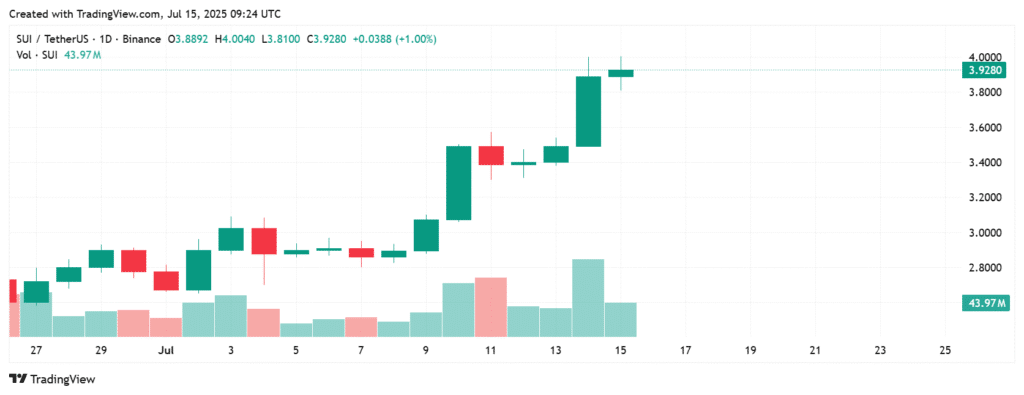

The Sui price jumped more than 10% on July 14, moving from $3.44 to a daily high of $3.99 before settling near $3.89. This increase came amid a broader crypto rebound but stood out for being driven by project-specific catalysts. Trading volume also spiked, crossing $2.33 billion in the last 24 hours.

Two major developments supported the rally: the launch of Bitcoin-backed tBTC on Sui and growing speculation around a U.S.-listed SUI exchange-traded fund (ETF). These events strengthened market confidence and pulled investor attention toward the project.

tBTC Integration Sets a New Standard

Sui made headlines on July 7 by becoming the first non-EVM blockchain to support the direct minting of tBTC. Unlike wrapped tokens, which rely on third-party custodians, Sui’s approach allows users to bring Bitcoin liquidity on-chain natively. This eliminates inefficiencies and reduces the risk of bridge exploits.

The move is seen as a technical milestone. It strengthens Sui’s position in the DeFi space by unlocking access to Bitcoin’s vast liquidity. It also gives Sui an edge over other Layer 1 networks struggling to offer smooth BTC integration.

$500 Million in Bitcoin Flows Into Sui

The market’s response was immediate. In less than a week, over $500 million in Bitcoin was deployed to Sui-native DeFi platforms like Bluefin and AlphaLend. These inflows now represent nearly 10% of the network’s total value locked (TVL).

This level of Bitcoin liquidity is rare for non-Ethereum chains. It reflects not just strong infrastructure, but rising institutional interest in Sui’s evolving ecosystem. The increase also added support to the Sui price rally.

ETF Filing Signals Growing Institutional Trust

Further optimism came from Nasdaq’s filing of a 19b-4 form to list a spot SUI ETF by 21Shares. The filing is currently under review by the U.S. Securities and Exchange Commission. While approval is not yet certain, it adds regulatory momentum to the project.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI |

|---|---|---|---|---|

| Jul 2025 | $ 2.74 | $ 3.12 | $ 3.95 | 0.48% |

| Aug 2025 | $ 2.98 | $ 3.09 | $ 3.19 | 18.75% |

| Sep 2025 | $ 2.93 | $ 3.03 | $ 3.17 | 19.38% |

| Oct 2025 | $ 2.69 | $ 2.86 | $ 2.99 | 23.82% |

| Nov 2025 | $ 2.85 | $ 2.93 | $ 2.99 | 23.96% |

| Dec 2025 | $ 2.97 | $ 3.04 | $ 3.11 | 20.93% |

Sui-based products in Europe have already attracted $300 million in institutional inflows this year. The possibility of a U.S.-listed ETF could further legitimize Sui as a long-term blockchain investment. This narrative is also helping drive the current rise in Sui price.

High-Speed Infrastructure Fuels Adoption

Sui’s technical strengths are also playing a role in its upward momentum. The network is capable of processing up to 297,000 transactions per second using a parallel execution engine. It also separates basic transfers, like those involving tBTC, from complex smart contracts.

This allows for near-instant processing of simple transfers—settled in just 400 milliseconds. Such speeds outperform Ethereum and Solana and are particularly appealing to institutions and DeFi developers alike. This efficiency is increasingly being priced into the Sui price.

Developer Activity and Real-World Usage Grow

Developer interest in Sui continues to increase. The total value locked in Sui’s ecosystem has risen more than 200% year-to-date, now reaching $12.29 billion. In May alone, Sui processed $110 billion in stablecoin volume, indicating real-world adoption.

These usage statistics highlight a growing and active user base. They also reinforce the perception that Sui is not only scalable but ready for real economic applications. This rise in activity underpins long-term confidence in the Sui price.

Sui Price Still Below All-Time Highs

Despite the latest rally, the Sui price remains 28.11% below its January all-time high of $5.35. One reason is the controlled token release schedule. Only 33% of the 10 billion total token supply is currently in circulation, with the remainder locked until 2030.

This limited circulating supply adds a deflationary element that could support future gains. Combined with strong fundamentals and rising adoption, it presents a case for a longer-term price climb.

Derivatives Market Reflects Bullish Sentiment

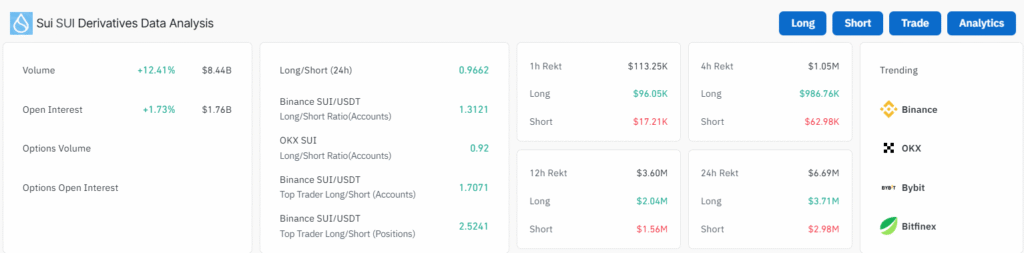

Speculators are also betting on continued price momentum. Open interest in SUI futures rose 1.73% in the past 24 hours, reaching $1.76 billion according to CoinGlass. At the same time, trading volume increased 12.41% to $8.44 billion.

This rise in both open interest and volume indicates that traders expect continued volatility and potential upside. It also suggests growing confidence in the short- to mid-term movement of the Sui price.

Conclusion

The recent surge in Sui price is not just a market reaction—it reflects progress on multiple fronts. From groundbreaking Bitcoin integration to real institutional interest, Sui is carving out a unique space in the blockchain sector.

If current trends hold, the token may continue to gain both in value and utility. The foundation appears solid, and the market is beginning to acknowledge that strength.

Summary

The Sui price surged over 10% on July 14. as key developments boosted market confidence. The launch of Bitcoin-backed tBTC and progress toward a U.S.-listed SUI ETF drew investor attention. Over $500 million in BTC flowed into Sui-based DeFi platforms, while institutional demand continued to rise.

With its high-speed infrastructure, growing developer activity, and a deflationary token model, Sui is positioning itself as a serious contender in DeFi. The rally reflects more than hype—it’s backed by strong fundamentals and rising adoption.

Frequently Asked Questions (FAQ)

1- What is driving the recent surge in Sui price?

The surge is driven by tBTC integration, ETF speculation, and rising institutional inflows.

2- Is there an ETF for Sui?

A 21Shares spot SUI ETF is currently under SEC review in the U.S., following strong inflows into European Sui-based ETPs.

3- What is tBTC, and why is it important for Sui?

tBTC is a Bitcoin-backed asset. Sui is the first non-EVM chain to mint it directly, enabling faster and more secure DeFi use.

4- Is there an ETF for Sui?

A 21Shares spot SUI ETF is currently under SEC review in the U.S., following strong inflows into European Sui-based ETPs.

Appendix: Glossary of Key Terms

Sui Price – The current market value of the SUI token, which reflects investor sentiment and platform developments.

tBTC – A Bitcoin-backed asset that enables BTC liquidity to move into DeFi ecosystems without wrapped tokens or third-party bridges.

TVL (Total Value Locked) – The total value of assets deposited in a blockchain’s smart contracts, used as a key indicator of DeFi activity.

EVM (Ethereum Virtual Machine) – A computation engine used by many blockchains to execute smart contracts; Sui operates independently from it.

ETF (Exchange-Traded Fund) – A regulated investment product that tracks the price of an asset like SUI and is tradable on traditional stock markets.

Open Interest – The total number of active futures or options contracts that have not been settled, used to gauge market sentiment.

Reference

Crypto.News – crypto.news