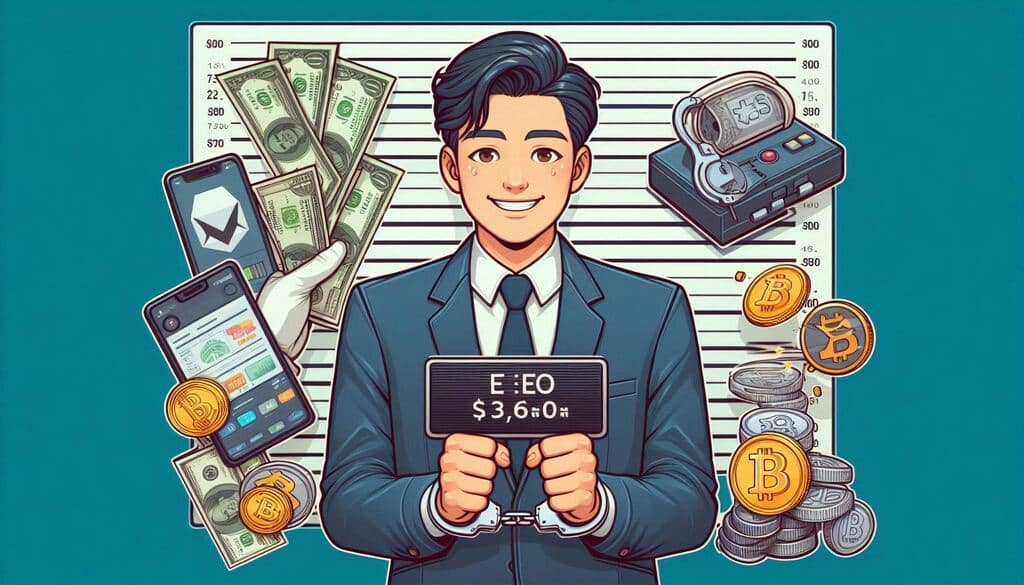

South Korean technology firm CEO Byun Young-oh finds himself at the center of a massive crypto fraud investigation, dealing a significant blow to the country’s financial community. Accused of orchestrating a $366 million Ponzi scheme under the guise of a platform called MainEthernet, Byun allegedly deceived more than 500 investors, many of whom were elderly Korean citizens. This scandal has sent shockwaves through the nation, highlighting serious gaps in the regulation of virtual currencies in South Korea.

Accused of orchestrating a $366 million Ponzi scheme under the guise of a platform called MainEthernet, Byun allegedly deceived more than 500 investors, many of whom were elderly Korean citizens. This scandal has sent shockwaves through the nation, highlighting serious gaps in the regulation of virtual currencies in South Korea.

South Korean Crypto Scam Unveiled: The Scheme and Its Victims

The South Korean technology firm Wacon, with a membership of approximately 12,000 individuals, is now under scrutiny for its involvement in one of the most extensive fraud cases in the country’s history. Byun Young-oh, alongside an accomplice known only as Yeom, is accused of setting up a fraudulent operation through MainEthernet, a platform that falsely advertised itself as a secure digital wallet. Promising investors returns of up to 50% on their Ethereum deposits, the scam lured many unsuspecting Koreans, particularly older citizens, into a web of deceit.

As the situation deteriorated, The BIT Journal closely monitored the unfolding scandal. By mid-2023, red flags began to emerge as investors reported being unable to withdraw their funds from MainEthernet. Despite these troubling signs, Byun continued to assure Korean investors that their assets were secure, insisting that the issues would soon be resolved.

South Korean Elderly Targeted in the $366 Million Fraud

Many of the victims in this Korean scam were elderly individuals who had placed their trust in Wacon’s offerings. The company, known for its virtual currency staking products, had established a reputation for reliability. However, this image was shattered when, in November 2023, the MainEthernet office in Seoul abruptly removed its signage, signaling the collapse of the scheme and leaving countless South Korean investors in financial ruin.

The Seoul Central District Prosecutors’ Office, spearheading the investigation, has formally charged Byun and his accomplice with fraud. As the case progresses toward trial, Korean prosecutors are diligently working to uncover the full scope of the fraud, seeking out additional victims and accomplices. Despite the mounting evidence, Byun continues to deny any involvement in illegal activities, asserting that he was unaware of the Ponzi scheme.

The Korean public’s reaction to the scandal has been one of outrage. The BIT Journal has documented widespread demands for more stringent oversight of virtual currency operations. The fact that a South Korean technology firm could allegedly defraud so many people on such a scale has raised serious concerns about the effectiveness of the nation’s current financial regulations.

This case has become emblematic of the broader issues surrounding the regulation of cryptocurrency in South Korea. The authorities have pledged to pursue justice, with the ongoing investigation serving as a stark reminder of the potential dangers of unregulated digital currency investments.

South Korean Authorities Pledge Accountability

As the investigation continues, South Korean authorities are determined to hold all those responsible accountable.

This case has underscored the need for stronger regulatory frameworks to protect investors from similar schemes in the future. The public’s trust in financial platforms has been severely shaken, and rebuilding this trust will require substantial reforms and stricter controls.

In conclusion, the arrest of the South Korean CEO represents a pivotal moment in the fight against financial fraud in the nation. As Byun Young-oh’s trial approaches, the South Korean public eagerly anticipates justice for the hundreds of victims ensnared by this scheme. This case has not only exposed significant vulnerabilities in South Korea’s financial regulations but also emphasized the urgent need for reform to prevent future frauds of this magnitude.

The BIT Journal remains committed to providing ongoing coverage of this significant case, ensuring that the truth comes to light and justice is served. The efforts of South Korean authorities to bring those responsible to justice are a crucial step in restoring public confidence and safeguarding against future financial frauds.