Institutional acceptance of Bitcoin (BTC) got a major boost after the USA eased rejecting the first Bitcoin exchange-traded funds (ETFs) in 2024. This marked as a start for more financial products that aimed to provide institutional investors in the asset class of BTC. Following this trend, Solv Protocol, an organization that aims at providing staking services for BTC, has recently sold $10 million worth of Bitcoin Reserve Offering.

Key Developments in Bitcoin Adoption

The approval of the Bitcoin ETFs by the SEC can be regarded as the highest point in the recognition of the cryptocurrency by institutional investors. Traditionally viewed as an unstable and high-risk instrument, the ongoing recognition of BTC in the financial system has raised its social validity for store-of-value. With the start of the Bitcoin ETFs, institutional investors got exposure to BTC, thus increasing demand from the institutional side.

Solv Protocol’s $10 million offering is a good example of the innovation taking place within the cryptocurrency industry to respond to this requirement. Created to serve as a staking service, Solv allows institutions seeking to find yield on their Bitcoins, an asset that only appreciated in value prior to this but provided no passive income stream.

The Bitcoin Yield Dilemma

Satoshi Nakamoto’s original vision for BTC was to create digital cash for everyday transactions. However, over time, the cryptocurrency has evolved into a store of value, often referred to as “digital gold.” Its fixed supply and disinflationary nature have contributed to its soaring price, but this transformation into a wealth-preserving asset has left investors with one problem—holding BTC generates no yield. While BTC value increases over time, investors can only realize returns when they sell, which limits its potential for long-term income generation.

Solv Protocol’s Innovative Solution

The absence of a proper solution that would allow institutional investors to generate yield from their invested BTC has been solved by Solv Protocol. Through providing its users an opportunity to give their Bitcoin to Solv, the platform invests the funds into assets that will bring yields, thus creating a way through which BTC can earn income.

Solv’s focus on the digital asset management and investment yields a premise where BTC will not wait inactive, remarks Ryan Chow. It will be used to generate income in a passive manner for investors instead. The funds generated from its Bitcoin Reserve Offering will be used in yield generation activities such as investing in stable coins and other cryptos.

Solv’s Yield-Generating Instruments

Solv Protocol offers instruments that function similarly to convertible bonds to make Bitcoin staking attractive to institutional investors. By depositing BTC with Solv, institutions receive yield-bearing instruments that resemble debt securities. These instruments can provide returns without the need for Bitcoin holders to sell their assets, which helps preserve their long-term position in the market.

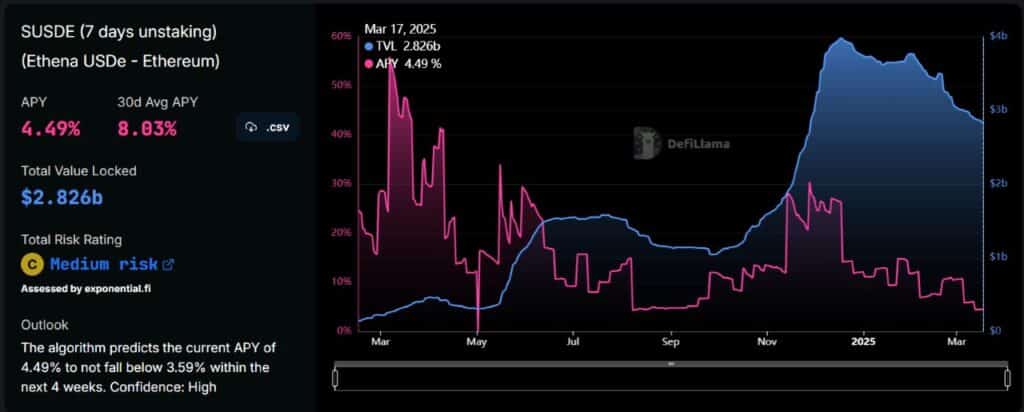

One example of Solv’s approach involves stablecoins like Ethena’s USDe, which offers a current yield of 4%. Although stablecoins are typically known for their low volatility, USDe has historically offered much higher yields, with returns reaching up to 56%. By pledging BTC as collateral, Solv can borrow stablecoins, which are then used to invest in various crypto assets, generating higher yields.

Strategic Investment in Crypto Assets

Solv’s investment strategy focuses on using BTC as collateral to access stablecoins and other assets that offer substantial returns. This approach not only diversifies the investment portfolio but also maximizes returns through strategic asset allocation. The firm also leverages other stablecoins that can be used to access different types of crypto investments, expanding its yield-generation potential.

Chow highlighted that Solv’s strategy is designed to meet the growing demand from institutional investors seeking more sophisticated and secure ways to earn passive income from their digital assets. By providing a trusted platform for BTC staking, Solv is positioning itself as a key player in the emerging institutional BTC market.

Future Fundraising Plans

With its successful $10 million Bitcoin Reserve Offering, Solv Protocol is already planning future fundraising rounds. Chow mentioned that several prominent names in the crypto industry have already expressed interest in participating in the upcoming rounds, although he declined to disclose their identities. These commitments signal strong institutional backing and highlight the increasing interest in Bitcoin yield-generation opportunities.

Solv’s innovative approach could pave the way for future platforms offering similar services as institutions continue to look for ways to maximize their returns from BTC holdings while minimizing the risks associated with holding the asset.

Institutional Support for Bitcoin’s Growth

Solv Protocol is just one example of how the cryptocurrency space is adapting to meet the needs of institutional investors. As Bitcoin continues to gain traction among large-scale investors, the demand for innovative financial products like Solv’s yield-bearing instruments is expected to rise. The ability to generate passive income from BTC could further solidify the cryptocurrency’s position as a long-term store of value and a key asset class in institutional portfolios.

Conclusion

Solv Protocol’s $10 million Bitcoin Reserve Offering is a clear indication of the growing institutional appetite for Bitcoin as a yield-generating asset. By offering innovative staking solutions and yield-bearing instruments, Solv is helping bridge the gap between BTC potential as a store of value and its need for income generation. With strong institutional support and the SEC’s approval of Bitcoin ETFs, the future of institutional BTC adoption looks brighter than ever. As more investors flock to the crypto space, platforms like Solv are poised to play a key role in shaping the future of digital asset management.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

Frequently Asked Questions (FAQ)

1. How did the SEC’s approval of Bitcoin ETFs impact Bitcoin adoption?

It boosted institutional demand, making BTC more accessible as a mainstream investment.

2. What gap does Solv Protocol fill for Bitcoin holders?

It allows institutions to earn yield from Bitcoin by staking it, addressing the lack of passive income.

3. What is Solv Protocol’s key innovation?

Solv offers yield-generating instruments, allowing BTC to produce returns without selling.

4. How is Solv attracting institutional investors?

By providing strategic, high-return crypto investments using BTC as collateral.

Appendix Glossary of Key Terms

Bitcoin (BTC): A decentralized digital currency created through blockchain technology, known for its volatility and as a store of value, often referred to as “digital gold.”

Exchange-Traded Fund (ETF): A financial product that tracks the value of an asset or group of assets, like BTC, and can be traded on stock exchanges. The first spot Bitcoin ETF was approved in 2024.

Staking: The process of locking up cryptocurrency in a platform to support network operations or generate yield, typically offering rewards or interest to the staker.

Yield-Generating Instruments: Financial tools that produce income or returns, such as bonds or stablecoins, used to generate passive income from assets like BTC.

Stablecoins: Cryptocurrencies designed to have a stable value, often pegged to traditional assets like the US dollar, and used for trading or investing without the volatility of typical cryptocurrencies.

Convertible Bonds: Debt securities that can be converted into a predetermined number of shares or equity in a company, often used in yield-generating investment strategies.

References

Bitcoin.Com – news.bitcoin.com

CoinDesk – coindesk.com

Coinglass – coinglass.com

Ethena – Ethena.fi