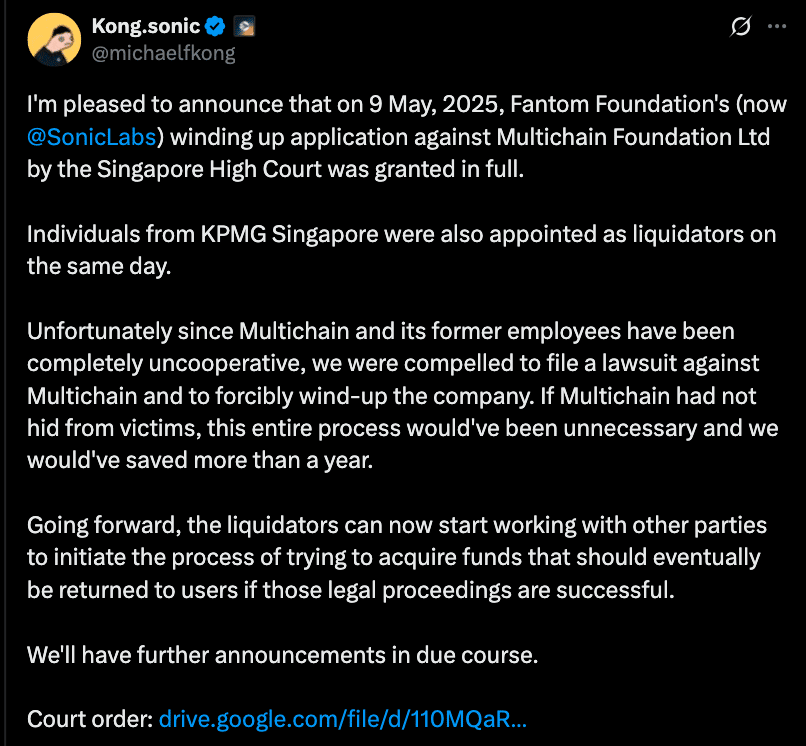

In a new legal development, Sonic Labs has successfully secured a court order from the Singapore High Court approving the Multichain liquidation. The ruling, issued on May 9, 2025, grants Sonic Labs the right to initiate the winding-up of the embattled Multichain Foundation, following prolonged non-cooperation from the latter. KPMG’s Singapore branch has been officially appointed as the liquidator.

Michael Kong, CEO of Sonic Labs, confirmed the ruling in a public statement shared on X (formerly Twitter), describing the Multichain Foundation’s ongoing refusal to comply with court-ordered obligations as a key factor behind their legal escalation.

“If Multichain had not hidden from victims, this entire process would have been unnecessary,” Kong stated.

Multichain’s Collapse Triggered by Security Breach and Refusal to Comply

The court-approved Multichain liquidation follows a protracted legal dispute dating back to July 2023, when a severe security breach resulted in the loss of over $210 million in digital assets. Affected holdings included stablecoins such as USDT, USDC, and DAI, as well as wrapped tokens stored on the Multichain Bridge.

Sonic Labs, previously known as Fantom Foundation, filed for damages after Multichain failed to deliver 4.175 million FTM tokens or equivalent compensation. On September 18, 2023, the Singapore High Court awarded Sonic Labs a total of $2.19 million, comprising $58,620.55 for stablecoins and $2,129,250 for the FTM tokens, based on prevailing market valuations.

Despite the judgment, Multichain Foundation reportedly failed to cooperate or fulfill its financial obligations, prompting Sonic Labs to pursue the Multichain liquidation process to protect stakeholders and secure potential asset recovery for affected users.

KPMG to Lead Recovery Efforts Amid Legal Proceedings

With the court now authorizing the Multichain liquidation, KPMG’s Singapore team will assume full authority over the company’s dissolution and financial tracing. The appointed liquidators are expected to begin immediate asset recovery efforts in collaboration with blockchain forensic teams and external legal counsel. Sonic Labs has expressed hope that this process will result in the eventual return of some assets to impacted users, although this depends on the outcome of complex legal proceedings.

Industry Reaction and Implications for Cross-Chain Protocols

The court’s endorsement of the Multichain liquidation shows growing scrutiny of cross-chain projects that fail to uphold their fiduciary duties. The Multichain case has already cast a shadow over the credibility of some bridge protocols, with several market participants urging greater transparency, code audits, and disaster recovery frameworks.

Legal analysts believe the Multichain liquidation could set a standard for future decentralized finance (DeFi) litigation. “This ruling is a wake-up call to developers managing large sums of user funds without sufficient governance,” noted a Singapore-based blockchain compliance expert.

Sonic Labs has reiterated that the Multichain liquidation was not its first course of action.

“Unfortunately, Multichain and its former employees were completely uncooperative,” Kong explained. “Their refusal to engage made litigation and liquidation the only viable path forward.”

What’s Next for Sonic Labs and Users?

Now that the Singapore court has formally approved the Multichain liquidation, KPMG’s mandate will focus on identifying and retrieving recoverable funds. The firm will likely engage with exchanges, DeFi platforms, and smart contract auditors to trace digital assets lost during the bridge exploit.

Sonic Labs has promised continued transparency as the Multichain liquidation progresses. The company is also considering launching a dedicated claims portal to allow victims of the Multichain hack to file for potential reimbursement, pending the availability of recovered assets.

In the meantime, the crypto community is watching the case closely, as it may establish legal templates for dealing with failed protocols and unresponsive teams. With the Multichain liquidation now underway, market participants await further updates from the liquidators in the coming weeks.

Conclusion: A Legal Turning Point in Cross-Chain Accountability

The Multichain liquidation represents more than a court victory for Sonic Labs, it is a new step in holding blockchain protocols accountable. As DeFi matures, legal frameworks like this could help build the trust necessary for broader adoption. For now, affected users and stakeholders look to KPMG and the courts to bring long-awaited closure and financial redress.

Follow us on Twitter and LinkedIn, and join our Telegram channel.

FAQs

Why did Sonic Labs seek Multichain liquidation?

Multichain failed to cooperate and comply with a court ruling after a major security breach and missed compensation payments, forcing Sonic Labs to pursue liquidation.

What role does KPMG play in the Multichain liquidation?

KPMG’s Singapore branch has been appointed as the official liquidator to oversee the asset recovery and dissolution process.

How much was Sonic Labs awarded in damages?

The Singapore High Court awarded Sonic Labs $2.19 million, including $2.13 million for missing FTM tokens and $58,620 for stablecoins.

Can users expect compensation?

Possibly. KPMG will attempt to recover assets during the Multichain liquidation, which could be redistributed to affected users if successful.

Is this case a precedent for future DeFi litigation?

Yes. The Multichain liquidation could influence how courts and investors address protocol failure and uncooperative teams in DeFi.

Glossary

Multichain Liquidation: The court-ordered process of winding up the Multichain Foundation and distributing its remaining assets.

Liquidator: A court-appointed party responsible for managing the dissolution of a company and recovering assets.

FTM Tokens: The native cryptocurrency of the Fantom network, involved in the dispute between Sonic Labs and Multichain.

Stablecoins: Cryptocurrencies pegged to fiat currencies, including USDT, USDC, and DAI.

Bridge Exploit: A security breach targeting cross-chain token bridges, often resulting in significant losses.