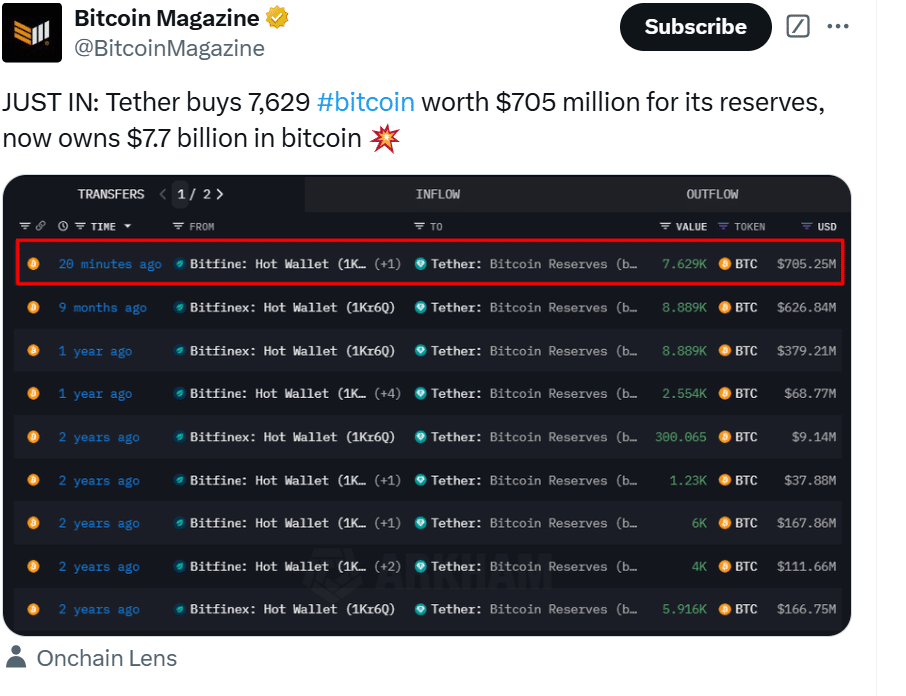

Tether’s recent move to bolster its strategic reserve by procuring over $700 million in Bitcoin—representing the firm’s largest single Bitcoin buy since March of last year—serves to diversify the stablecoin issuer’s holdings further and fortify its asset foundation. By transferring a bounty of 7,629 BTC into its reserves from March 2024’s amount, Tether reaffirms its dedication to maintaining a mixed portfolio that is better able to weather possible storms.

Though constituting its most substantial Bitcoin obtainment in eleven months, this latest accumulation forms only part of Tether’s prudent, ongoing efforts to safeguard the stability and security supporting USDT, the world’s premier stablecoin, for the benefit of its vast user base.

Tether: Strategic Allocation of Profits

In May of 2023, the stablecoin issuer Tether announced an ambitious strategic initiative to allocate up to fifteen percent of their cumulative net operating profits towards acquiring Bitcoin. This sizeable recent cryptocurrency transaction conformed with that strategy, bringing Tether’s complete stash of Bitcoin to over eighty-two thousand of the premier digital assets, equating to a valuation of approximately seven point six billion United States dollars.

Paolo Ardoino, the chief executive of Tether, articulated that,

“Our consistent investment in Bitcoin underlines our viewpoint in its potential as a long-lasting store of importance and its duties in bolstering our reserves.”

Corporate Adoption of Bitcoin Accelerates

Tether’s massive investment is part of a widening pattern of corporate firms incorporating Bitcoin into their economic aims. MicroStrategy, an intelligence consulting firm, pioneers this movement with assets surpassing 423,650 BTC, obtained at a median cost of $62,428 per Bitcoin. The company’s daring procurement approach has positioned it as a trailblazer in corporate Bitcoin acceptance.

Likewise, KULR Technology Group, an energy management platform, recently obtained 217.18 BTC valued at $21 million, denoting its entrance into the Bitcoin treasury approach. The company’s shares rocketed to an unprecedented peak following the announcement, displaying shareholder certainty in this strategic transfer.

Governmental Interest in Bitcoin Reserves

The corporate realm is far from alone in acknowledging Bitcoin’s latent aptitude. Numerous states across the US have been exploring including the premier cryptocurrency in their treasury reserves.

Both Ohio and Texas, alongside Pennsylvania, have put forth bills proposing an allocation of a segment of funds under their purview into Bitcoin, citing its potential as a safeguard against economic unpredictability. Representative Giovanni Capriglione of the Lone Star State articulated,

“Establishing a Bitcoin stockpile is a strategic maneuver to shelter our state’s financial prospects against future storms.”

Tether’s Diversification Efforts

Beyond merely stockpiling Bitcoin, Tether has been diversifying its investment portfolio in interesting ways. Recently, the company sunk $775 million into Rumble, a video-sharing platform renowned for its dedication to unfettered expression. This manoeuvre underscores Tether’s commitment to backing platforms that align with its principles and expanding its impact within the digital sphere.

Summing Up

Tether’s latest procurement of Bitcoin underscores a rising phenomenon among institutions and administrations to acknowledge the cryptocurrency as a prudent resource for diversifying holdings and bolstering financial resilience. While more actors blend Bitcoin into their stockpiles, the digital asset’s function in the global financial order continues evolving, intimating a modification towards a more comprehensive reception and integration of virtual resources across sectors.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

Why did Tether purchase $700 million worth of Bitcoin?

Tether’s large Bitcoin buy aligns with their strategic goal of allocating a portion of profits to the premier digital currency, demonstrating faith in Bitcoin as a sound long-term store of wealth. This substantial increase also serves to bolster Tether’s reserves.

What is the total size of Tether’s Bitcoin holdings presently?

Answer: Following the most recent significant purchase, Tether’s complete stash of Bitcoin now stands at an immense 83,000 BTC, valued at approximately $7.75 billion—a colossal sum surely to legitimize the crypto market further.

How might this sizeable Bitcoin investment by Tether potentially impact the wider cryptocurrency scene?

Answer: Tether’s action reinforces the role of Bitcoin as a primary reserve asset, likely boosting broader confidence in the industry and encouraging further incorporation into the operations of major corporations and governments, perhaps precipitating even broader adoption worldwide.