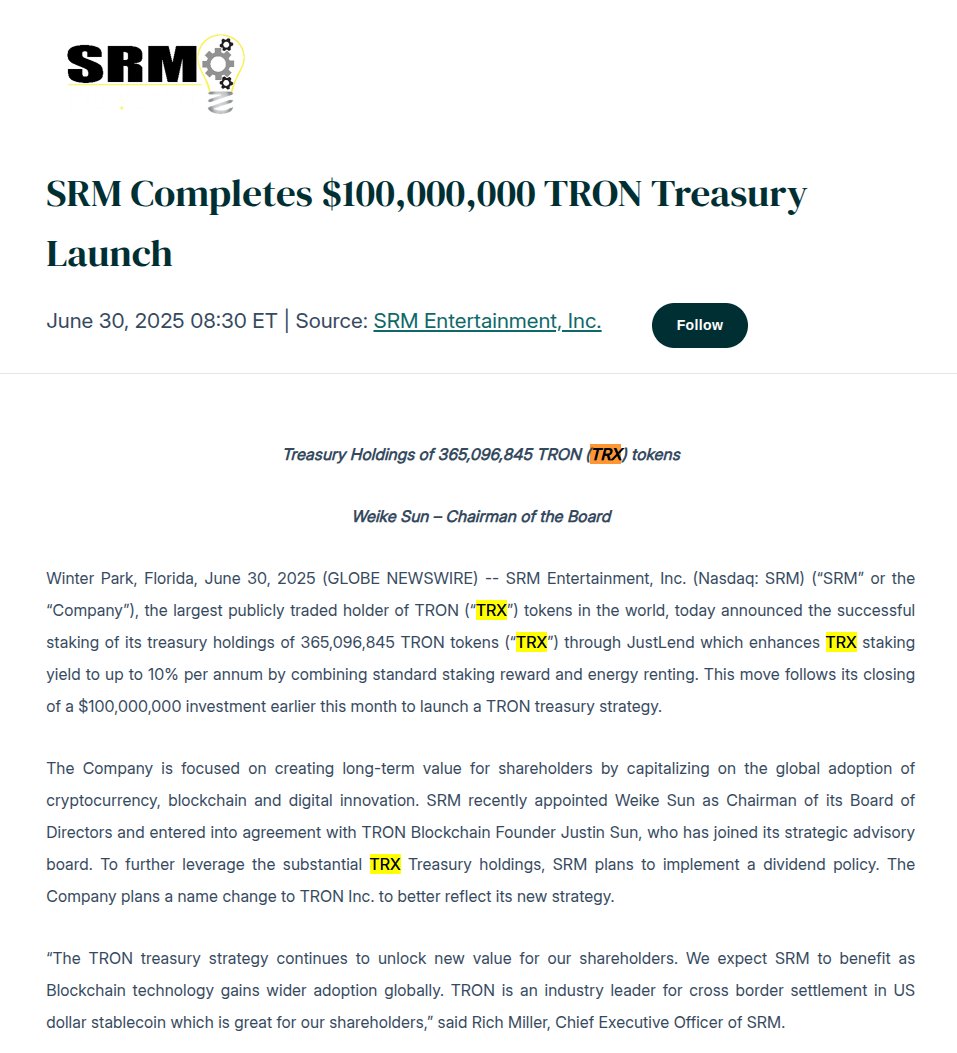

SRM Entertainment has triggered renewed interest in the TRON ecosystem with its $100 million TRON treasury launch, becoming the largest known corporate staker on the network to date. By staking 365,096,845 TRX, the company is now earning an estimated 10% annual yield, leveraging both traditional staking rewards and TRON’s native energy renting system.

According to a press release from SRM Entertainment, the company’s treasury strategy is built entirely on-chain and powered through the JustLend platform, which supports TRON’s DeFi lending and staking activity.

Why This Matters

The mechanics of SRM’s $100M TRON treasury launch center on maximizing passive returns while deepening on-chain participation. The staked TRX will generate yield through two distinct avenues:

Standard Proof-of-Stake Rewards, which are issued to validators and their delegators for securing the network.

Energy Renting, a unique TRON protocol that allows users to monetize their bandwidth and energy by leasing them to other network participants.

Combined, this dual-yield model offers an estimated 10% APY, a compelling incentive in both crypto and traditional finance circles. The size and transparency of the treasury also aim to showcase what’s possible when corporate entities use DeFi-native tools for capital growth.

SRM Entertainment’s Board Chairman Weike Sun emphasized that the initiative represents a “long-term commitment to blockchain innovation,” and confirmed that TRON founder Justin Sun is serving as an advisor in the firm’s broader Web3 transition.

Impacts for TRON Holders and the Network

This TRON treasury launch isn’t just about SRM maximizing idle capital as the implications for TRON ($TRX) holders are notable:

The first is Increased Liquidity Depth. Large-scale staking reinforces TRON’s DeFi infrastructure, stabilizes staking rewards, and attracts other yield-seeking participants. Another is Governance Power Shift. With over 365 million TRX staked, SRM now holds substantial governance weight. This could influence validator elections and future protocol proposals, sparking new conversations about decentralization versus institutional stewardship.

SRM’s move also sets an example for other public or private firms evaluating crypto as a treasury tool, particularly those looking for stable, on-chain income streams. The company’s treasury is fully transparent, and all staking activity can be verified through on-chain explorers like TRONScan.

The impact has already started to reverberate in DeFi circles. According to data from TRON DAO, staking activity rose 4.2% in the 48 hours following the announcement, with an uptick in net new wallets interacting with JustLend.

From Toys to Tokens: SRM’s Web3 Transformation

Originally a Nasdaq-listed toy and entertainment company, SRM Entertainment’s transformation began in late 2024. After announcing a merger with TRON-affiliated partners, SRM began looking into digital asset finance.

With this $100M treasury, the company is not only rebranding as TRON Inc., but also preparing a tokenized dividend policy for shareholders. In a public statement, the firm said it plans to “return TRON-denominated yield to shareholders,” essentially becoming one of the first U.S.-listed companies to offer blockchain-native returns.

According to Reuters, the U.S. SEC has paused prior inquiries into TRON-related operations, clearing the path for SRM’s full-scale transition into crypto treasury management.

Risks and Regulatory Watchpoints

While the TRON treasury launch appears bullish, analysts caution that staking strategies of this scale carry risks. The underlying value of TRX could fluctuate dramatically, affecting the dollar-denominated value of the treasury.

Yield is contingent on the health and usage of the TRON network, particularly demand for bandwidth rentals. Centralized stake ownership can spark fears of on-chain control by a single entity, reducing network neutrality.

Nonetheless, the move aligns with a larger industry trend toward “proof-of-stake capital efficiency,” where companies are replacing idle reserves with yield-generating crypto assets.

Conclusion: TRON Enters the Institutional Yield Era

SRM’s TRON treasury launch is a real-time case study in how public companies can adopt blockchain-native tools for capital growth and on-chain influence. For TRON, this brings validation, liquidity, and possibly more institutional interest. For SRM, it is a radical transformation into a yield-powered Web3 entity.

The convergence of DeFi infrastructure, public market regulation, and staking economics is starting to crystallize. And with $100M committed on-chain, TRON just gained a very loud and very powerful corporate stakeholder.

Summary

By staking 365 million TRX on the JustLend protocol, SRM aims to earn up to 10% APY while influencing TRON governance. This boosts network liquidity and sets a standard for public companies exploring staking-based treasuries. SRM plans to rebrand as TRON Inc. and issue TRX-denominated dividends, aligning shareholder returns with on-chain performance.

FAQs

What is the TRON treasury launch by SRM?

It refers to SRM staking 365 million TRX ($100M) on TRON to earn yield through staking and energy renting.

How much annual yield is SRM expecting?

Up to 10% APY, combining staking rewards and TRON’s energy renting incentives.

What platform is SRM using for staking?

JustLend, TRON’s official DeFi lending and staking platform.

Will SRM change its name?

SRM plans to rebrand as TRON Inc. to align with its blockchain-focused strategy.

Does SRM gain governance rights from staking?

With 365M TRX staked, SRM now holds considerable influence over TRON’s protocol decisions.

Glossary

TRX: Native cryptocurrency of the TRON blockchain.

JustLend: TRON’s decentralized lending and staking platform.

Energy Renting: A TRON-native mechanism where users lease bandwidth for fees.

On-Chain Treasury: A digital fund managed via smart contracts for yield generation.

Governance Token: A token that allows holders to vote on blockchain upgrades or proposals.

References