In a bid to strengthen its position as a leading player in the global cryptocurrency arena, South Korea is fast-tracking legislation to enable the issuance of domestic stablecoins. This move comes as newly elected president Lee Jae-myung follows through on campaign promises aimed at bolstering the country’s digital asset sector.

South Korea’s Stablecoin Legislation

South Korea’s ruling Democratic Party introduced the Digital Asset Basic Act on Tuesday, a significant step towards facilitating the issuance of stablecoins by domestic companies. The bill, reported by Bloomberg, aims to enhance transparency in the cryptocurrency sector and foster competition within the digital asset market. Under the proposed legislation, South Korean companies will be able to issue stablecoins, provided they meet specific requirements.

The bill mandates that companies wishing to issue stablecoins must have a minimum equity capital of 500 million won (approximately $368,000). Additionally, these companies must guarantee refunds through reserves and obtain approval from South Korea’s Financial Services Commission, the country’s primary financial regulator.

Overview of South Korea’s Booming Crypto Market

South Korea’s crypto sector has seen exponential growth, with stablecoin trading becoming a major part of the market. In the first quarter of this year alone, transactions involving US dollar-backed stablecoins surged to 57 trillion won ($42 billion) across five major domestic exchanges, according to data from the Bank of Korea.

More than a third of South Korea’s population, or roughly 18 million people, are engaged in some form of cryptocurrency activity. This large and growing user base has made the country an attractive destination for crypto-related innovation, and the new legislation is poised to further expand the market’s reach.

Lee Jae-myung’s Vision for South Korea’s Crypto Future

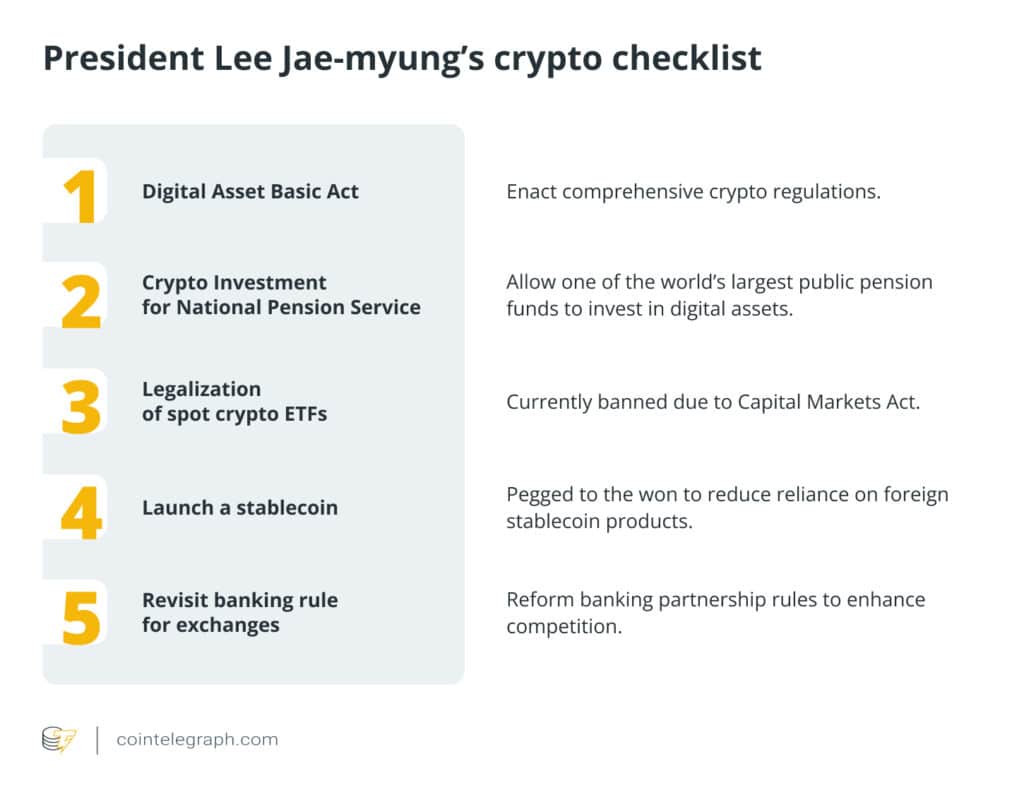

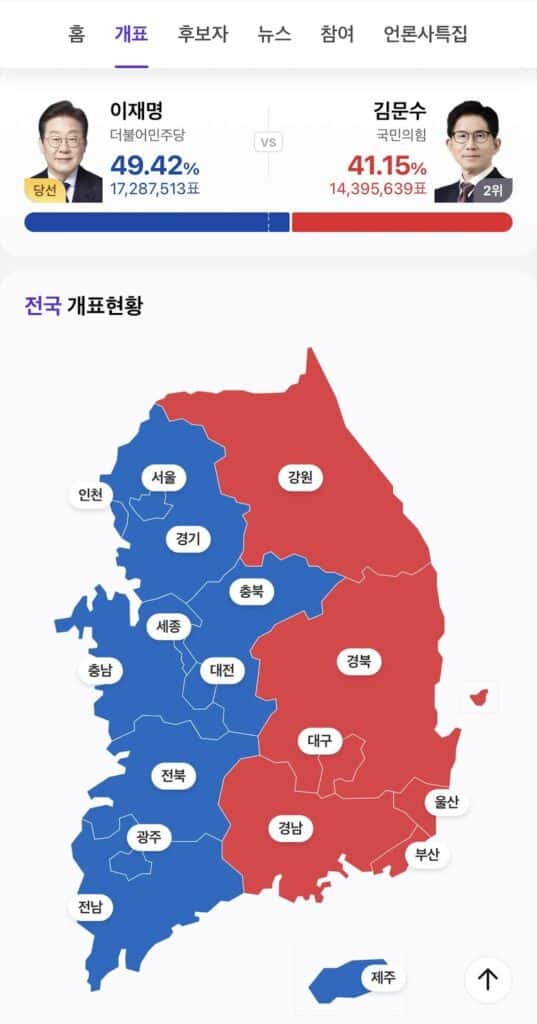

South Korea’s newly sworn-in president, Lee Jae-myung, is making swift progress on his vision for the nation’s crypto future. Following his victory in the snap elections on June 3, Lee has outlined ambitious plans for the local crypto sector.

Along with the proposed stablecoin bill, Lee has also suggested that the national pension fund should invest in Bitcoin and other cryptocurrencies. Moreover, he has called for the launch of Bitcoin exchange-traded funds (ETFs) in South Korea, reflecting his commitment to positioning the country as a global crypto leader.

During a policy discussion in May, Lee emphasized the need for a won-backed stablecoin market to prevent capital flight and protect national wealth from moving abroad. He believes that a stablecoin pegged to the Korean won will help South Korea maintain control over its financial system and prevent reliance on foreign-backed stablecoins.

The Debate Over Central Bank Control

However, Lee’s crypto ambitions have not been without opposition. The Bank of Korea, South Korea’s central bank, has raised concerns over the potential risks associated with non-bank issued stablecoins.

Governor Rhee Chang-yong has warned that non-bank stablecoins could undermine the effectiveness of the country’s monetary policy. The central bank has argued that it should take the lead in regulating the issuance of a local currency stablecoin, citing potential risks to financial stability.

Despite these concerns, Lee remains steadfast in his belief that South Korea must move forward with its stablecoin plans to remain competitive in the global digital asset space.

South Korea’s Crypto Stock Surge and Global Context

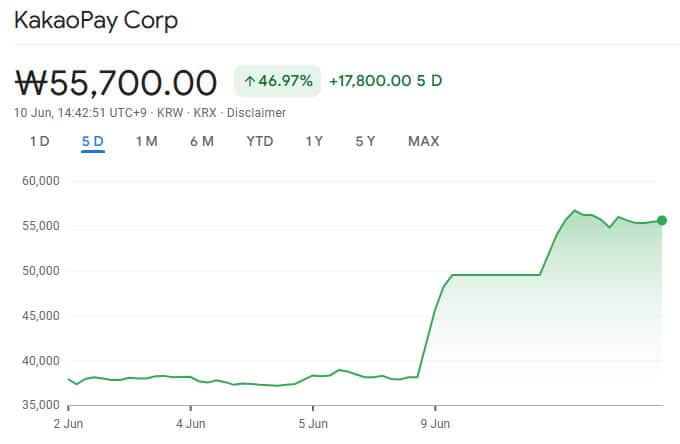

South Korea’s push for stablecoin legislation has sparked a rally in local stocks, particularly those linked to mobile payments and digital wallets. Shares of KakaoPay, a prominent digital wallet service, have surged as much as 45% over the past five days, reflecting investor optimism about the country’s crypto policies.

However, analysts from JPMorgan, including Stanley Yang and Jihyun Cho, caution that the rally in Kakao-related stocks may be unjustifiable, as the tangible benefits of Lee’s stablecoin policy remain uncertain.

Globally, the stablecoin market has gained significant traction, with the total value of stablecoins reaching an all-time high (ATH) of $250 billion in May 2023. This growth occurs amid increasing attention to stablecoin regulation, with the GENIUS Act and STABLE Act in the United States also advancing legislation in the stablecoin space.

Conclusion

The country is poised to become a key player in the stablecoin market, with President Lee Jae-myung’s proactive legislation and vision for the future. The introduction of the Digital Asset Basic Act marks a significant shift toward greater regulation and transparency in the crypto market.

As the country moves forward with its plans, the success of its stablecoin policies could have a lasting impact on both the national economy and the broader global cryptocurrency landscape.

Frequently Asked Questions (FAQ)

1- What is the Digital Asset Basic Act?

It is a proposed bill that would regulate South Korea’s cryptocurrency market, including the issuance of stablecoins.

2- How will the new crypto bill impact country’s market?

It will likely boost competition, improve transparency, and foster growth in South Korea’s rapidly expanding crypto sector.

3- What are the requirements for companies to issue stablecoins?

Companies must have a minimum of 500 million won in equity capital, guarantee refunds through reserves, and get regulatory approval.

4- Why is the Bank of Korea opposed to non-bank stablecoins?

The Bank of Korea fears that non-bank stablecoins could weaken the effectiveness of the country’s monetary policy.

Appendix: Glossary of Key Terms

Stablecoin: A type of cryptocurrency designed to maintain a stable value, typically pegged to a currency or asset like the US dollar.

Digital Asset Basic Act: A legislative proposal in South Korea aimed at regulating and fostering the development of digital assets, including stablecoins.

Equity Capital Requirement: The minimum financial capital that companies must hold to issue stablecoins, set at 500 million won in South Korea’s proposed bill.

Financial Services Commission (FSC): South Korea’s primary financial regulator, responsible for overseeing the cryptocurrency sector and stablecoin issuance.

Stablecoin Trading: The buying and selling of stablecoins has grown significantly in South Korea’s crypto market, with billions in transactions.

Bitcoin Exchange-Traded Fund (ETF): A type of investment fund that allows investors to trade Bitcoin on traditional stock exchanges, a move supported by South Korea’s president.

References

Cointelegraph – cointelegraph.com