After weeks of decline, Solana has broken out of its bearish trend with a sharp 24% rally, pushing its price to $161. This surge follows Donald Trump’s announcement to include SOL in the U.S. crypto reserves, reigniting investor interest and speculation about a new market rally.

Solana Investors Escape Selling Pressure

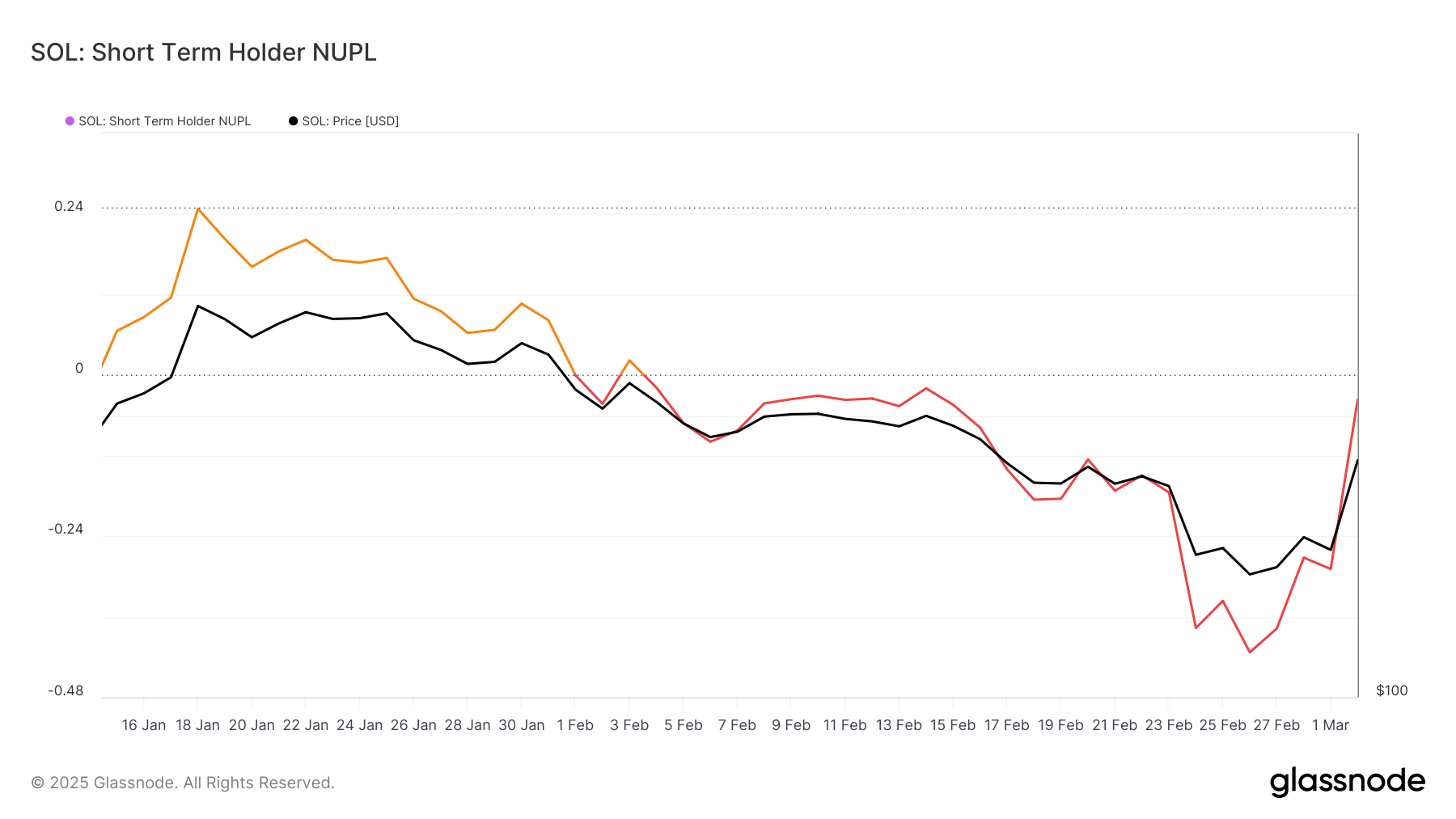

As Solana climbs, short-term holders are moving into profit, reducing selling pressure. The Short-Term Holder (STH) profit/loss ratio has started to rise, suggesting that investors are less likely to offload their holdings. If this trend persists, Solana could establish stability, paving the way for a sustained bull run.

Historically, when investors’ profit margins improve, it strengthens upward momentum. This signals that SOL may be gearing up for another significant push higher.

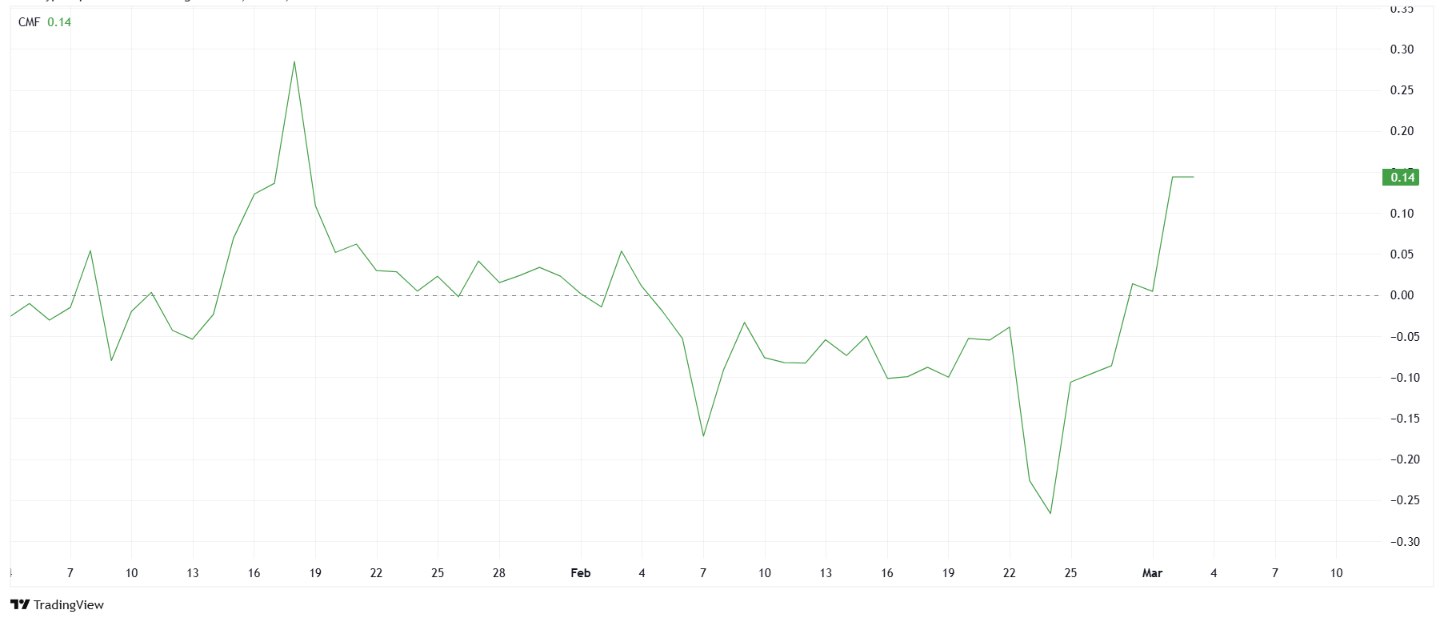

Institutional Investors Pour Capital Into Solana

The recent price movement has drawn attention from institutional investors. The Chaikin Money Flow (CMF) indicator confirms substantial capital inflows, reflecting increased buying pressure. Notably, these investments began even before Trump’s announcement, indicating a long-term belief in Solana’s strength.

If these inflows continue, SOL could maintain its bullish trajectory, potentially breaking through key resistance levels and extending its rally.

Can Solana Hit $200?

Following its 24% jump, Solana is now testing the $161 support level. If it holds and bounces upward, the next target is $183. A successful breakout above this level could pave the way for $200. However, failure to surpass $183 may lead to renewed selling pressure.

Should SOL drop below $161, a correction towards $150 or even $138 is possible. Investors should closely watch these critical levels to assess the coin’s next move.

Will Trump’s Crypto Policy Propel Solana Higher?

Trump’s latest stance on cryptocurrency has caused waves across the market. While Bitcoin and Ethereum face selling pressure, Solana’s resilience has attracted significant investor interest. If Trump continues to embrace crypto-friendly policies, major institutional funds may shift towards SOL.

Moreover, as regulatory uncertainties clear and ETF applications progress, Solana could see further gains. The coming weeks will be crucial in determining whether SOL can sustain its momentum or face renewed market resistance.

Stay updated with the latest market developments on The Bit Journal.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!