hours | +3% | Cautiously bullish |

Analysts’ Warnings of a Potential Drop

MadWhale’s analysis points to the $164 support level as a pivotal marker. Historically, this level has provided a reliable safety net for SOL, preventing deeper pullbacks. However, in a recent TradingView post, the analyst suggested that this time might be different. The persistent downward pressure has put this support under strain, and should it give way, the door could open for a swift 25% decline.

According to the analyst’s chart, if $164 fails to hold, Solana’s price might head toward the next major support around $125. At this level, the token would find itself testing a monthly support zone that has, in the past, helped stave off more severe losses. But there’s a catch: if $125 doesn’t hold, the risk of a drop as low as $80 becomes very real. This outlook aligns with comments from another crypto analyst, PizzaDriver, who recently warned of a possible return to double-digit prices for SOL—a scenario reminiscent of its 2022 crash.

| Analyst | Prediction |

| MadWhale | Decline to $125 |

| PizzaDriver | 2022-like crash scenario |

On-Chain Metrics and Market Sentiment

On-chain data and market sentiment further reflect the precarious state of Solana price. Santiment, a leading crypto analytics platform, reported that market sentiment around Solana pricd has plummeted to levels last seen in January’s major retrace. As the token dropped to a three-month low of $161, traders voiced their frustration, and the market’s mood turned increasingly bearish.

However, this bearish sentiment isn’t all doom and gloom. Santiment also noted that historically, when crowd sentiment reaches such pessimistic levels, a high probability of a price bounce often follows. This dynamic suggests that while fears of a deeper crash are valid, there’s also room for a potential rebound.

Can Solana Price Rebound From Here?

Not all analysts are predicting continued losses. In contrast to the dire warnings, crypto commentator Mr. B recently shared a more optimistic outlook. After a steep drop to $160, Mr. B observed a notable recovery. Solana managed to bounce off a daily support level and, as of this writing, was trading around $172—up over 3% in the past 24 hours.

Mr. B sees a potential path to $185, provided Solana’s price can maintain its current upward momentum. The analyst highlighted $185 as a key resistance level; if breached, the next psychological milestone of $200 could come into play. Conversely, failure to overcome $185 might mean another downturn, though it would be less severe than the scenarios outlined by MadWhale and PizzaDriver.

Key Levels to Watch and Final Thoughts

As it stands, the $164 support level is the immediate point of interest. If this fails, a move to $125 becomes increasingly likely. On the other hand, holding above this level could allow SOL to recover toward $185.

Investors should keep an eye on trading volume, broader market conditions, and on-chain metrics to gauge whether sentiment shifts from bearish to bullish. While a significant drop remains a risk, the potential for a rebound cannot be dismissed.

Conclusion on Solana Price

Solana’s short-term price trajectory hangs in the balance. On the one hand, the threat of a plunge to $125 looms, driven by support levels under siege and negative sentiment dominating the market. On the other hand, hints of recovery and historical bounce patterns suggest that a rebound could be just as likely. The coming days will determine whether Solana is poised for a deeper correction or a fresh rally toward $200. Keep following The Bit Journal and keep an eye on Solana’s price.

FAQs

What is causing Solan price drop?

The current decline in the Solana price is attributed to a retest of critical support levels around $164. If this support fails, it could trigger a more significant drop.

Can Solana recover from this downturn?

While some analysts warn of further losses, others believe Solana could rebound to $185 or even $200 if it breaks key resistance levels.

How likely is a rebound from the current price levels?

While there are signs of a potential rebound—such as historical bounce patterns and increasing trading volumes—breaking the $185 resistance level will be critical. Without that move, the recovery may be short-lived.

What role does on-chain data play in the analysis?

On-chain data provides insights into investor behavior, trading activity, and overall market sentiment. It helps analysts identify trends, gauge sentiment shifts, and predict potential price movements.

Why are analysts comparing the current situation to 2022?

Some analysts have likened Solana’s current price pattern to its steep drop in 2022, pointing to similar bearish sentiment, market conditions, and the possibility of SOL falling to double-digit prices again.

Glossary of Key Terms

Support Level: A price point where an asset’s downward movement is expected to halt due to buying interest.

Resistance Level: A price point where an asset’s upward movement is likely to stop due to selling interest.

On-Chain Data: Information directly recorded on the blockchain that helps analyze market trends and investor sentiment.

Monthly Support Zone: A long-term price level often used as a critical benchmark for potential reversals.

Bearish Sentiment: A market condition where most investors expect prices to decline.

Bounce Probability: The likelihood that an asset’s price will recover after a sharp decline or bearish sentiment.

References

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!