As Gary Gensler’s tenure at the SEC concludes, a wave of cryptocurrency ETF applications has swept in, marking a significant moment in the crypto industry. Late Friday, coinciding with Gensler’s last day as SEC Chair, at least five new ETF proposals, including those for Solana, were submitted.

A Surge in Crypto ETF Applications

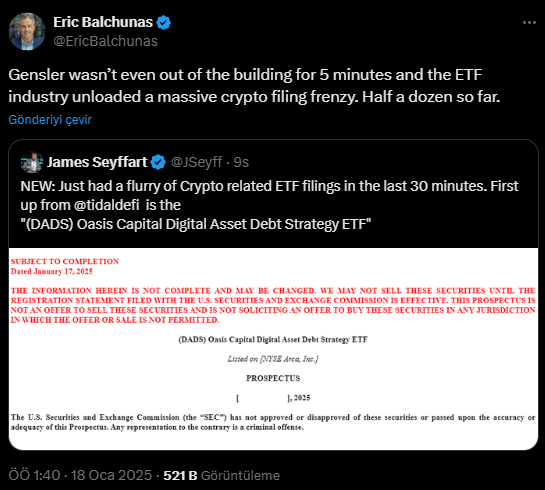

Gary Gensler’s departure from the SEC has been met with a flurry of activity from the ETF industry. Applications for ETFs such as XRP and Solana Futures ETFs have surged, highlighting the anticipation of a shift in the regulatory environment. Bloomberg analyst Eric Balchunas described the timing as a bold statement by the ETF industry, saying, “Not even five minutes after Gensler left the building, the ETF sector launched a massive wave of crypto filings.”

Among the standout submissions, Tidel Finance introduced the “Oasis Capital Digital Asset Debt Strategy ETF (DADS).” This fund aims to target debt securities tied to industries like crypto mining, companies holding direct crypto assets, and payment service providers. ProShares also filed for a Solana Futures ETF, building on its prior experience with an Ethereum ETF approved in July 2024.

Broader Participation in Altcoin ETFs

CoinShares joined the fray with its “CoinShares Digital Asset ETF,” a fund linked to the CoinShares-Compass Crypto Market Index, which tracks 10 cryptocurrencies. While Bitcoin and Ethereum comprise 70% of the index, other assets like XRP, Cardano, and Chainlink make up the rest. Similarly, VanEck submitted plans for an actively managed “Onchain Economy ETF,” targeting blockchain-powered businesses and ecosystems.

Commentators like Chad Steingraber observed the strategic timing of these filings, remarking, “The crypto ETF industry waited until the final hours of Biden’s SEC to start filing, signaling a shift toward a Trump-aligned pro-crypto administration.” With Paul Atkins, known for his crypto-friendly stance, set to take over as SEC Chair, the industry’s optimism for a favorable regulatory landscape appears well-founded.

Ripple Effect on XRP

Ripple’s XRP hit an all-time high just as Gensler’s term ended, fueled by speculation of an imminent XRP ETF approval under the incoming SEC leadership. This milestone has bolstered investor confidence, positioning XRP as a key player in the evolving crypto market.

Gensler’s Last Stand

Even in his final days, Gary Gensler maintained his critical stance on the crypto industry, issuing a $38 million fine to Digital Currency Group. Earlier in the week, he reiterated his concerns, labeling the sector as rife with fraud and misconduct. Despite his departure, Gensler’s influence on crypto regulation remains a defining feature of his tenure.

The Road Ahead

The wave of ETF filings suggests a growing belief in a more supportive regulatory environment under new leadership. As The Bit Journal continues to monitor these developments, the crypto market is poised for significant changes, particularly with ETFs for Solana and other altcoins gaining traction.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!