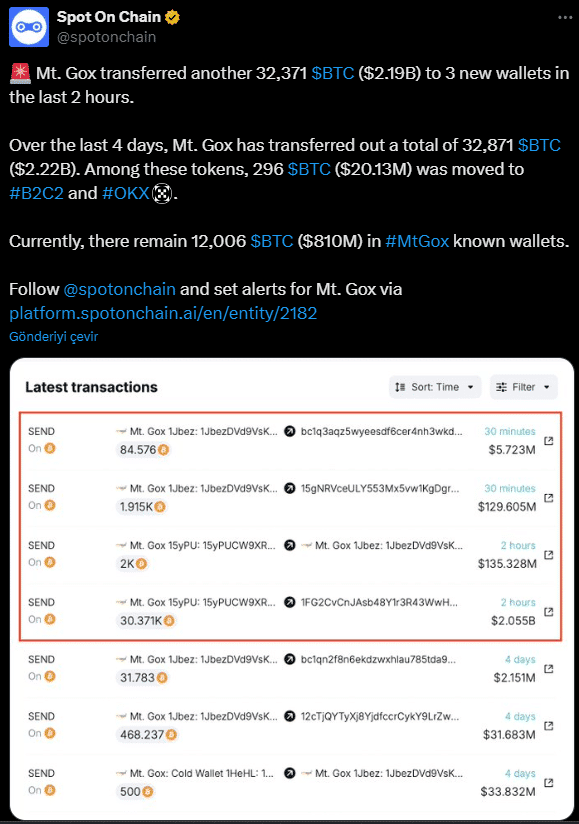

The now-defunct crypto exchange Mt. Gox has once again sent shockwaves through the crypto world. This past Monday, the exchange transferred a total of 32,371 Bitcoin (BTC), worth approximately $2.2 billion, to anonymous wallets. According to blockchain analytics firm Arkham, this large-scale transfer marks one of Mt. Gox’s biggest moves in recent months. As Mt. Gox aims to repay creditors in its bankruptcy proceedings, the timing and purpose of this transaction have raised curiosity and concern within the crypto community.

Massive Bitcoin Transfer from Mt. Gox

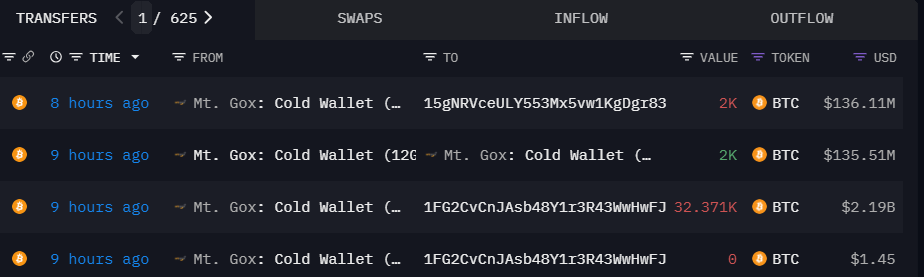

This transfer from Mt. Gox was split between two separate wallets: the majority, 30,371 BTC, was sent to the address “1FG2C…Rveoy,” while the remaining 2,000 BTC was transferred to “1Jbez…LAPs6.” Additionally, the 2,000 BTC move is noted as an internal transfer from one of Mt. Gox’s cold wallets to another, suggesting the exchange might be reorganizing its holdings. This large transaction follows a smaller movement of 500 BTC last week, fueling speculation that creditor repayments may be accelerated.

Historically, Mt. Gox transfers have often preceded payment processes, so some speculate that this latest transfer may have a similar purpose. However, the exchange recently announced that creditor repayments would be delayed to October 31, 2025. Initially scheduled for October 31, 2024, the date was extended by a Japanese court for an additional year.

Payment Delays and Mt. Gox’s Troubled History

Mt. Gox’s bankruptcy was triggered by a series of cyberattacks in 2014, resulting in the loss of around 850,000 BTC and shaking the global crypto market. At the time, Mt. Gox managed over 70% of all Bitcoin transactions worldwide, and its collapse left thousands of investors in limbo. Following years of legal proceedings, a rehabilitation plan was established for creditors, but the recent delay means they will need to wait even longer to receive their payments.

While this delay has brought some temporary relief to Mt. Gox creditors, market analysts are already evaluating the potential impact of these repayments. Previous announcements from Mt. Gox have led to sudden price fluctuations in Bitcoin, as fears of a mass sell-off from the exchange’s Bitcoin holdings loom over the market. It’s anticipated that Mt. Gox’s future movements could continue to affect Bitcoin prices until the repayment date.

How Has the Market Reacted?

How Has the Market Reacted?

Mt. Gox’s Bitcoin transfers have sparked mixed reactions among crypto investors. The possibility of creditors quickly liquidating their Bitcoin assets has raised concerns about increased selling pressure. Bitcoin’s recent price volatility could amplify the effects of such transfers. For example, market uncertainty surrounding the U.S. presidential election has contributed to a 7% drop in Bitcoin’s price.

Bitcoin’s Price Drop Costs Traders $200 Million: What’s Next?

Market analysts expect heightened volatility this week, with potential price swings of up to $8,000 in Bitcoin. Should Mt. Gox’s creditors start selling their assets, a short-term price drop is likely. Some traders also anticipate further declines depending on the U.S. election results. Particularly, if Kamala Harris wins, there is concern that stricter crypto regulations could impact prices. Established in 2010, Mt. Gox once managed over 70% of Bitcoin trading but went bankrupt following a series of hacks between 2011 and 2014, marking one of the biggest crises in Bitcoin’s history.

For ongoing updates on Mt. Gox and its potential market impact, stay tuned to The Bit Journal.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!

How Has the Market Reacted?

How Has the Market Reacted?