South Korea now allows selected institutions to move into cryptocurrency trading in stages through new regulatory moves. The Financial Services Commission, through its press release, started removing the trading restrictions that institutions faced since 2017.

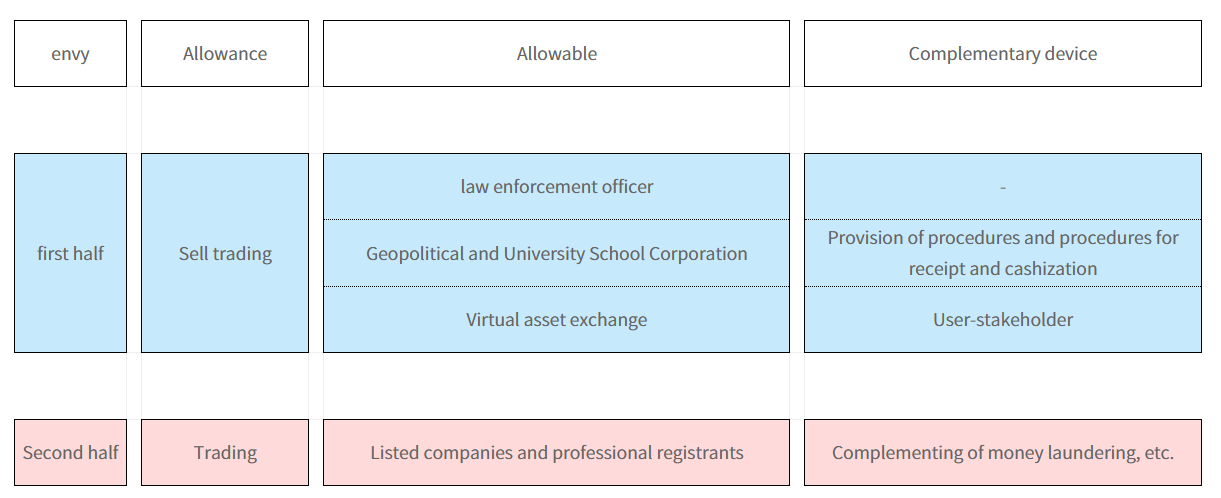

Under phase one law enforcement agencies plus nonprofits educational systems and universities can exchange Bitcoin and Ethereum for cash. The approved institutions will start trading virtual assets during the first part of 2021.

South Korea Begins Institutional Crypto Pilot

South Korea will begin testing crypto trading participation through a pilot project that includes three thousand five hundred registered corporations and public companies. Licensed Capital Market Act investors will join digital asset trading as the main stage becomes operational in the second half of 2023.

The FSC builds an effective market control system to protect investor rights. A unified group from the Financial Supervisory Service and banking associations plus DAXA will create rules for internal controls and financial transactions.

FSC Enforces Anti-Manipulation Crypto Policies

The regulators will pay special attention to stopping market manipulation during their oversight work. The FSC set a rule that businesses with 10 billion won ($6.8 million) of financial investment product holdings can participate in digital asset trading.

To gain entry the corporation needs to show professional investor status yet will face stricter approval steps if it lacks those credentials. The FSC intends to put strong rules into place to check the origins of money during cryptocurrency deals to fight money laundering.

South Korea Strengthens Crypto Trading Rules

Exchanges will have the right to trade their owned digital assets both from user fees and from their existing holdings. Although regulators have concerns about market fluctuations they stay alert after crypto tokens enter the market. South Korea limits its crypto rules because the country experienced misuse of its market in the past.

The Virtual Asset User Protection Act started in July 2024 made authorities work to end unfair trading practices. South Korea started seeing illegal market manipulation in crypto on January 16 when authorities charged suspects who operated a fake pump-and-dump business during the first month.

FSC Aims for a Resilient Crypto Framework

South Korea wants to let crypto stay new while protecting its users so it is opening crypto markets little by little. Through close supervision and expert industry partnerships the FSC wants to build up a clear and resilient digital asset platform.

The government team will follow and assess the pilot program’s next stages while making new decisions through the review process. As South Korea develops cryptocurrency regulations further international investors watch to understand their impact on digital asset market participation.

Conclusion

South Korea now slowly allows organizations to trade in crypto assets while showing a different view on this subject. The FSC creates an organized system to show market information truthfully while protecting users from market manipulation. The government makes developments in cryptocurrency regulation that keep the pace of change under control.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

1. Why is South Korea allowing institutional crypto trading?

To regulate the market while enabling businesses to participate safely.

2. Who can trade crypto under the new rules?

Law enforcement, non-profits, schools, and later, corporations and investors.

3. How will South Korea prevent market manipulation?

Through strict oversight, trading guidelines, and anti-money laundering rules.

4. Can crypto exchanges sell their holdings?

Yes, but with restrictions to prevent market manipulation.

Glossary of Key Terms

FSC (Financial Services Commission) – South Korea’s main financial regulator overseeing crypto trading.

Capital Market Act – A law governing professional investors and securities trading.

Pump and Dump – A scheme where prices are artificially inflated and then sold off quickly.

DAXA (Digital Asset eXchange Alliance) – A group helping regulate crypto exchanges.

Virtual Asset User Protection Act – A 2024 law preventing unfair crypto trading practices.

AML (Anti-Money Laundering) – Rules to prevent illegal financial activities in crypto.