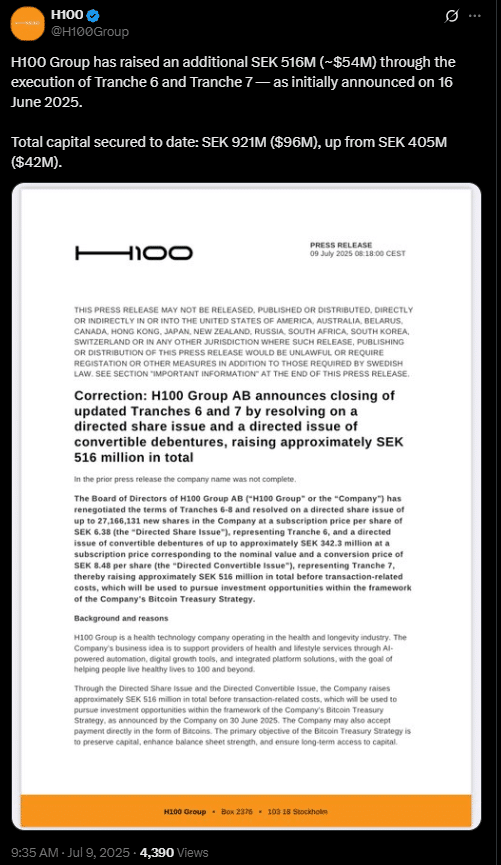

In a bold demonstration of corporate confidence in Bitcoin, Swedish publicly traded company H100 Group has successfully closed a new funding round worth approximately $54 million. The entire sum is earmarked for direct Bitcoin purchases, reinforcing the company’s long-term digital asset strategy.

With this latest round—conducted as their sixth and seventh capital increase—H100 Group’s total raised capital has reached an impressive $96 million. The announcement was officially made via the company’s X (formerly Twitter) account on July 9, 2025.

A Strategic Bet on Bitcoin

H100 Group’s management confirmed that 100% of the newly acquired funds will be allocated toward Bitcoin acquisitions, aligning with their institutional reserve policy. The goal is to fortify their corporate portfolio and capitalise on long-term growth opportunities in the crypto sector.

Backed by both current and new investors, the company is pursuing a strategy that reflects a maturing institutional interest in digital assets, particularly Bitcoin. According to H100 Group, the decision is rooted in confidence that Bitcoin will play a pivotal role in future financial systems.

A Broader Shift in Corporate Sentiment

The move marks another significant milestone in the evolving narrative of Bitcoin as a treasury asset among European enterprises. H100 Group is now positioning itself alongside a growing cohort of global companies diversifying reserves with digital assets.

This development not only strengthens H100’s market reputation but also sets a benchmark for other firms evaluating crypto adoption. It highlights a broader paradigm shift: institutional players are no longer cautiously observing from the sidelines—they’re leading the charge.

Conclusion

H100 Group’s decisive pivot toward Bitcoin is part of a growing wave of corporate financial innovation in Europe. As regulatory clarity improves and investor appetite expands, more firms may soon follow suit, transforming Bitcoin from an alternative asset into a mainstream financial instrument.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

References:

- Official H100 Group Disclosure on X (https://twitter.com/H100Group)

- Nasdaq Nordic Company Listings (https://www.nasdaqomxnordic.com)

- European Securities and Markets Authority (ESMA) Updates – esma.europa.eu