Sui (SUI) has recorded the highest stablecoin inflows among all blockchains, marking a net increase of $6.1 million. This sharp influx stands in stark contrast to the outflows seen on other major blockchains like Ethereum, Solana, and BNB Chain, suggesting a potential capital rotation within the cryptocurrency market. These strong stablecoin inflows hint at a growing demand for SUI, signaling a potential surge in on-chain activity and investor confidence in the blockchain’s near-term outlook.

Rising Stablecoin Inflows and Open Interest

The recent surge in stablecoin liquidity towards SUI is an indicator of growing market interest. Stablecoin inflows are often seen as “dry powder,” meaning liquidity ready to be deployed into native assets like SUI, which could put upward pressure on its price. This influx of capital could signal that investors are preparing for a potential rally, further evidenced by a sharp rise in open interest on SUI.

Open interest (OI), which reflects the total value of outstanding contracts in derivatives markets, surged by 30.64% in the past 24 hours, bringing the total to $785.35 million. This dramatic increase highlights the growing speculative interest in SUI, with traders positioning themselves for potential volatility. While spot inflows reflect long-term investment, rising open interest typically suggests that traders are gearing up for short-term price movements, often in anticipation of a breakout.

Overview of SUI’s Technical Setup and Price Action

In addition to rising liquidity, SUI’s price action has shown promising signs of a potential breakout. SUI recently formed a classic cup and handle pattern on the daily chart, a technical formation commonly associated with bullish continuation. As of writing, SUI was trading at $2.16, marking a 12.82% increase over the last 24 hours. The handle portion of the pattern seems to be developing within a descending wedge, with a clear breakout point at $2.23.

However, for this pattern to become actionable, SUI needs to close a strong candle above the $2.23 resistance level. If this happens, SUI’s next significant resistance target would be $2.80, suggesting that the token could experience a significant price rally. However, the price must confirm this breakout before traders can fully embrace the bullish potential.

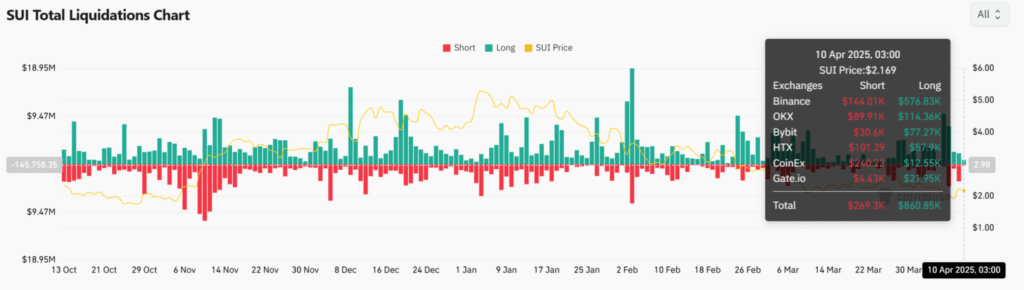

Impact of Liquidations on Market Sentiment

In the past 24 hours, SUI also saw a significant $860.6k in long liquidations, compared to just $269.3k in short liquidations. This imbalance suggests that overleveraged bullish positions were liquidated, especially on major exchanges like Binance and OKX. Liquidations often trigger temporary sell-offs and can impact short-term market sentiment. Still, they also serve as a “reset” button, clearing out excess leverage and potentially setting the stage for a healthier price movement.

While liquidations can create a brief price dip, they often lead to a more sustainable upward move once the excessive leverage is cleared. If bullish momentum returns after these liquidations, it could help fuel a price recovery and push SUI to higher levels in the near term.

Funding Rates Point to Bullish Sentiment

Sui’s open interest-weighted funding rate, which measures the cost of holding long positions, turned slightly positive at 0.0087% on April 10. This indicates that traders have been paying to hold long positions, further reinforcing the presence of bullish sentiment in the market. Positive funding rates are typically a sign that traders are willing to bet on continued upward movement despite the volatility and liquidations seen in the past day.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI |

|---|---|---|---|---|

| Apr 2025 | $ 2.19 | $ 4.36 | $ 7.51 | 246.17% |

| May 2025 | $ 6.83 | $ 8.76 | $ 10.46 | 381.93% |

| Jun 2025 | $ 5.48 | $ 6.62 | $ 7.80 | 259.49% |

| Jul 2025 | $ 7.52 | $ 7.98 | $ 8.90 | 310.07% |

| Aug 2025 | $ 5.80 | $ 7.11 | $ 8.04 | 270.48% |

| Sep 2025 | $ 4.84 | $ 5.59 | $ 6.23 | 187.30% |

| Oct 2025 | $ 4.90 | $ 5.63 | $ 5.93 | 173.22% |

| Nov 2025 | $ 3.75 | $ 4.23 | $ 4.76 | 119.22% |

| Dec 2025 | $ 4.08 | $ 4.42 | $ 4.68 | 115.78% |

Moreover, a recovery in the funding rate following a liquidation event is often a sign of renewed confidence among market participants. This, combined with the rising stablecoin inflows and open interest, strengthens the case for a potential SUI price breakout.

The Path to a Potential Breakout

SUI’s market activity in the past 24 hours, including rising stablecoin inflows, increased open interest, and positive funding rates, indicates growing confidence in the altcoin. The cup and handle pattern also suggests that SUI is in the midst of a potential breakout. However, confirmation above the $2.23 resistance level is essential for traders to embrace the bullish outlook fully.

If SUI can break above this key level, it could quickly move toward the $2.80 resistance, marking the next major target for the altcoin. With strong liquidity and an influx of speculative interest, SUI could be well-positioned for a bullish run in the coming sessions.

Conclusion

Sui is showing several positive signs that indicate potential for growth in the near term. With rising stablecoin inflows, a surge in open interest, and bullish technical patterns, SUI may be on the cusp of a breakout. However, confirmation above the $2.23 resistance level is crucial before calling a definitive bullish move. Should the altcoin successfully break out, SUI could see a sustained rally, potentially reaching new price levels and increasing its adoption in the blockchain ecosystem.

Frequently Asked Questions (FAQ)

1- What are stablecoin inflows and how do they affect SUI?

Stablecoin inflows represent liquidity that could be deployed into native assets like SUI, signaling investor confidence and potentially increasing demand for the token.

2- What is open interest and why is it important?

Open interest measures the total value of outstanding derivative contracts. A rise in open interest indicates growing speculative interest in an asset, suggesting traders are preparing for price volatility.

3- What is the cup and handle pattern?

The cup and handle pattern is a bullish chart formation where the price forms a rounded bottom (cup) followed by a consolidation (handle). A breakout above the handle’s resistance often leads to an upward price movement.

4- What do liquidations mean for SUI’s price?

Liquidations can temporarily reduce market sentiment, but they often clear out excessive leverage, setting the stage for a healthier and more sustainable price move.

Appendix: Glossary of Key Terms

Sui (SUI) – A high-performance blockchain designed to offer scalability and low latency for decentralized applications and assets.

Stablecoin Inflows – The movement of stablecoins into a blockchain, often acting as liquidity that can be deployed into native assets or used for investments.

Open Interest (OI) – The total value of outstanding contracts in the derivatives market, reflecting the level of speculative interest in an asset.

Cup and Handle Pattern – A technical analysis chart pattern resembling a cup with a handle, indicating a potential bullish continuation after a breakout.

Liquidations – The forced closure of a trader’s position due to insufficient margin, which can impact market prices and sentiment.

Funding Rate – The interest paid by traders holding long or short positions in derivatives markets, indicating market sentiment and expected price movement.

Breakout – A price movement that surpasses a significant level of resistance, indicating a potential upward trend or continued momentum.

Sources

AMB Crypto – ambcrypto.com

TradingView – tradingview.com