After much anticipation, US President Donald Trump signed an executive order to create an official strategic Bitcoin reserve. Based on current BTC prices, the President and White House crypto Czar believe the government’s shortsightedness caused it to forfeit at least $17 billion.

According to a post on social media site X, Trump’s AI and Crypto Czar, David Sacks, has sharply criticized past US administrations for failing to enact a Strategic Bitcoin reserve. In the post, Sacks revealed that the government earned a measly $336 million for crypto sales over the past decade.

$17 B Loss for Lack of Long Term Strategy

The US government seized stashes of Bitcoin from civil and criminal proceedings, and by Sacks’ estimates, the government had sold off at least 195,000 Bitcoins, earning $336 million in proceeds. However, the White House official argues that if there was a Strategic Bitcoin reserve and the government held to the crypto, it would be valued at $ 17B, with the price of BTC holding on to around $90,000. Sacks said:

“Over the past decade, the federal government sold approximately 195,000 bitcoin for proceeds of $366 million. If the government had held the bitcoin, it would be worth over $17 billion today. That’s how much it has cost American taxpayers not to have a long-term strategy.”

Stockpile of Crypto Seized from Criminals

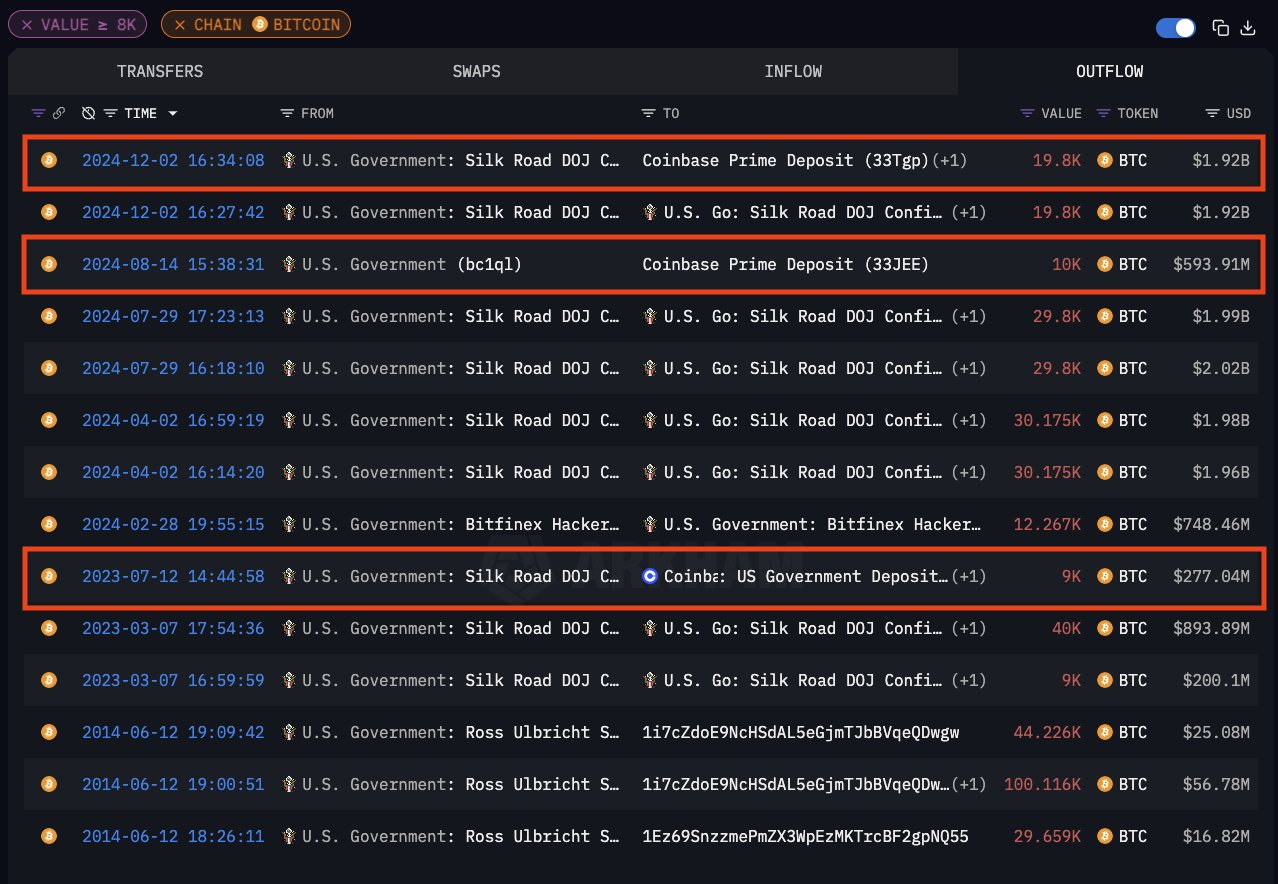

David Sacks shared a Bitcoin sales analysis generated by Elon Musk’s Grok AI showing how the US government treated the BTC holdings under its care. Available data shows that the US government started seizing Bitcoin in 2013 when the FBI confiscated 11 BTC, the first recorded incident of the federal agency gaining control of the asset.

Sacks shared a Federal Government Bitcoin Sales Analysis generated by Elon Musk-backed Grok AI, which appears to be another hint of a potential US crypto reserve under President Donald Trump. According to available public records, the BTC was seized from a criminal who tried to buy illegal drugs using the crypto asset. Following that incident, the FBI and other government agencies reportedly confiscated at least 195,000 BTC, with data showing that the federal government sold Bitcoin 11 times over the past 12 years, with 173,000 BTC liquidated by November 2015 in four significant sales over three years.

The government made Several BTC Sales

According to crypto analyst Arkham, most of the proceeds were from the sale of Bitcoin seized from renowned hacker James Zhong of the defunct dark web marketplace Silk Road. The FBI seized at least 9,861 Bitcoins from Zhong and liquidated them in March 2023 for $215 Million. According to Arkham, subsequent sales in June, July 2023, and April 2024 garnered an additional $2.27 billion in proceeds.

Conclusion

David Sacks’ revelation of the probable financial loss the US government would suffer for failing to enact a Strategic Bitcoin reserve earlier shows the motivation behind the team working on its creation. Only time will tell whether the US president’s ongoing efforts will turn into a reality, seeing that the matter is still being deliberated and no final decision has been made.

Frequently Asked Questions (FAQs)

What’s the case for a US strategic Bitcoin reserve?

Proponents believe that as the price of Bitcoin appreciated, the value of the reserve could grow and strengthen the government’s balance sheet.

How would a US Bitcoin reserve work?

The US government already holds over 200,000 BTC seized from criminal operations like the Silk Road marketplace, but some amount has already been sold off in an auction. The government could have missed the price appreciation through its BTC sales.

How would a Bitcoin strategic reserve impact the crypto market?

A Bitcoin strategic reserve would likely increase the price of BTC and benefit existing Bitcoin holders and investors.

What would a crypto strategic reserve look like?

US President Donald Trump has signed an executive order to create a reserve, but there are few details on exactly how it will look.

Appendix: Glossary of Key Terms

Bitcoin: An alternative form of digital money that is not issued by any government or controlled by a financial institution.

Strategic Reserve: A stockpile of selected essential items or commodities that can be used when needed and are held back from everyday use to meet unexpected events or to pursue a particular

Executive Order: A declaration by the president with the force of law, usually based on existing statutory powers and requiring no action by Congress.

References