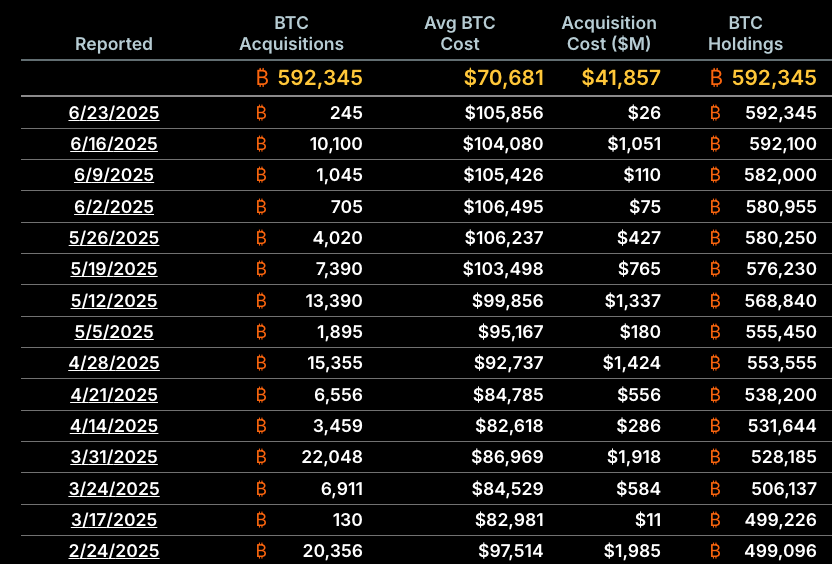

Based on available reports, Strategy, the institutional behemoth led by Michael Saylor, has again reinforced its long-standing belief in Bitcoin with a fresh $26 million BTC purchase, even as market sentiment turned cautious amid geopolitical unrest.

In a new filing with the U.S. Securities and Exchange Commission (SEC), the company disclosed that it had purchased 245 BTC last week at an average price of $105,856 per coin, despite Bitcoin’s sharp decline to sub-$99K levels during the same period.

Strategy’s Holdings Now Exceed 592K BTC

The latest Strategy BTC purchase pushes the company’s total stash to 592,345 BTC, acquired for a cumulative $41.9 billion. This brings its average purchase price to roughly $70,681 per coin, highlighting its aggressive buying even during Bitcoin’s rallies. According to data from market sources, Bitcoin traded as low as $98,700 last week before recovering above $105,000, suggesting Strategy’s timing coincided with peak volatility.

Despite market pullbacks, Strategy’s approach appears deliberate. The firm’s founder, Michael Saylor, has made no secret of his intent to accumulate Bitcoin indefinitely, regardless of short-term price action.

“I’m sure that I will be buying Bitcoin at $1 million a coin, probably $1 billion a day of Bitcoin at $1 million a coin,” Saylor stated in a public interview.

Yield Ticks Higher as 2025 Target Nears

Strategy’s Bitcoin yield, a metric the company uses to track return on its BTC investments, rose to 19.2% year-to-date following the latest purchase. This is a slight uptick from the 19.1% yield reported after its $1 billion acquisition earlier this month. The company aims to hit a 25% BTC yield by year-end 2025, a revised goal that reflects its growing expectations for Bitcoin’s appreciation.

The steady increase in yield aligns with Strategy’s broader capital deployment strategy, which favors consistent accumulation and long-term value over short-term trading gains.

Long-Term Vision: Bitcoin at $21 Million?

Saylor’s latest price forecast sparked both enthusiasm and skepticism within the crypto community. During a keynote this weekend, the Strategy chairman predicted Bitcoin could hit $21 million in the next 21 years.

While the figure appears symbolic, mirroring the 21 million total BTC supply; it nonetheless shows the company’s thesis that Bitcoin will serve as a long-term store of value, potentially rivaling or surpassing traditional assets like gold.

The company’s small but timely buy may have been tactical: it supports the thesis of buying into weakness while maintaining a cost average that benefits from BTC’s long-term trend.

Conclusion: Confidence or Complacency?

Strategy’s continued BTC purchases even during sharp pullbacks, raise important questions. Is this a signal of institutional confidence, or could the firm be overexposed? Some analysts have voiced concerns that smaller purchases at lower levels may reflect caution or a waiting game for broader confirmation of market recovery.

Still, Strategy’s accumulation is unlikely to wane, especially given Saylor’s commitment and the firm’s updated capital allocation model, which prioritizes Bitcoin as its core treasury reserve asset.

Summary

Strategy’s latest BTC purchase of 245 Bitcoin for $26 million adds to its dominant institutional position, with total holdings now exceeding 592,000 BTC. The buy occurred during a market dip, reflecting the company’s continued commitment to its long-term Bitcoin thesis. Founder Michael Saylor reaffirmed his ultra-bullish outlook, predicting BTC could reach $21 million in 21 years.

The firm’s year-to-date yield rose to 19.2%, edging closer to its 25% target for 2025. While the purchase is smaller than past transactions, it fits into Strategy’s consistent “buy the top” strategy. Despite concerns about geopolitical uncertainty, the move reaffirms Strategy’s positioning as Bitcoin’s most committed corporate backer.

FAQs

How much Bitcoin did Strategy buy last week?

Strategy purchased 245 BTC for $26 million, with an average price of $105,856 per coin.

What is Strategy’s total Bitcoin holdings?

As of the latest filing, Strategy holds 592,345 BTC, valued at approximately $41.9 billion.

Why didn’t Strategy buy more during the dip?

The firm has not publicly disclosed its exact reasons, but the smaller buy could reflect strategic rebalancing or staged deployment during volatility.

What is Strategy’s year-to-date BTC yield?

After the most recent BTC purchase, the BTC yield stands at 19.2%, with a target of 25% by end of 2025.

What did Saylor say about Bitcoin’s long-term price?

Michael Saylor forecasted that Bitcoin could reach $21 million per coin over the next 21 years.

Glossary

Strategy BTC Purchase: Refers to the regular acquisition of Bitcoin by Michael Saylor’s firm as part of its long-term crypto treasury strategy.

BTC Yield: A measure used by Strategy to track percentage returns on its Bitcoin investment.

Average Purchase Price: The average cost per BTC across all of Strategy’s accumulated holdings.

SEC Filing: A regulatory document submitted to the U.S. Securities and Exchange Commission detailing material financial transactions.

Geopolitical Dip: A price drop in financial assets triggered by international political instability.