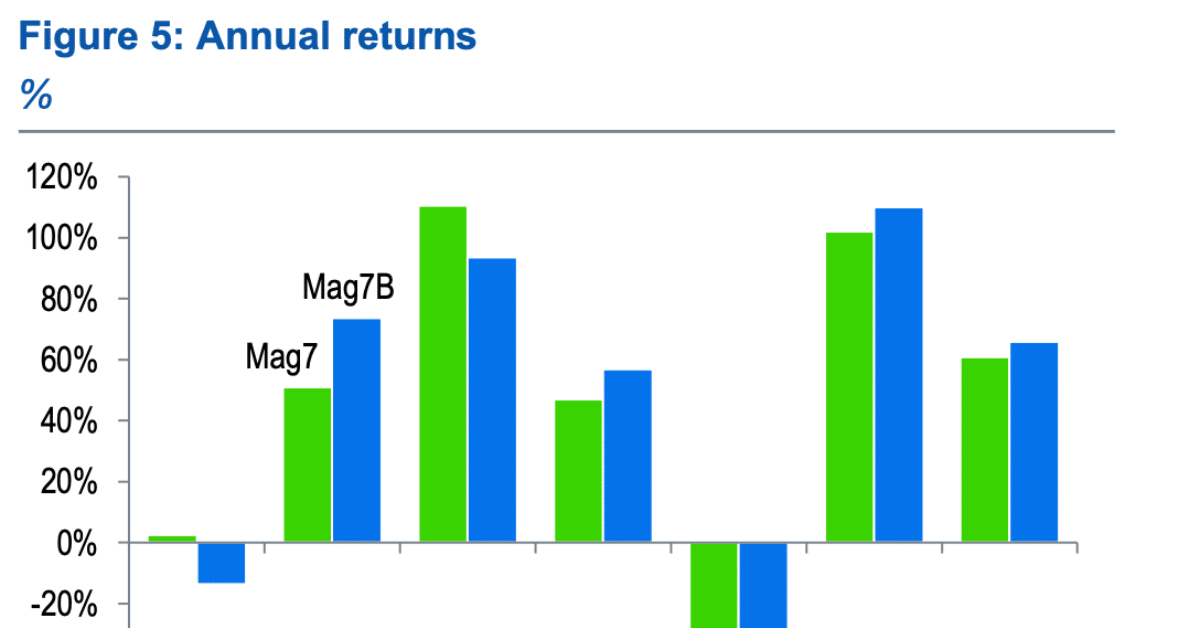

Standard Chartered has built a modified version of the “Magnificent 7” tech index called “Mag 7B,” replacing Tesla with Bitcoin, and found it could bring higher returns and lower volatility than the original Mag 7 Index.

According to a report by Geoffrey Kendrick, the head of digital asset research at Standard Chartered, Bitcoin behaved more like a tech asset than a commodity in the short term and showed a stronger correlation with the NASDAQ than with gold.

Both tech stock and a Hedge against TradFi Risks

Kendrick’s report stated that when Bitcoin is treated as both tech stock and a hedge against the risk of traditional finance, the Mag 7B index reflected how institutional investors could increasingly incorporate the asset into their diversified portfolios. He said:

“If it were included, the implication would be more institutional buying as BTC would serve multiple purposes in investor portfolios.”

The original Magnificent 7 index incorporates Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta, and Tesla stocks. Kendrick’s modified Mag 7B index removes Tesla, which has been the smallest member by market capitalization, and places Bitcoin in its place to see whether the flagship cryptocurrency should be considered a tech stock as well as a hedge against the risks and issues facing traditional finance.

Bring Fresh Capital Inflows

Market data shows that Bitcoin’s market cap of $1.7 trillion at the time of writing was at least two times that of Tesla at $800 billion. Following the test, Kendrick stated:

“We find that Mag 7B has both higher returns and lower volatility than Mag 7 […] this suggests that investors can view BTC as both a hedge against TradFi and as part of their tech allocation. Indeed, as BTC’s role in global investor portfolios becomes established, we think having more than one use will bring fresh capital inflows to the asset. This is particularly true as Bitcoin investment becomes more institutionalized.”

Growth Asset and Hedge

The proposal by Standard Chartered to swap Tesla with Bitcoin comes at a time when the presence of institutional BTC portfolios was growing, something Kendrick believes gives BTC the power to act as a growth asset and hedge against inflation. Kendrick suggests that the foregoing factors can fuel additional capital inflows from institutional players. He further predicted a positive short-term momentum for Bitcoin, citing expectations of a more favorable U.S. tariff announcement and NASDAQ rebalancing. Kendrick said:

“Over time, I think BTC may come to serve multiple purposes in investor portfolios […] higher NASDAQ will equal higher Bitcoin, $90,000 in focus now.”

Performance Boost Beyond Returns

Kendrick further observed that the Standard Chartered experiment showed the performance boost from including Bitcoin went beyond returns, highlighting that Mag 7B showered lower volatility than the original Magnificent 7 in every year of their analysis, adding that it was 2% less volatile on average. Combining more substantial returns gave Mag 7B a higher information ratio: 1.13 versus 1.04. He said:

“This suggests to us that Mag 7 portfolios would have benefited from including BTC and removing TSLA over the past seven years […] we think that BTC should be seen as serving multiple purposes in investor portfolios; this would open up the possibility of even more institutional buying.”

Conclusion

The market sentiment is currently favorable for Bitcoin, and considering that NASDAQ is struggling, investors could quickly shift to Bitcoin. With Bitcoin at least 3.5% higher this week, analysts believe the report by Standard Chartered could quickly propel institutional adoption and work well for the flagship cryptocurrency.

Frequently Asked Questions (FAQs)

What are the primary motivators for institutional adoption of Bitcoin?

Numerous drivers behind institutional investors’ interest in cryptocurrencies include hedge against inflation, portfolio diversification, client expectations, and technological advancements.

What potential drawbacks accompany institutional crypto adoption?

The promise of institutional crypto adoption comes with challenges such as price volatility, regulatory ambiguity, reputational risks, and cyber security threats.

What are the other alternatives institutions are eyeing?

Crypto ETFs are becoming more commonplace as investment vehicles; however, institutions are looking into various alternatives, including stablecoins and crypto derivatives.

Appendix: Glossary to Key Terms

Mag 7: A group of seven dominant, high-performing, and influential technology companies that significantly impact the stock market and are often seen as drivers of market growth.

NASDAQ: A stock market exchange known for its electronic trading system, particularly for technology and growth companies.

TradFi: “TradFi” or Traditional Finance is the established financial system with centralized institutions like banks, stock exchanges, and insurance companies, contrasting with decentralized finance (DeFi).