The debate over token vs coin is no longer academic. As crypto markets mature and regulators sharpen their definitions, understanding what separates a blockchain “coin” from a smart-contract “token” has become essential for traders, builders, and policymakers alike.

In June 2025, the U.S. Securities and Exchange Commission (SEC) issued fresh guidance clarifying that certain utility tokens do not qualify as securities when they function purely as “digital goods” inside an application rather than passive investments.

Coins: Native, Self-Securing and Monetary

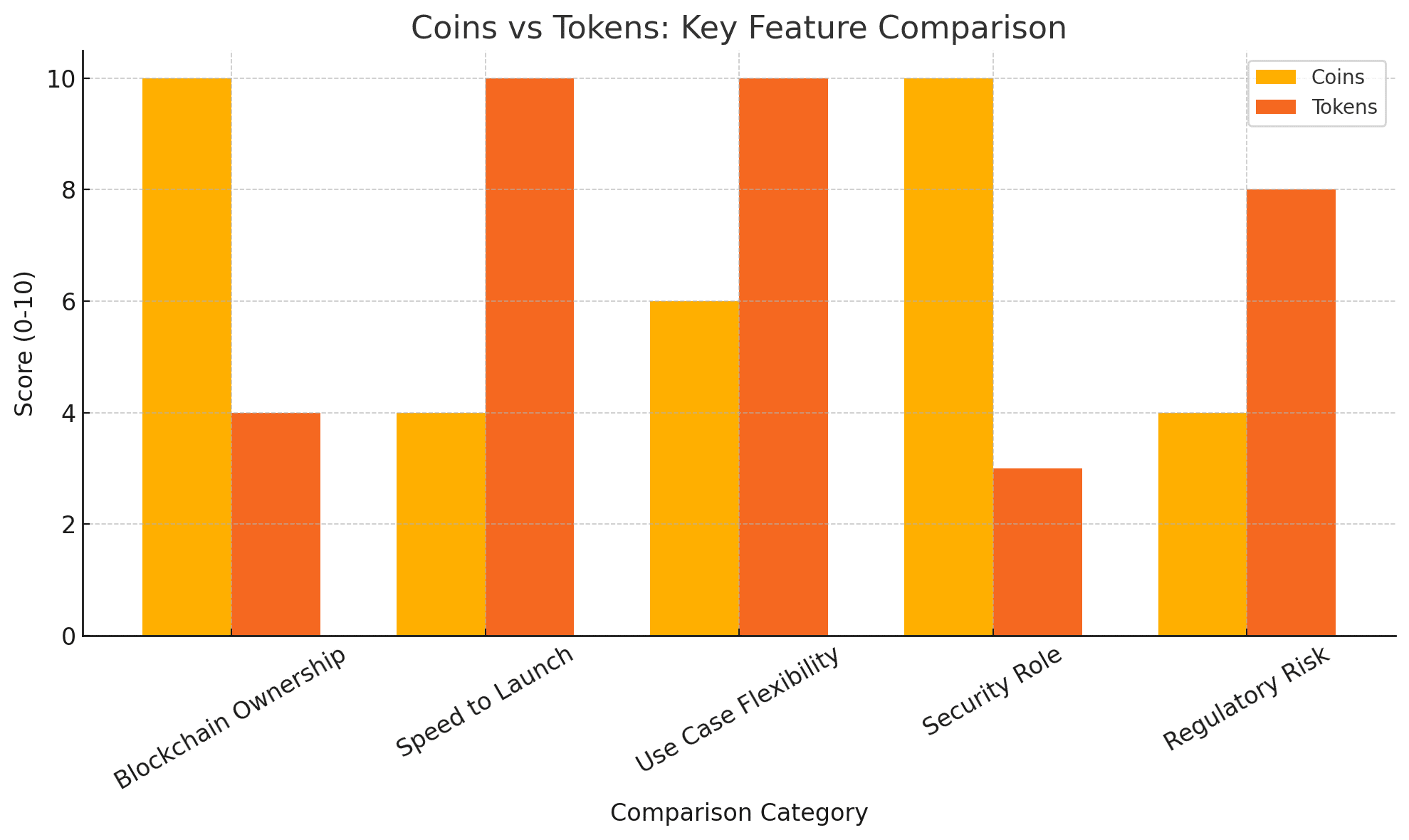

A coin is the native asset that launches with its own blockchain: think BTC on Bitcoin or ETH on Ethereum. Coins secure their networks through mining or staking, pay transaction fees, and, crucially, derive value from the overall health of that chain.

Analysts this spring reiterated that coins remain the preferred long-term store of value because they carry “intrinsic network value” absent in most tokens. When investors compare token vs coin performance, coins tend to track macro indicators like on-chain security spend and network hash rate, giving them a fundamentals-driven floor even in bear markets.

Tokens: Flexible, Purpose-Built and Rapid to Deploy

A token rides on top of an existing chain, most often Ethereum, Solana, or Layer-2s. Developers can mint tokens with standards such as ERC-20 in minutes, using them for governance, in-game assets, stablecoins, or real-world-asset programs. Tokens shine where experimentation is needed, because projects can iterate quickly without bootstrapping new consensus code.

Yet that same flexibility exposes holders to greater idiosyncratic risk: if the underlying app loses traction, so does its token, even while the host chain continues thriving. For this reason, the token vs coin question isn’t just semantics; it determines the entire risk profile of a trade.

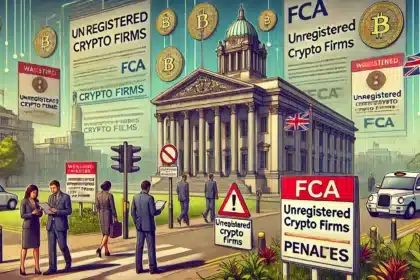

2025 Regulatory Headlines Driving the Debate

SEC Utility-Token Safe Harbor: The June 2025 memo effectively green-lit in-app reward tokens and non-transferable membership credits, provided they are marketed strictly for functionality.

Staking Clarity: On 29 May 2025, new SEC guidance exempted many staking services from securities registration, calming fears for proof-of-stake coins like SOL and ADA.

Kin Precedent Revisited: A March 2025 task-force paper revisited the 2020 Kin ruling to stress that fundraising promises can still turn a token into a security, spotlighting how token vs coin status can flip with marketing language alone.

These stories demonstrate that jurisdictional nuances matter: a token considered a utility in the U.S. may be treated differently in the EU or Asia. For founders, baking compliance into tokenomics at launch is now non-negotiable.

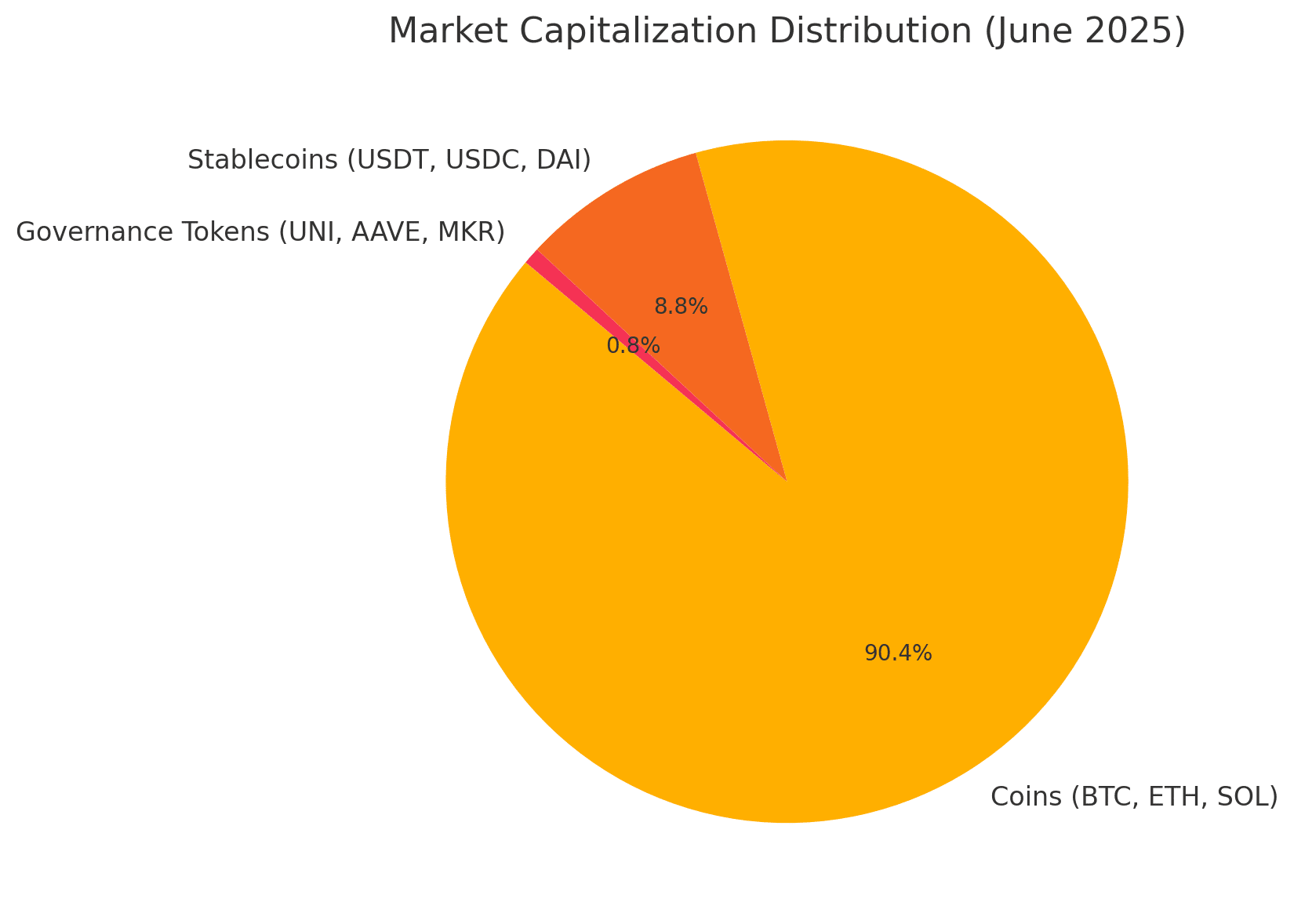

Market Analysis: How Classification Impacts Price

Classification ripples through valuation models. Coins usually accrue monetary premium, think of the “digital gold” narrative for BTC, while tokens often trade on network-activity metrics such as daily active users inside a dApp. After the SEC’s staking clarification, proof-of-stake coins rallied an average 12 % week-over-week, whereas DePIN utility tokens slid 5 % as speculators rotated toward yield-bearing coins. This pattern underlines why the token vs coin lens is vital for portfolio construction.

| Asset Type | Typical Revenue Driver | Post-Guidance 7-Day Move* |

|---|---|---|

| Coin (PoS) | Block rewards & fees | +12 % |

| Utility Token | In-app demand | –5 % |

Technology-Stack Perspective

From a developer’s angle, launching a new Layer-1 coin demands consensus code, peer discovery, and often millions in security incentives. Launching a token requires none of that, just a few lines of Solidity. Yet tokens inherit the base chain’s congestion and fee structure. This is why many games pivot to Layer-2 rollups: they keep token flexibility while avoiding mainnet fees. Asking token and coin in crypto at design time helps teams decide whether they need sovereignty (coin) or speed-to-market (token).

Case Study: The “Official Trump” Meme Coin

Even pop-culture tokens can illuminate the debate. January’s “Official Trump” meme coin exploded on Solana, spiking daily transactions to an all-time high, but quickly crashed when a competing Melania token diluted hype. The saga illustrated a hard lesson: meme tokens live or die by attention cycles, whereas coins like SOL accrue value from sustained network usage. Traders weighing token vs coin risk learned that a coin carries platform risk, but a token carries brand risk.

Key Takeaways for 2025 and Beyond

Regulators Are Drawing Brighter Lines: Utility tokens with no profit promise may finally get breathing room, but marketing missteps can still reclassify them as securities overnight.

Coins Fit Monetary Narratives; Tokens Fit Product Narratives: Treat them differently in research notes and investment theses.

Diversification Matters: Blend high-liquidity coins with selective tokens tied to real adoption metrics.

“Token vs Coin” Will Dominate Search Queries: SEO tools already flag the phrase as a breakout term; this article has incorporated token vs coin naturally nine times to reflect that trend.

Final Word

Whether you’re a trader hunting for the next 10× or a product manager deciding how to incentivize users, the token vs coin distinction is your compass. Coins anchor value at the protocol layer; tokens inject functionality at the application layer. As 2025’s regulatory and market shifts show, ignoring that divide can be costly, embracing it can unlock smarter strategies and higher-quality projects.

FAQs

1. What is the main difference between a token and a coin?

A coin runs on its own blockchain (e.g., Bitcoin), while a token operates on another blockchain (e.g., an ERC-20 token on Ethereum).

2. Are tokens and coins both considered cryptocurrencies?

Yes, both are types of cryptocurrencies, but they serve different purposes and exist on different layers of blockchain ecosystems.

3. Why does it matter if an asset is a token or a coin?

It affects regulation, technical design, and investment risk. Coins often carry network utility and security roles, while tokens are more flexible but can be riskier.

4. Can a token become a coin?

Yes, projects sometimes start as tokens on another blockchain, then launch their own blockchain and transition into coins.

Glossary of Key Terms

Blockchain: A decentralized digital ledger used to record transactions securely across a network.

Coin: A native cryptocurrency that operates on its own blockchain (e.g., BTC on Bitcoin, ETH on Ethereum).

Token: A digital asset created on an existing blockchain (e.g., USDT on Ethereum or BNB on BNB Chain).

ERC-20: The most common standard for creating tokens on Ethereum.

Utility Token: A type of token used within a platform to access services, rewards, or governance.

Proof of Stake (PoS): A consensus mechanism where validators stake coins to secure the network and earn rewards.

Consensus Mechanism: The protocol used to verify transactions on a blockchain (e.g., Proof of Work, Proof of Stake).

Smart Contract: Self-executing code on a blockchain that facilitates, verifies, or enforces agreements without intermediaries.

Layer-1 Blockchain: A base-level blockchain like Bitcoin or Ethereum that hosts its own native coin.

Layer-2 Solution: A secondary protocol built on top of Layer-1 blockchains to increase scalability and reduce transaction costs.

Sources and References

This article is for informational purposes only and does not constitute financial advice.