Solana (SOL) has witnessed a notable surge in price, trading at $142.76, marking a 1.18% increase in the last 24 hours. With $3.35 billion in trading volume, interest from investors remains strong, highlighting a growing demand for the token. However, despite this positive momentum, technical indicators are signaling some caution, including a bearish divergence in key metrics. As the market watches Solana closely, both short-term challenges and long-term opportunities are on the horizon.

Key Developments

Over the past week, Solana has gained 14.58%, contributing to a market capitalization of $72.99 billion. The trading volume, which rose by 6.05% during the last 24 hours, points to continued interest in the asset. While the price has risen, the trading activity indicates that investors are anticipating further gains in the short term. However, a closer look at the technical indicators reveals some signs of potential weakness in the uptrend.

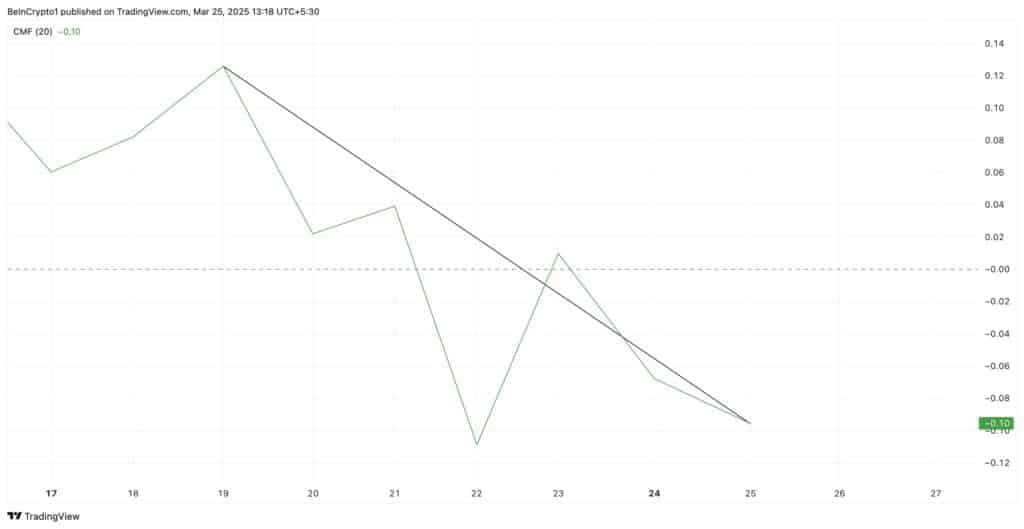

Bearish Divergence in Technical Indicators

A crucial signal has been given out in the form of a bearish divergence where CMF shows a decline in the buying pressure while the Solana price is on the rise. Currently, the CMF is declining but the price of SOL is rising, even though CMF indicates buying and selling pressure. It occurs when the price goes up while the CMF goes down, which means that the uptrend is not backed by a lot of demand. This might suggest a bearish trend that may point to a possible reversal or slowdown of Solana’s price in case the trend persists.

Market Sentiment and Short Positions

This is also made apparent from the current long/ short investor ratio, which gives an outlook of investor sentiment. With most of the ratio at 0.97, there are more short positions than long ones, implying that a large part of the market expects a price downtrend in the short term. Such a formation aligns with the bearish perception and puts emphasis on the possibility of a reversal shortly after an extended spike in the near term. The sentiment within the context of the market today has become neutralized to a certain extent, where the bearish short-term sentiments are equal to the bullish long-term sentiments.

Solana’s Price Technical Analysis

On the hourly chart, Solana has broken through a key resistance level at $140, which is now expected to act as support in the event of a pullback. However, the Relative Strength Index (RSI) is nearing the 80 mark, signaling that Solana might be overbought in the immediate short term. When RSI reaches this level, it often indicates a potential correction or consolidation phase before further gains. Despite the RSI’s warning, the Exponential Moving Average (EMA) has produced a golden cross, a bullish signal that suggests the possibility of sustained upward momentum if the price holds above current support levels.

Key Support and Resistance Levels

In terms of support, Solana is likely to find strong footing at the $137 mark, which aligns with the previous resistance level of $140. Should the price dip further, a major support zone is around $120, followed by the $112 mark. On the upside, immediate resistance is at $152.90, and if Solana can surpass this, the next significant price target would be $180. Traders and investors should keep an eye on these levels, as they will dictate whether Solana can maintain its upward momentum or face a pullback.

Solana Price Prediction 2025

For 2025, Solana’s price could see substantial growth, potentially reaching around $170. As the network continues to gain adoption and as technical indicators such as the Golden Cross suggest a continued uptrend, Solana is poised to push past significant resistance levels. If Solana can hold above key support zones and avoid further bearish divergences, $170 represents a realistic target in the coming months.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI |

|---|---|---|---|---|

| Mar 2025 | $ 138.17 | $ 148.31 | $ 154.67 | 8.81% |

| Apr 2025 | $ 135.06 | $ 142.70 | $ 149.29 | 5.02% |

| May 2025 | $ 134.32 | $ 139.18 | $ 143.97 | 1.28% |

| Jun 2025 | $ 132.72 | $ 141.68 | $ 164.97 | 16.05% |

| Jul 2025 | $ 170.15 | $ 213.78 | $ 272.34 | 91.58% |

| Aug 2025 | $ 225.98 | $ 238.98 | $ 256.79 | 80.64% |

| Sep 2025 | $ 244.51 | $ 290.10 | $ 323.40 | 127.51% |

| Oct 2025 | $ 243.93 | $ 281.07 | $ 309.43 | 117.68% |

| Nov 2025 | $ 228.62 | $ 255.32 | $ 280.22 | 97.13% |

| Dec 2025 | $ 228.06 | $ 232.56 | $ 236.64 | 66.47% |

Solana Price Prediction 2028

Looking further into the future, 2028 might see Solana’s price reaching $244.58, a 71.37% increase from its current price. This projection is based on the ongoing growth of Solana’s ecosystem and the broader adoption of blockchain technologies in traditional finance. The expectation is that Solana will continue to innovate and expand its decentralized finance (DeFi) presence, which could drive significant price appreciation over the next several years.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI |

|---|---|---|---|---|

| Jan 2028 | $ 182.19 | $ 192.72 | $ 199.68 | 40.08% |

| Feb 2028 | $ 198.30 | $ 209.48 | $ 233.43 | 63.75% |

| Mar 2028 | $ 235.08 | $ 262.23 | $ 279.15 | 95.83% |

| Apr 2028 | $ 220.51 | $ 237.22 | $ 263.95 | 85.16% |

| May 2028 | $ 234.58 | $ 250.03 | $ 264.37 | 85.46% |

| Jun 2028 | $ 221.82 | $ 233.80 | $ 255.03 | 78.91% |

| Jul 2028 | $ 220.52 | $ 247.25 | $ 271.76 | 90.64% |

| Aug 2028 | $ 222.73 | $ 234.62 | $ 246.24 | 72.74% |

| Sep 2028 | $ 219.91 | $ 231.35 | $ 245.14 | 71.97% |

| Oct 2028 | $ 229.99 | $ 246.27 | $ 263.02 | 84.51% |

| Nov 2028 | $ 249.05 | $ 300.71 | $ 329.16 | 130.91% |

| Dec 2028 | $ 267.24 | $ 289.29 | $ 313.42 | 119.87% |

Solana Price Prediction 2030

For 2030, the price of Solana could experience even more significant growth, with projections ranging from $195.27 to $387.01. This suggests a potential return on investment (ROI) of 171.17%, fueled by further technological advancements, broader global adoption, and increasing integration of Solana’s blockchain into the traditional financial sector. If Solana continues to deliver on its promises and strengthens its position in the DeFi and Web3 spaces, it could see substantial price gains in the years to come.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI |

|---|---|---|---|---|

| Jan 2030 | $ 310.06 | $ 331.54 | $ 358.91 | 151.70% |

| Feb 2030 | $ 302.90 | $ 313.81 | $ 333.19 | 133.67% |

| Mar 2030 | $ 319.60 | $ 348.64 | $ 387.01 | 171.41% |

| Apr 2030 | $ 253.46 | $ 297.06 | $ 335.83 | 135.52% |

| May 2030 | $ 223.58 | $ 240.87 | $ 258.99 | 81.63% |

| Jun 2030 | $ 230.55 | $ 236.71 | $ 248.59 | 74.34% |

| Jul 2030 | $ 235.60 | $ 243.72 | $ 251.52 | 76.39% |

| Aug 2030 | $ 228.22 | $ 231.52 | $ 236.13 | 65.60% |

| Sep 2030 | $ 226.19 | $ 229.85 | $ 232.23 | 62.86% |

| Oct 2030 | $ 201.71 | $ 220.35 | $ 234.57 | 64.51% |

| Nov 2030 | $ 198.71 | $ 201.33 | $ 202.62 | 42.10% |

| Dec 2030 | $ 195.27 | $ 201.12 | $ 216.00 | 51.48% |

Conclusion

Solana’s recent price increase has captured the attention of investors, but technical indicators suggest caution in the short term. The bearish divergence and high long/short ratio indicate that the rally may be running out of steam, and a pullback could be on the horizon. However, Solana’s strong network fundamentals, coupled with a positive technical outlook in the long run, make it a promising candidate for continued growth. Solana’s position in the broader ecosystem will likely dictate its future price trajectory.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

Frequently Asked Questions (FAQ)

1- What is the current price of Solana?

As of press time, Solana is trading at $142.76, showing a 1.18% increase in the last 24 hours.

2- What is the bearish divergence in CMF?

It indicates that while Solana’s price is rising, the underlying buying momentum is weakening, which could signal a potential price reversal or slowdown.

3- What are the short-term price targets for Solana?

Solana’s immediate resistance is at $152.90, and if it surpasses this, $180 could be the next target.

4- What is Solana’s price prediction for 2028?

Solana’s price in 2028 could reach $244.58, representing a 71.37% increase from its current level.

Appendix: Glossary of Key Terms

Solana (SOL) – A high-performance blockchain platform designed for decentralized applications (dApps) and crypto transactions, known for its speed and scalability.

Chaikin Money Flow (CMF) – A technical indicator that measures the volume-weighted average of accumulation and distribution over a specified period to assess buying and selling pressure.

Relative Strength Index (RSI) – A momentum oscillator used to measure the speed and change of price movements, typically indicating whether an asset is overbought or oversold.

Golden Cross – A bullish technical pattern that occurs when a short-term moving average crosses above a long-term moving average, suggesting an uptrend.

Exponential Moving Average (EMA) – A type of moving average that gives more weight to recent prices, used to smooth out price data and identify trends.

Long/Short Ratio – A measure of the number of long positions (bets on price increases) to short positions (bets on price declines) in the market, often used to gauge market sentiment.

References

BeinCrypto – beincrypto.com

FX Leaders – fxleaders.com

FXStreet – fxstreet.com

CoinCodex – coincodex.com

CoinMarketCap – coinmarketcap.com

TradingView- tradingview.com