Few companies have disrupted corporate finance like Strategy (formerly MicroStrategy). Once an enterprise software company, it’s now a major player in capital markets through an unconventional approach, using equity to buy Bitcoin. Despite holding only 0.07% of the US equity market, Strategy accounted for 16% of all equity raised in 2024, according to Bloomberg Intelligence.

Is this a new financial model or a wild gamble? Strategy’s $21 billion capital expansion plan, the STRK financial instrument, and its commitment to Bitcoin may set a standard or expose it to big risks.

Riding the Bitcoin Wave with Aggressive Capital Plays

Strategy’s 2024 has made it an outlier in capital markets. Companies raise capital for expansion, acquisitions or operational scaling. Strategy has raised capital to buy Bitcoin.

The company’s $2 billion convertible note issuance in November 2024 and its broader $21 billion, three-year funding plan are clear indicators of its high stakes financial strategy. By December, $561 million had been raised with a big chunk going towards Bitcoin.

This has changed the software industry’s funding landscape. In 2024 alone, Strategy’s capital raising accounted for over 70% of the $39.5 billion in fresh equity raised in the software industry. That is more than biotechnology ($30.1B), oil & gas ($26.46B) and aerospace & defense ($21.13B) combined.

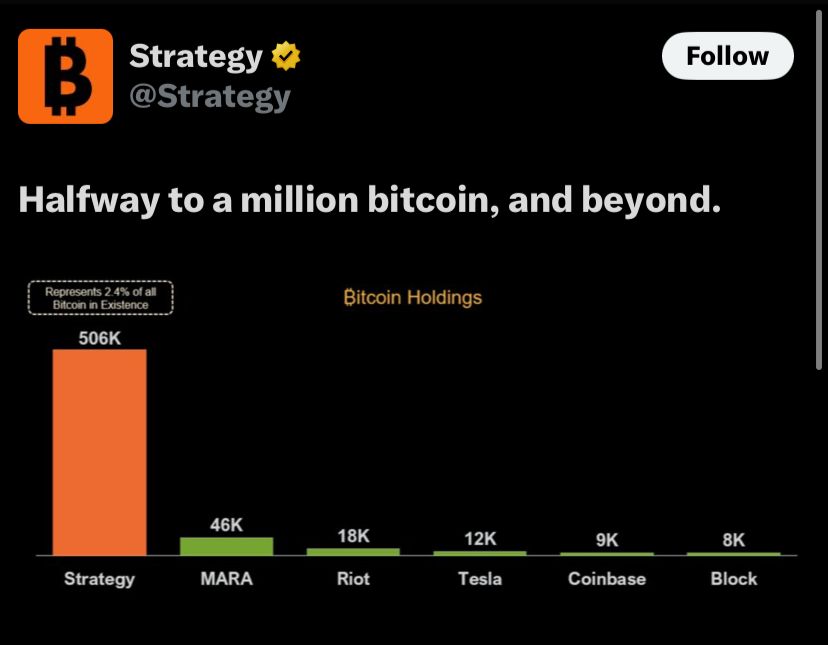

Unlike Tesla and Block, which made one-time Bitcoin purchases, Strategy has increased its holdings nearly every quarter since 2020. This continuous accumulation has made it the largest public Bitcoin holder.

As of March 25, 2025 the company owns 506,137 BTC purchased for $33.7 billion with an average cost basis of $66,608 per BTC. With Bitcoin trading at $87,000, its holdings are worth over $44 billion or an unrealized gain of $10.3 billion. But such a high stakes play raises questions: Is this sustainable? What happens in a prolonged Bitcoin downturn?

The Risk and Reward of High-Beta Bitcoin Exposure

While Strategy’s plan has worked out well, its reliance on Bitcoin price appreciation could be a big risk.

The company reportedly has over $4 billion in long-term debt, mostly in convertible notes maturing between 2028 and 2032. With relatively low cash reserves, analysts say this debt could become a liability if Bitcoin goes into a long bear market or if capital markets tighten.

Furthermore, Strategy’s stock has become highly correlated with Bitcoin. On March 24, 2025, Nasdaq rose 2.27% and Strategy’s stock rose over 10% adding $8 billion in market cap with no material business update.

This is not a coincidence. MSTR stock has historically had a beta of over 2.0 to Bitcoin, meaning it amplifies Bitcoin’s moves in both directions. While this has been good for shareholders during bull runs, it also means they are exposed to big volatility.

STRK: Financial Engineering or a New Model for Crypto Exposure?

In January 2025, Strategy introduced STRK (Series A Perpetual Strike Preferred Stock); a financial instrument to raise capital without immediate shareholder dilution.

STRK is not just a stock or a bond. It’s a hybrid. It offers 8% annual dividend, payable in cash or additional STRK shares. Conversion feature: If MSTR stock reaches $1,000, each STRK share can be converted into 0.1 MSTR shares.

Priced at $80 per share, the STRK offering raised $563 million, more than double the original target. Now trading at $86.60, STRK has held up, yielding almost 7%.

Unlike traditional Bitcoin-backed instruments like ETFs, STRK gives you indirect Bitcoin exposure without the MSTR stock or BTC price volatility.

But STRK is not risk free. Its value is tied to performance and Bitcoin prices. If Bitcoin goes down, Strategy may not be able to pay dividends and STRK could lose appeal.

A Precedent for Public Markets or a Singular Case?

Their 2024-2025 actions represent a complete disruption of how capital markets interact with digital assets. Strategy is not just experimenting with Bitcoin, it is now fully integrated it into their DNA.

This goes beyond just one company. If it succeeds, the model could lead to New hybrid financial instruments that combine crypto exposure with equities; Other public companies adopting Bitcoin-backed funding strategies; Institutional investors rethinking Bitcoin on their balance sheets.

However, this is untested in extreme financial distress. If Bitcoin goes down for a long time, they could face liquidity issues and set the opposite precedent; one that warns against overleveraging corporate assets in crypto.

The Future: A High-Stakes Experiment in Capital Markets

Strategy is pushing the limits of corporate finance and using Bitcoin in a way no other public company has. The $21 billion capital raise and STRK are a high-risk, high-reward experiment.

The future will depend on three things: Bitcoin’s long term trend—A bull run will validate their model; a crash will stress their balance sheet; Investor demand for hybrid instruments—If STRK works, others will follow; Regulatory and macro environment—Tighter regulations or higher interest rates could limit their ability to raise capital.

Whether Strategy is inventing a new era of financial engineering or walking a tightrope, one thing is for sure: capital markets will never be the same.

FAQs

How is Strategy’s Bitcoin strategy different from other corporate holders?

Unlike Tesla or Block, which made one-time BTC purchases, Strategy accumulates Bitcoin as a core treasury asset, funding acquisitions through equity and debt offerings.

What is STRK, and how does it work?

STRK is Strategy’s Series A Perpetual Strike Preferred Stock, 8% dividend and convertible into MSTR shares if the stock price reaches $1,000.

What are the risks of Strategy’s financial model?

High debt, Bitcoin appreciation, and stock volatility are big risks, especially in a prolonged BTC downturn.

Can other companies do what Strategy is doing?

If successful, Strategy’s approach may inspire other public companies to use hybrid financial instruments for Bitcoin exposure.

Glossary

Convertible Notes – A type of debt that can be converted into equity under certain conditions.

Beta (Stock Market Term) – A measure of a stock’s volatility relative to the overall market.

Treasury Reserve Asset – An asset held by a company to preserve capital and hedge against inflation.

Perpetual Preferred Stock – A type of stock that pays dividends forever but has no maturity date.