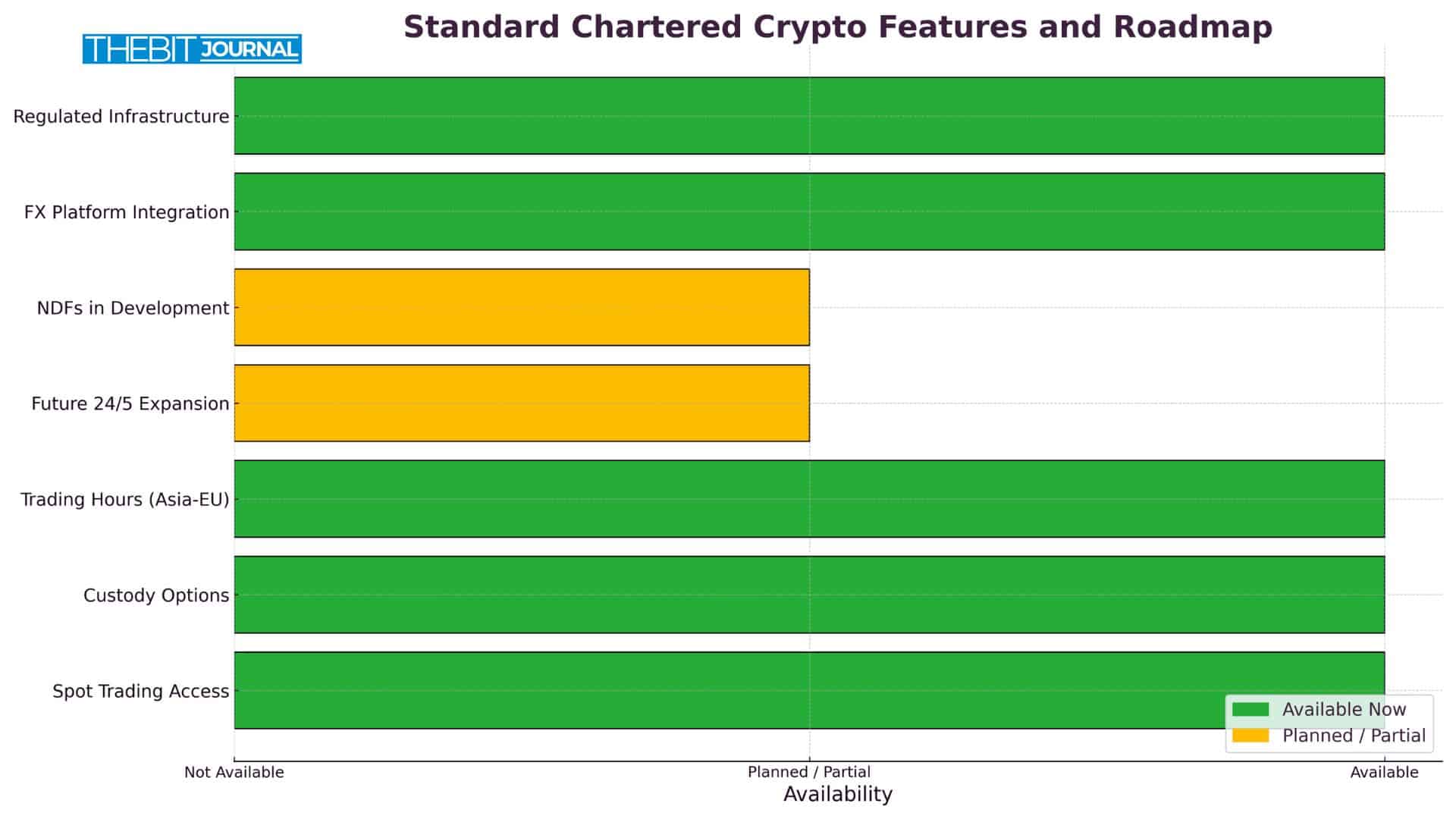

As per the source, Standard Chartered Crypto now offers spot trading for Bitcoin and Ether. This update meets the growing institutional demand for regulated access to digital assets and places the bank ahead of its global peers in crypto adoption.

Institutional Access To Crypto Simplified With Standard Chartered Crypto

Standard Chartered Crypto integrates spot trading into its existing foreign exchange (FX) platforms. Institutional clients; including corporations, asset managers, and hedge funds can now access Bitcoin and Ether trading through systems they already use.

The process supports flexible settlement with approved custodians, including Zodia Custody, in which the bank holds a stake. Trading is currently open during Asia and Europe hours, with plans to expand to nearly round-the-clock service based on client interest.

| Feature | Details |

|---|---|

| Assets | Spot Bitcoin and Ether |

| Platform | Institutional FX systems |

| Custody | Client-selected, including Zodia Custody |

| Trading Hours | Asia–Europe; possible 24/5 expansion |

| Derivatives | Non-deliverable forwards (NDFs) in development |

Banking Meets Crypto Compliance

Standard Chartered crypto sets a new benchmark by offering the first deliverable spot trading service for Bitcoin and Ether from a global bank. The service is part of a broader institutional push to meet demand through secure and compliant channels.

Bill Winters, CEO of Standard Chartered, said the bank wants to help clients manage digital asset exposure “safely and efficiently within regulatory requirements.”

Rene Michau, the bank’s global head of digital assets, reinforced this point, stating that institutions want reliable access to crypto through familiar banking infrastructure. This approach reflects the bank’s commitment to trust, regulation, and market standards.

Why Crypto Readers Should Take Note

- Regulated infrastructure: Institutions thus have direct and unrestricted access to crypto without the need for unregulated exchanges.

- Quality of service: Clients transact using familiar platforms within legally permissible and operational setups.

- Market movement: Traditional banks are becoming essential players in the arena of digital asset markets, particularly for large-scale investors.

The timing coincides with the growing appetite for fintech products based on cryptos, for example, ETFs, and with the increased institutional fray in the digital asset space. Other cryptographic ventures that Standard Chartered has supported include alliances with FalconX and, of course, tokenization initiatives using its platform, Libeara.

On The Horizon: NDFs With Standard Chartered Crypto

In this case, Standard Chartered has developed NDFs or Non-Deliverable Forward contracts meant to allow institutional clients to hedge against price fluctuations in cryptocurrency without having to hold the actual commodity.

While they exist most prominently in traditional finance for currency exposure management, Standard Chartered is adapting them for digital assets. This will expand its offering while keeping clients within compliance boundaries.

Industry Context Behind Standard Chartered Crypto

Other major financial players have explored crypto custody and brokerage services. Still, Standard Chartered Crypto is the first from a global systemically important bank to deliver a regulated spot product aimed directly at institutions. The bank has also built strategic partnerships with digital asset firms, including Zodia Markets and FalconX, which further support infrastructure for high-volume institutional trading.

Conclusion

Standard Chartered crypto introduces a practical and regulated gateway for institutions to trade Bitcoin and Ether. With familiar platforms, flexible custody, and substantial compliance, the bank’s new offering fills a clear need in the market. The upcoming addition of NDFs will only strengthen its appeal.

This development is likely to encourage other banks to take similar steps, pushing crypto further into mainstream finance.

Summary

Standard Chartered has launched a regulated crypto trading service for institutions, offering spot Bitcoin and Ether through its FX platform. Clients can trade using familiar systems and settle with custodians like Zodia. The bank plans to add non-deliverable forwards (NDFs) soon. This move gives institutions a secure and compliant way to access digital assets, marking a significant step as traditional banking continues to integrate with the crypto sector.

FAQs

What is Standard Chartered Crypto?

A banking service that allows institutional clients to trade Bitcoin and Ether through regulated FX platforms.

Who can use it?

The service is available to corporates, asset managers, hedge funds, and other institutional investors.

What are NDFs?

Non-deliverable forwards are contracts that track the price movement of an asset without actual delivery, which helps manage risk.

Why is this move significant?

It provides the first regulated spot crypto trading option from a global bank, which improves trust and access.

How does custody work?

Clients select their custodians, including Zodia Custody, for secure storage and settlement.

Glossary of Key Terms

Spot Trading: Buying or selling an asset for immediate delivery.

Bitcoin (BTC): A decentralized digital currency and store of value.

Ether (ETH): The native cryptocurrency of the Ethereum blockchain.

Custody: A secure service for storing and managing digital assets.

NDF (Non‑Deliverable Forward): A contract that provides exposure to asset prices without actual ownership.

FX Platform: A banking interface for foreign exchange, adapted for digital assets.