Looking at crypto reports, Sonic, formerly known as Fantom, has gained significant traction in the crypto market, surging 30% over the past week. The bullish momentum has propelled the altcoin’s price past $0.60, marking a critical retest of resistance levels and fuelling speculation about a potential rally toward $1. With growing investor interest, technical indicators flashing bullish signals, and rising trading volumes, market participants are eager to see whether Sonic can sustain its upward momentum or face resistance in the coming days.

Price Surge: Key Market Metrics

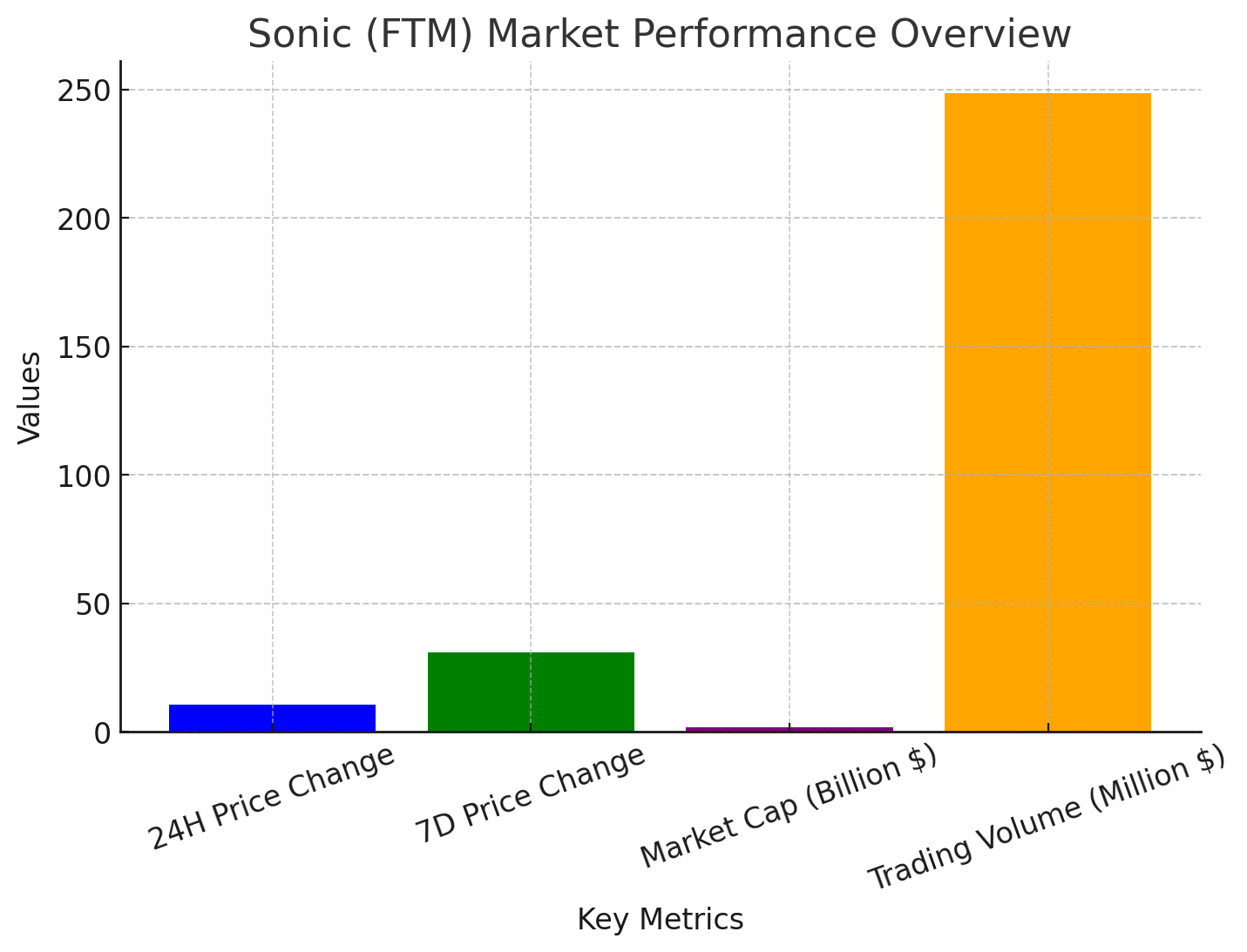

Over the past 7 days, FTM has experienced a sharp price increase, signaling strong buying interest and market optimism. Here’s a snapshot of its recent performance:

- 24-Hour Price Change: Up 10.38%

- 7-Day Price Change: Up 30.81%

- Market Capitalization: $1.94 billion (Ranked #51)

- Trading Volume: $248.61 million

With the price maintaining its position above $0.60, investors are closely monitoring resistance at $0.8575 and support at $0.3590 as key levels in Sonic’s price trajectory.

Technical Analysis: Will FTM Maintain Its Bullish Momentum?

Several technical indicators suggest that FTM is poised for continued gains:

- Relative Strength Index (RSI): The RSI has successfully retested its oversold range and is now approaching overbought levels, indicating increasing momentum.

- Simple Moving Average (SMA): The SMA trendline continues to act as a support, reinforcing bullish sentiment.

- Volume Analysis: Increasing trading volume suggests sustained buying interest, preventing sharp price pullbacks.

With these indicators aligning, a potential breakout could push Sonic toward higher resistance levels if bullish sentiment persists.

Can Sonic (FTM) Reclaim the $1 Mark?

Sonic’s impressive 30% rally over the past week has sparked speculation on whether it can break the $1 mark in the near term. The potential for continued price appreciation remains high with strong technical indicators, rising investor interest, and bullish market sentiment. However, key resistance levels, market corrections, and overall crypto trends will influence the next move. Below, we assess both bullish and bearish scenarios for FTM’s price trajectory.

- Bullish Scenario: If the buying momentum continues,FTM could first target its immediate resistance level at $0.6400. A successful breakout above this point could lead to further gains, testing the $0.8575 resistance in the coming weeks. If bullish pressure sustains, a rally toward $1 is possible before the end of Q1 2025.

- Bearish Scenario: However, if the bears take control, FTM’s price could drop to its support level at $0.4780. A further breakdown might see it testing $0.3590, a crucial level that could determine whether the altcoin enters a consolidation phase or faces a stronger reversal.

Expert Analysis: What’s Next for Sonic?

Recognizing that Sonic’s surge is driven by a mix of technical strength, investor sentiment, and macroeconomic trends, with growing trading volumes and bullish indicators, Sonic has positioned itself as a strong altcoin. However, sustainability depends on market conditions, liquidity, and external economic factors. Sonic could continue its climb if institutional interest rises, but investors must remain mindful of potential volatility and corrections. Below, industry experts weigh in on the future trajectory of Sonic.

Other Industry experts weigh in on Sonic’s recent rally and future prospects:

Michael Reed, Crypto Market Analyst:

“Sonic’s ability to sustain its bullish momentum depends on trading volume and resistance breakouts. If it clears $0.8575, we could see a push toward $1.10 in the short term. However, market-wide corrections could lead to a retest of lower support levels.”

Dr. Emily Carter, Blockchain Strategist at DeFi Insights:

“While Sonic’s fundamentals remain strong, investors should be cautious of volatility. Profit-taking at resistance levels may slow its rally, but increasing adoption of its Layer-1 solutions could drive long-term demand.”

Sonic Price Predictions for 2025

Sonic’s price trajectory in 2025 will largely depend on market sentiment, institutional adoption, and overall crypto market conditions. Analysts have identified three potential price scenarios: conservative, base, and bull case projections. As Sonic continues to attract investor interest and demonstrate technical strength, it could reach new highs if momentum sustains. However, external factors such as regulatory developments and liquidity shifts will also play a crucial role in determining how far Sonic’s price can go in the coming years.

Analysts have provided price projections for Sonic under different market scenarios:

| Year | Conservative Case | Base Case | Bull Case |

| 2025 | $0.80 | $1.50 | $2.00 |

| 2030 | $3.00 | $5.50 | $8.00 |

Conclusion: Will FTM Sustain Its Bullish Rally?

FTM’s recent surge and positive technical indicators suggest that altcoin is on a strong upward trajectory. However, breaking key resistance at $0.8575 will be critical in determining its next major move.

If bullish momentum sustains, FTM could reach $1.00–$1.10 in the coming months. However, investors should remain cautious of profit-taking and market corrections. As institutional adoption and ecosystem developments progress, Sonic’s long-term growth potential remains promising.

The BIT Journal is available around the clock, providing you with updated information about the state of the crypto world. Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

1. What is driving FTM’s price surge?

Increased investor interest, bullish technical indicators, and strong market sentiment drive FTM’s recent 30% price increase.

2. Can FTM hit $1 in 2025?

If bullish momentum continues, Sonic could break past $0.8575 resistance, with a realistic target of $1.00–$1.10 in the coming months.

3. What are the key support and resistance levels for FTM?

Key resistance stands at $0.8575, while major support is at $0.4780 and $0.3590.

4. Should investors be cautious about Sonic’s price movements?

While Sonic has strong upside potential, market volatility and profit-taking at resistance levels could impact short-term movements.

Glossary

Resistance Level: A price point where selling pressure may prevent further gains.

Support Level: A price point where buying pressure may prevent further declines.

Relative Strength Index (RSI): A momentum indicator measuring the strength of price movements.

Simple Moving Average (SMA): A technical indicator showing the average price over a set period.

References

- Sonic Market Data – Bloomberg

- CryptoQuant Sonic Price Analysis

- DeFi Insights Research Report

- FTM Technical Insights – TradingView

- SEC Crypto Market Updates

Disclaimer

This article is for informational purposes only and does not constitute financial, investment, or legal advice. Readers should conduct independent research before making investment decisions.