After years of academic hype, zero knowledge proofs have broken out of the lab and into production blockchains. From the European Central Bank’s digital-euro prototypes to StarkWare’s new mobile-friendly prover, the technology is transforming how developers think about blockchain privacy while unlocking the throughput promised by zk rollups. This article unpacks the latest research, live projects and looming challenges, showing why 2025 may be remembered as the year zero-knowledge conquered scale.

From 1985 to ZK-SNARKs: A Brief History

The term zero knowledge proofs first appeared in a 1985 paper by Goldwasser, Micali and Rackoff. For decades, proofs were purely theoretical, until Zcash launched shielded transactions with zk-SNARKs in 2016.

Fast-forward to 2025 and every major L1 and L2, from Polygon to ZKsync, is racing to integrate the math that lets a prover convince a verifier without revealing any underlying data. The result is a new privacy scale that regulators can still audit, a win-win at the heart of modern blockchain privacy thinking.

How Zero Knowledge Proofs Work, and Why They Matter

At its core, a zero knowledge proof lets Alice show she owns a secret (a password, a UTXO, a CBDC balance) without exposing that secret to Bob. Proof systems come in two flavors: interactive rounds of challenge-and-response, and non-interactive protocols known as zk-SNARKs or zk-STARKs.

When these proofs are batched into zk rollups, an L2 network can compress thousands of transactions into a single call on Ethereum, shrinking gas costs while preserving cryptographic integrity. The same math grants bullet-proof blockchain privacy, because user balances never leave the prover’s encrypted circuit.

ZK Rollups: Scalability Without Sacrificing Security

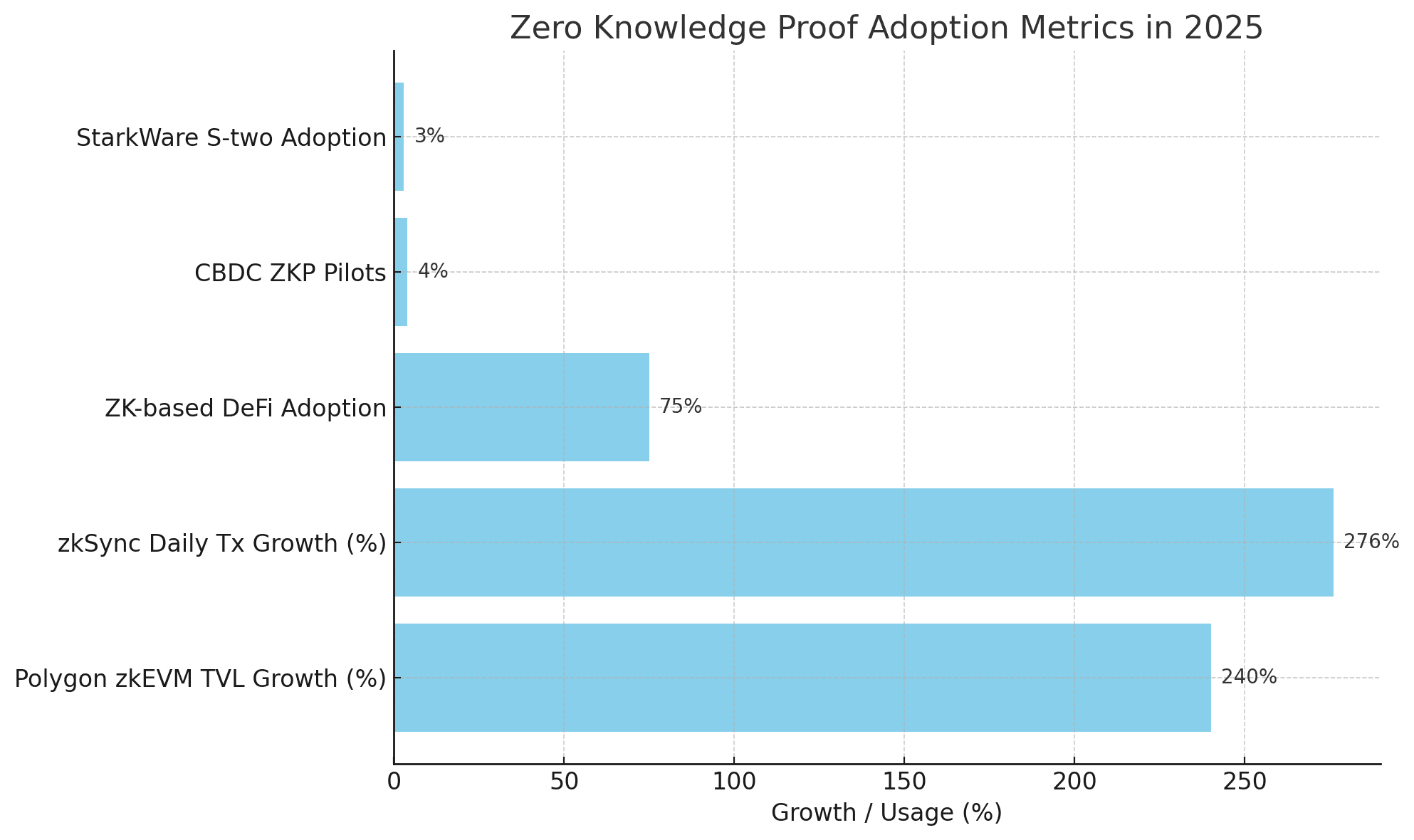

TVL on Polygon’s zkEVM soared past $312 million in Q1 2025, up 240 percent year-over-year, as DeFi giants Aave and Balancer went live on the rollup. ZKsync Era processed more than 276 percent more daily transactions quarter-on-quarter after projects like Lens and WonderFi ported over, reinforcing its claim that zk rollups can finally rival optimistic rollups on throughput.

Developers love that they write Solidity exactly as on mainnet, but the execution settles in a proof posted back to L1. For users, that means faster swaps and, crucially, stronger blockchain privacy guarantees than any shielded wallet hack or mixer ever delivered.

Proofs on a Phone: StarkWare’s S-two and the Consumer Leap

Last month StarkWare unveiled S-two, an open-source prover fast enough to run locally on laptops—and even mobile handsets. If a zero knowledge proof can be generated on an iPhone, then wallet developers can embed real-time account anonymity without routing data to a centralized server.

The hardware leap also slashes prover costs for zk rollups, pushing fee ceilings lower than their optimistic rivals. Suddenly the holy triangle, scale, security, blockchain privacy, looks achievable.

CBDCs and Institutional Experiments

Regulators once feared math they couldn’t read. Now the ECB cites zero knowledge proofs as the best compromise between oversight and user confidentiality in its digital-euro sandbox. AInvest research shows banks piloting proof-of-reserves dashboards that hide customer ledgers while letting auditors verify liquidity ratios, live blockchain privacy for TradFi. UBS even tokenized $1.7 billion in private credit on ZKsync, proving that zk rollups can handle real-world assets at scale.

Remaining Challenges: Trusted Set-ups, Heavy Math and UX

Trusted set-ups still haunt some zk-SNARK implementations; if the “toxic waste” parameters leak, the whole system can be forged. Though zk-STARKs remove that risk, they demand larger proofs, stretching L2 block limits. Meanwhile, user-experience hurdles persist: wallets must learn to display compressed data and handle proof creation without frying battery life. Even privacy can backfire, if every chain hides transfers, regulators worry money-laundering might become invisible again, undermining the very trust zero knowledge proofs intend to bolster.

How Upcoming Projects Are Capitalizing on Zero Knowledge

New projects are embracing zero knowledge proofs to launch faster, cheaper, and more private platforms. From DeFi startups on zkSync to cross-border CBDC trials in Europe, ZK tech is enabling real-time settlement without exposing sensitive data. Tools like Polygon’s zkEVM and Starknet’s Cairo are making it easier for developers to build scalable apps with built-in blockchain privacy, positioning them ahead of older, less secure protocols as mass adoption grows.

The Road Ahead for 2025-26

Hardware speed-ups like Intel’s hardware-accelerated SHA-512 and StarkWare’s consumer-grade rigs will keep shrinking proof times. Disney-incubated startup Linea plans an L2 where devs can mix optimistic blocks with zk rollups on demand, marrying instant finality to cryptographic certainty.

Polygon is prepping a “Type-2” upgrade that promises recursive zero knowledge proofs—a proof proving proofs, so entire daily blocks fit into a single Ethereum call. If that works, blockchain privacy will be cheaper than plaintext transfers on L1.

Conclusion: A Privacy-Preserving, High-Throughput Future

No longer an academic curiosity, zero knowledge proofs now anchor the most ambitious scalability plans and the strictest privacy guarantees in crypto. As ecosystems move funds onto zk rollups, and as mobile-grade provers empower consumers, a new default is emerging: public-ledger transparency when regulators need it, iron-clad blockchain privacy when users demand it. For builders, that means 2025 is the moment to embrace zero knowledge, or risk being left on chains that still shout every detail to the world.

FAQs

What are zero knowledge proofs in blockchain?

Zero knowledge proofs (ZKPs) are cryptographic methods that allow one party to prove a statement is true without revealing the actual data, ensuring privacy.

How do zk rollups help scale Ethereum?

Zk rollups bundle hundreds of transactions off-chain into a single proof posted to Ethereum, reducing gas fees while maintaining security.

Are zero knowledge proofs being used in real-world projects?

Yes. Projects like ZKsync, Polygon zkEVM, and CBDC trials in Europe are actively using ZKPs to ensure scalability and privacy.

What is the difference between zk-SNARKs and zk-STARKs?

Zk-SNARKs are smaller and faster but require a trusted setup, while zk-STARKs are more transparent but produce larger proofs.

Why is blockchain privacy important in 2025?

With increasing surveillance and compliance demands, blockchain privacy ensures personal and institutional data remain confidential while still verifiable.

Glossary of Key Terms

Zero Knowledge Proofs (ZKPs): A cryptographic technique allowing one party to prove knowledge of information without revealing it.

zk Rollups: Layer-2 scaling solutions that batch transactions and submit a single cryptographic proof to the main blockchain.

zk-SNARKs: A type of zero knowledge proof that is compact and fast but requires a trusted setup.

zk-STARKs: An alternative ZKP with enhanced transparency and scalability, though with larger proof sizes.

StarkWare: A company pioneering zk-STARK-based scalability solutions like Starknet and Cairo.

Polygon zkEVM: A ZK-compatible Ethereum Virtual Machine for private and scalable smart contracts.

Cairo: A programming language optimized for creating STARK-compatible smart contracts.

Merkle Tree: A data structure used in blockchains and ZKPs to verify information integrity efficiently.

CBDC (Central Bank Digital Currency): Government-issued digital currencies, now testing ZKPs to enhance user privacy.

On-Chain Privacy: The concept of preserving data confidentiality directly within blockchain transactions using cryptographic techniques.